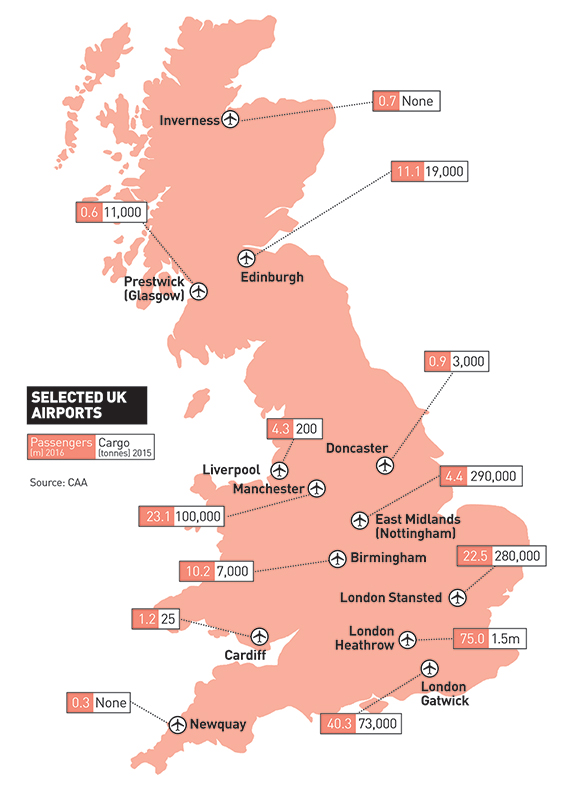

With more than a quarter of a billion passengers passing through their terminals each year, business is really taking off for UK airports. Just under two-thirds of travellers use one of London’s six airports, but that still leaves 90m people travelling from around 50 commercial airports across the rest of the country. And while the general trend is upwards, some airports are likely to develop at a much faster rate than others, bringing increased property values in surrounding areas in their wake.

With more than a quarter of a billion passengers passing through their terminals each year, business is really taking off for UK airports. Just under two-thirds of travellers use one of London’s six airports, but that still leaves 90m people travelling from around 50 commercial airports across the rest of the country. And while the general trend is upwards, some airports are likely to develop at a much faster rate than others, bringing increased property values in surrounding areas in their wake.

“Manchester Airport really stands out,” says Simon Bedford, Manchester-based partner at Deloitte Real Estate, pointing to the £800m Airport City commercial development taking place next to the airport. Airport operator MAG (which also runs London Stansted) is building out a 160-acre mixed-use scheme with Chinese investor BECG and the local authority pension fund.

The concept has been borrowed from Frankfurt and Barcelona – could it be a template for other UK regional airports? “Possibly not. There isn’t a one-size-fits-all solution,” says Bedford. Nevertheless, he tips Birmingham and Edinburgh as airports that could attract similar development.

“A vast number of regional airports are owned or co-owned by local authorities, and many have land around them to allow for growth,” says Gareth Wilson, partner at planning specialist Barton Willmore. He points to Newquay, wholly owned by Cornwall council, which has built a 90-acre aerospace park after achieving Enterprise Zone status (which offers a range of tax breaks and other incentives). Similarly, St Athan Enterprise Zone, next to Cardiff Airport in Wales has capitalised on specialising in aerospace maintenance.

Even without special land status, development is more likely to take place around airports where infrastructure enhancements are in the pipeline. For example, a relief road that will improve access to Doncaster Sheffield Airport is due to complete later this year, opening up two business parks which already have planning consent.

However, before signing up to an airport-related project, potential investors should focus their due diligence on the local planning situation, advises Dave Trimingham, managing director of planning consultancy Turley. “A disconnect exists between some of the growth targets set out by the masterplans of regional airports and the local authorities’ own development plans; where these don’t intersect, it can cause issues.”

Paul Clark, development director for GL Hearn, adds: “One particular aspect of airport development – and a potential source of difficulty for investors – is some of the restrictive planning consents that have been granted on sites around the red line of airports. We know from working with clients around other airports that some of these sites, many of which have excellent accessibility and great footfall, are limited to airport-related uses only. If these can be adjusted, there are some sites with great potential just waiting for the right investor and project.”

Liverpool Airport expects to update its masterplan this year and is one of the airports supported by public sector umbrella organisation Transport for North. “Unlike in the South of England, where ports and airports are heavily congested, the North’s international gateways have unused capacity,” says TfN chair John Cridland. He led an Independent International Connectivity Commission, which last month published a report that recommended major transport access improvements to airports across the North of England.

Steve Gillingham, director of the North at construction consultancy Mace, concludes: “If we in the North are to fulfil our ambitions to trade globally, then we need to improve our connectivity to international markets by upgrading road and rail connections to our airports.”

As many of these schemes have yet to find funding, they could represent an interesting opportunity for potential investment partners.

Northern promise: Scotland

Northern promise: Scotland

While English airports such as Heathrow and Manchester have attracted much media attention, airports in Scotland have quietly been improving their profile. Edinburgh, the country’s busiest airport, expects passenger numbers to rise by nearly one-fifth between now and 2020. Transport connections have recently been improved – by the introduction of a tram from the airport to Edinburgh city centre via the business parks on the west of the city in 2014, and then the opening of a main line railway interchange at the end of last year.

While English airports such as Heathrow and Manchester have attracted much media attention, airports in Scotland have quietly been improving their profile. Edinburgh, the country’s busiest airport, expects passenger numbers to rise by nearly one-fifth between now and 2020. Transport connections have recently been improved – by the introduction of a tram from the airport to Edinburgh city centre via the business parks on the west of the city in 2014, and then the opening of a main line railway interchange at the end of last year.

Unusually for a major city airport, there is huge development potential around the Edinburgh site as it sits on land originally protected as countryside. Negotiations to release space mean that the first phase of the £700m International Business Gateway scheme, owned by a consortium including Murray Estates, could soon begin construction. Up to 2.25m sq ft of commercial and residential property is planned. “It seems likely that the airport will evolve as a hub of commercial development as Edinburgh expands,” says Edinburgh-based Cushman & Wakefield partner James Thomson.

Further north, the £315m City Deal (central government funding) for Inverness agreed last month could stimulate development around the city’s airport, says Stuart Black of Scottish Cities Alliance. A planned new town of 12,500 homes and dualling of the A96 road will benefit the Scottish government-owned airport. It is one of 11 in Scotland operated by Highlands & Islands Airports. Managing director Inglis Lyons says: “Once you build up a critical mass of connectivity, that’s when you start making money. Well, we’re very close to that right now.”

Born free: UK free ports?

Britain’s exit from the European Union opens up the possibilities of “free ports” around its airports, offering customs duty advantages, which could attract significant investor interest.

The world’s first free trade zone was created at Shannon Airport in Ireland in 1959 and there are now around 3,500 globally, though none in the UK. Supporters such as Yorkshire politician Rishi Sunak say that the concept would be quick and simple to implement.

However, Greg Dickson, head of transport infrastructure at planning consultancy Turley, notes: “It is early days for this idea and the government will need to give a lot of thought to it.”

Case study: Liverpool’s John Lennon Airport

Long in the shadow of nearby Manchester, Liverpool’s John Lennon Airport has big plans. The city council is so confident that it took a 20% share in the airport from owner Peel Holdings last year.

Long in the shadow of nearby Manchester, Liverpool’s John Lennon Airport has big plans. The city council is so confident that it took a 20% share in the airport from owner Peel Holdings last year.

“We can’t get close to Manchester’s 20m passengers, but we can provide a choice. Why can’t we double what we’ve got?” asks the airport’s director of air service development Mark Povall.

With passenger numbers expected to have topped 4.3m last year, the existing terminal has capacity for up to 5.5m, and a £4m retail improvement programme is due to complete this year.

“We’re now looking at the best uses of land around the airport,” says Povall, who has ambitions to land long-haul traffic to the USA and the Middle East.

London potential

Last autumn, the UK government finally made the controversial decision to build an additional runway at London Heathrow.

In theory, this should allow new logistics space to service the airport to come forward, but tight land supply means new development is likely to be limited.

Ironically, much more land is available around Gatwick, the other contender for a new runway. As the choice of Heathrow was not universally popular among the UK business community, commentators suggest that a second runway at Gatwick is still a possibility.