Lazari Investments has completed a £409m refinancing of six of its central London properties as part of a process led by Lloyds Bank Commercial Real Estate.

For Lazari the refinancing forms part of a restructure initiated by the company’s co-founder Christos Lazari, shortly before his death in July 2015.

The company has established two new subsidiaries, Lazari Developments, which will have a developer/trader model that contrasts with the invest and hold model of the main business, and Lazari Finance which will issue property loans.

Of the £409m, around £200m will go towards repaying debt due to Lloyds in April this year, with the remainder providing reserves for the new initiatives and for the seven development and refurbishment projects Lazari has in its pipeline as well as prospective new acquisitions.

Directors and siblings Andrie, Nicholas and Len Lazari, alongside co-founder, director and wife of Christos, Mary, now run the business.

Andrie said: “It has been a difficult period because he [Christos] was a very hands-on and dynamic chairman, and of course, our father, and it has been intense because of the restructure. This refinancing is part of the jigsaw of the restructure that has been put in place to safeguard my father’s legacy in the longer term and give us more freedom with our existing cash reserves.”

Andrie said: “It has been a difficult period because he [Christos] was a very hands-on and dynamic chairman, and of course, our father, and it has been intense because of the restructure. This refinancing is part of the jigsaw of the restructure that has been put in place to safeguard my father’s legacy in the longer term and give us more freedom with our existing cash reserves.”

The refinancing has been undertaken as two separate transactions.

A £118m loan has been put in place with a 10-year term secured against 72-86 Baker Street, W1, and Maple House at 149 Tottenham Court Road, W1.

Advertising and public relations group Publicis occupies 72,000 sq ft of the 83,900 sq ft 72-86 Baker Street on a 10-year lease and Maple House is a 170,000 sq ft mixed-use building which includes Sainsbury’s and PC World among its retail tenants.

The finance has been sourced through Lloyds’ partnership with its subsidiary Scottish Widows, matching the longer-term

liabilities of the insurer. It is the biggest deal undertaken by the partnership since its formation in March 2015.

The second loan for £291m has a five-year term and has been provided equally by Lloyds, Met Life and Royal Bank of Scotland secured against four properties – Greater London House, Hampstead Road, NW1; Turner House, Great Marlborough Street, W1; Ferguson House, Marylebone Road, NW1 and 1 Welbeck Street, W1.

Greater London House, which is undergoing a £40m refurbishment, is Lazari’s own headquarters and is also home to online retailer Asos. Lazari bought 1 Welbeck Street from Aberdeen Asset Management last March for £103m.

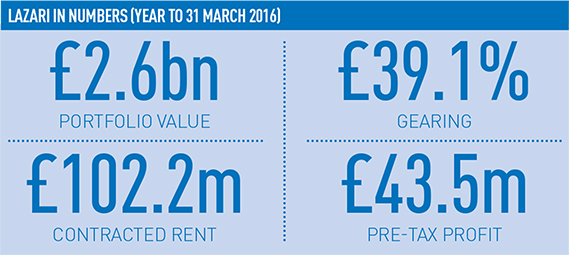

The new debt reflects an overall loan-to-value ratio of between 40% and 50% against the properties. Lazari’s gearing ratio as of 31 March 2016 was 39.1% on its £2.7bn portfolio.

The new debt reflects an overall loan-to-value ratio of between 40% and 50% against the properties. Lazari’s gearing ratio as of 31 March 2016 was 39.1% on its £2.7bn portfolio.

Mary O’Reilly, director at Lloyds, said: “These two agreements showcase the broad scope and flexibility of support we can provide our clients, through our partnership with Scottish Widows and the strength of our arrangement capabilities.

“We can take a relatively complex mix of asset types and lease profiles and then structure bespoke solutions that draw on the breadth of our product offering. In this case, we have worked with our long-standing client Lazari Investments to develop a funding package that best serves each asset and the management team’s long-term aspirations.”

The Christos Lazari story

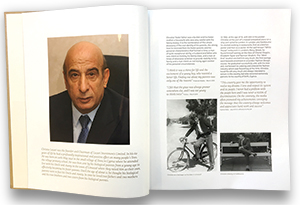

The Lazari Investments annual report is always an impressive tome – hardback, highly transparent for a private company and a good 100 pages long. The one delivered to EG a few months ago was particularly impactful because of the heartfelt and engaging 10-page tribute to the company founder and chairman, Christos Lazari who passed away in July 2015. A man who was initially adopted by his aunt and uncle and effectively ended up with two sets of parents, he left Cyprus for England at 16 with £20 in his pocket and established a clothing empire before building a formidable property portfolio now valued at £2.5bn. He was clearly also a man who didn’t take himself too seriously and is cited as saying: “I take my coffee without sugar and drink my ouzo straight. I enjoy the good company of old friends, laughing and joking and I have been known to dance to Greek music, the only music I truly understand.”

The Lazari Investments annual report is always an impressive tome – hardback, highly transparent for a private company and a good 100 pages long. The one delivered to EG a few months ago was particularly impactful because of the heartfelt and engaging 10-page tribute to the company founder and chairman, Christos Lazari who passed away in July 2015. A man who was initially adopted by his aunt and uncle and effectively ended up with two sets of parents, he left Cyprus for England at 16 with £20 in his pocket and established a clothing empire before building a formidable property portfolio now valued at £2.5bn. He was clearly also a man who didn’t take himself too seriously and is cited as saying: “I take my coffee without sugar and drink my ouzo straight. I enjoy the good company of old friends, laughing and joking and I have been known to dance to Greek music, the only music I truly understand.”

• To send feedback, e-mail david.hatcher@estatesgazette.com or tweet @hatcherdavid or @estatesgazette