Real estate’s popularity among investors has been at an all-time high as government bond yields have tumbled to record lows, making property a comparatively attractive investment. But will that trend continue?

The Bank of England meets on 16 March to announce updates to its policies, raising the question of whether interest rates will rise as the UK triggers the process to leave the EU.

Gilt yields tend to rise in response to rising inflation and as investors expect interest rates to increase. After hitting lows of around 0.6% last August, 10-year gilts have once again inched up, hitting 1.41% in January.

UK 10-year gilt yields

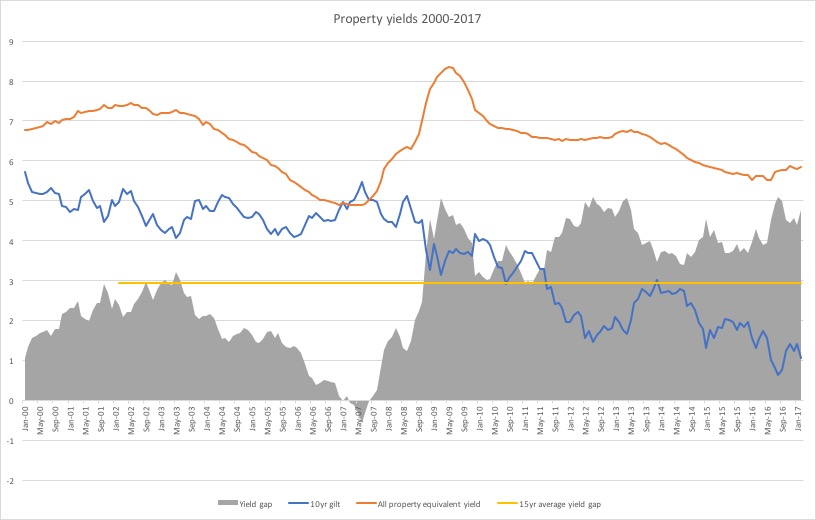

Meanwhile, property yields have been relatively stable, cutting the premium investors get from choosing property over government bonds.

At a time when real estate yields have been at 10-year lows, their saving grace has been the yield gap. If the premium shrinks, so does appetite for property.

While the rise in bond yields has sped up over the past few months, in the long term the premium for investing in property is still substantial.

Over the past 15 years, real estate has enjoyed a 2.82 percentage point premium on 10-year gilt yields. Government bond yields would have to rise by another 200 bps from their current 1.07% before the gap closed to that level again.

This is unlikely to happen in the near future considering the last time bond yields hit 3% was in December 2013, and the last time they were consistently above that level was between September 2010 and June 2011.

Comment – Sabina Kaylan, global chief economist and head of EMEA strategy and research, CBRE GI

Although gilt yields have been a bit more volatile both before and after the EU referendum vote, and have started to rise a little, the gap between the property yield and the gilt yield is still so historically wide that it can absorb quite a substantial rise in the bond yield before you have to see a knee-jerk upward move in the property yield.

It really depends on why the bond yield is rising as to what the reaction then is in the property world. If the bond yield is rising because economic growth is very strong and occupier market growth and rent growth is good, then actually you might tolerate the lower yield on property.

But if the bond yield is rising because of systemic weakness and worry about sovereign risk and structural problems with the underlying market you’re buying the real estate in, then maybe you want to demand a higher cap rate when you’re buying.

CBRE GI has come to the conclusion that we’re not quite as worried on the yield side of things. If there’s any pain in the UK in particular, it will be through the occupier market. If you look at the City and the West End, rent growth had come through, the supply side is now coming through in the City. These are classic late-cycle reasons to think there’s not much more rent growth to come.

This next soft landing in the UK will probably more occupier than yields driven.

To send feedback, e-mail karl.tomusk@egi.co.uk or tweet @ktomusk or @estatesgazette