Almost a decade on from the financial crash and following a tumultuous year, have investors finally learned to prepare for potential changing fortunes?

A bumpy, unpredictable cycle awaits UK property in general and London real estate specifically – but it is a cycle investors are ready for, according to a study by BNP Paribas Real Estate and Ipsos MORI.

Their Cycology report, which combines data from surveys of 29 investors, occupiers and academics, argues that although recent and upcoming political events are leading the cycle into uncharted and uncertain territory, investors have learnt to handle the

unknown.

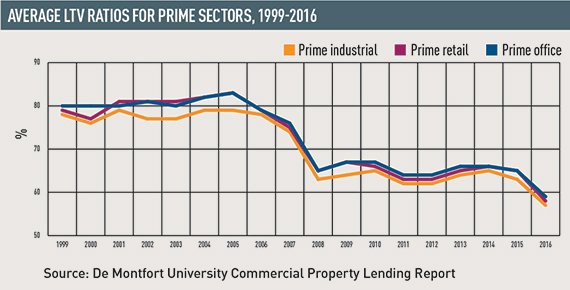

Almost a decade on from the global financial crisis, risk management is a priority for the industry. Banks have cut down their exposure to speculative development, propcos are focusing more on recurring income than capital value growth, and LTV ratios have plunged since their peak in 2004.

But regardless of how many lessons have been learnt since the financial crisis, the report says, the future is fraught with changes that cannot be predicted.

Elections across Europe, technological advances and an ageing population leave both the industry and the outside world in limbo.

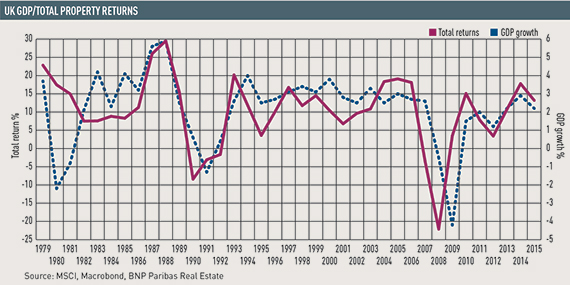

Historically, property returns have had a strong correlation with economic performance. Times of high GDP growth, a fall in inflation and cheap lending correspond with times of high total returns. This was most obvious in the 14 years of positive total returns that ended with the global financial crisis. Although investors in the survey acknowledged that the crash came from an over-leveraged, debt-fuelled market, respondents said the cycle was “bigger than real estate”. The macroeconomic trends that drove total returns were beyond their control.

While economic trends cannot be avoided, investors have turned to risk management to mitigate future shocks. The survey revealed that the industry is consciously using less debt. Some investors said they had teams set up for risk management and were doing less speculative building. Others said they were investing “significantly more” in income-producing assets – ones with more predictable returns – rather than those with enhancement potential.

The lessons the industry learnt in 2008 are not enough to avoid shocks forever. Respondents said that in an increasingly globalised and politically uncertain world, there are unforeseen risks they cannot prepare for.

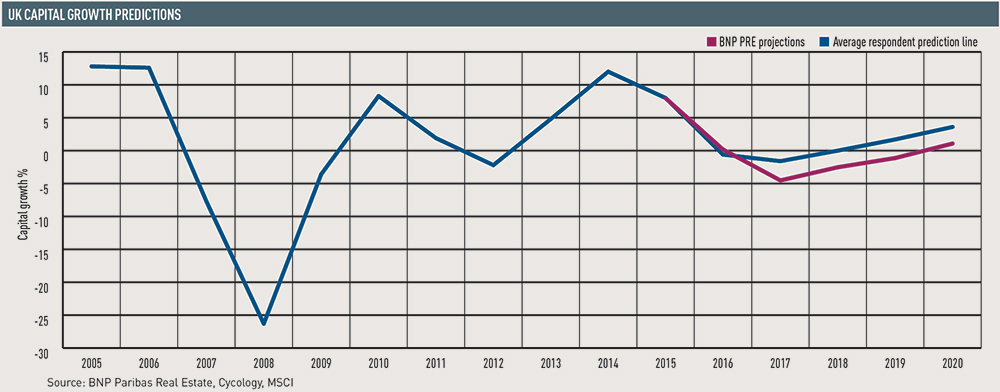

The report found that on average investors expected capital growth to be -1.6% in 2017, before a bounce back to 0% in 2018, and 3.6% by 2020. BNP PRE’s own projections were less optimistic: -4.5% in 2017 following negative capital growth until 2020, when it will hit 1.1%.

This cycle will be “shorter, bumpier and driven by political events”, the report said, with strong variation in predictions for capital growth in the future. One investor added: “Maybe history isn’t a good predictor of the future.”

By contrast, other investors raised concerns that lessons will be forgotten. New generations are “destined” to repeat previous mistakes, having not lived through the crash. Already, one respondent said, the industry has moved from not wanting to invest in secondary assets with poor liquidity to doing just that in a chase for yield.

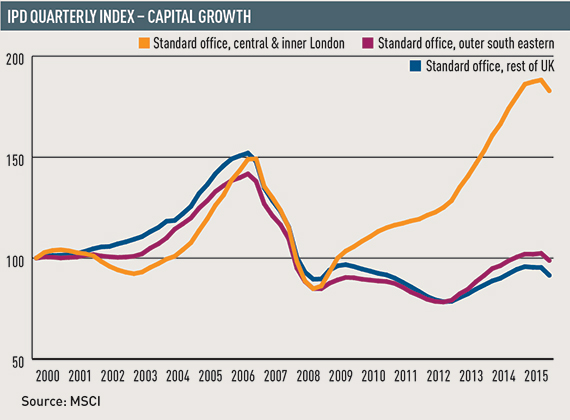

But for those looking for a safe haven, London has proved resilient. Central London saw unprecedented growth following the crash and now, the report says, the global nature of the city combined with its transparency is making it particularly attractive for investors.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette