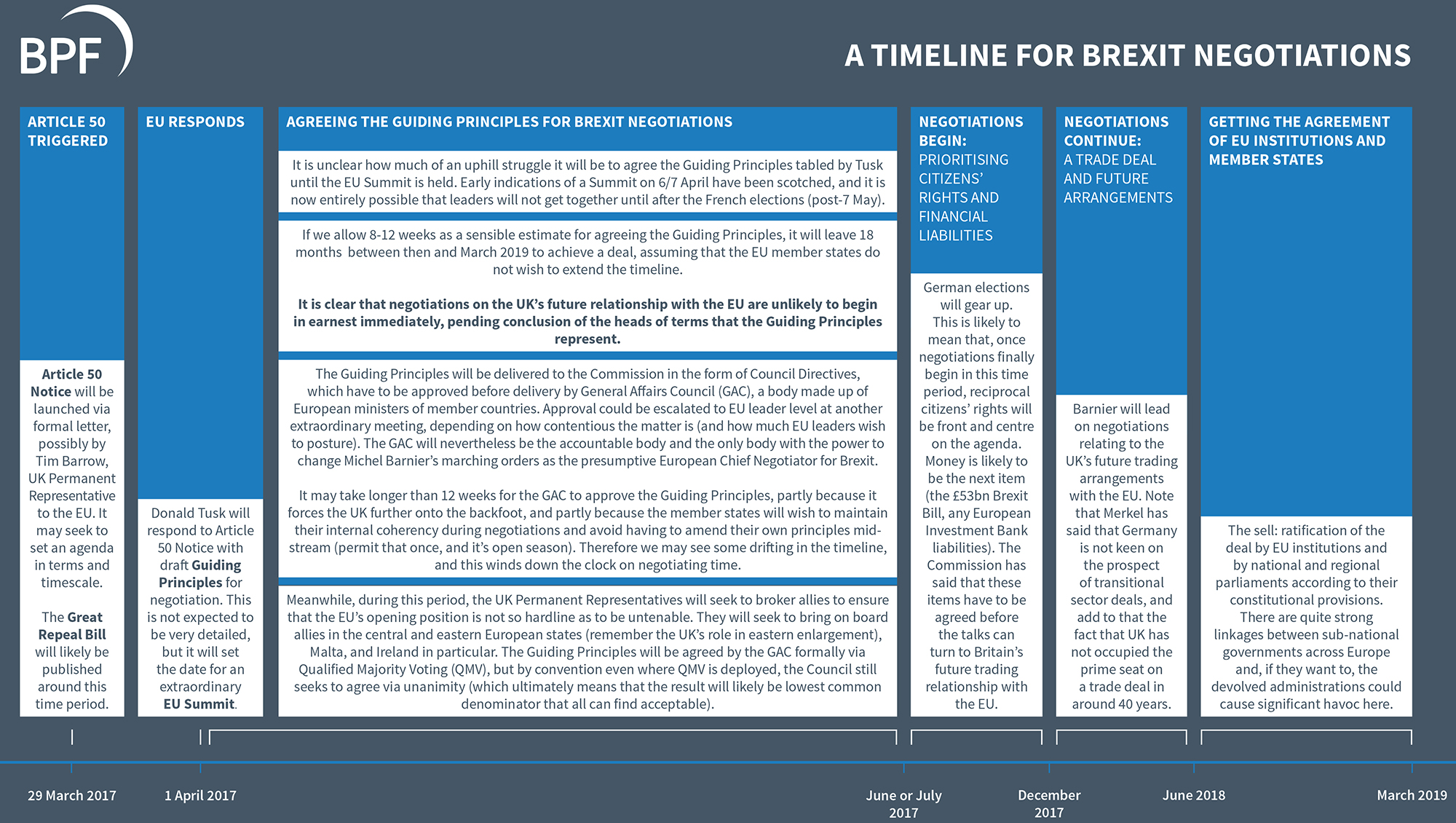

FROM THE ARCHIVES: With Theresa May set to trigger Article 50 next Wednesday, passporting keeps coming up as a serious concern. But who is actually going to be affected? Are we going to see a mass exodus of financial services or have we all got it wrong? Ian Borman, partner at Winston & Strawn, James Roberts, chief economist at Knight Frank, and Julie Patterson, head of the Regulatory Centre of Excellence for Investment Regulation at KPMG, give EG their thoughts on the subject.

International banks

The JP Morgans and Goldman Sachs of the world have made headlines when it comes to passporting, but from a legal standpoint, they have the least to fear.

As Borman says, international institutions already have offices across the world that act as national subsidiaries, which gives them access and a licence for those specific markets.

They would not be reliant on UK presence to do business in the EU even if their main offices were in London.

Goldman Sachs, for example, has 27 offices across EMEA, including 17 in the EU – 13 without the UK. JP Morgan has four offices in the EU outside the UK, covering Germany, Italy, France and Spain.

The likely outcome for them, Roberts says, is a gradual move toward relocating back office, administrative jobs to other parts of Europe − a continuation of a trend that has been going on for years. Shoreditch and Southbank, once the home to financial back offices, are now dominated by tech and creative firms.

As a result, there could be an impact on office take-up in London, but that impact will likely be muted as other industries move in.

Source: Experian/ONS

UK institutions and property funds

If passporting does hurt anyone, it will be UK-based companies and funds that want to expand their business into the EU. In particular, Patterson says, UK funds trying to sell to European investors – which they can do freely at the moment – will have to comply with individual countries’ private placement rules.

Not only does this mean there will be more paperwork involved, but not all member states have private placement regimes. Where they do have them, some do not permit real estate funds being sold.

Bank |

UK employees |

Response to Brexit |

|---|---|---|

| Barclays | n/a | Planning to establish a main EU hub in Dublin and moving 150 staff there, according to Bloomberg |

| Citigroup | 9,000 | About 100 staff in sales and trading might need to be moved, although the bank already has a presence in Dublin, Reuters has reported |

| Credit Suisse | n/a | Dublin has emerged as a favourite for Credit Suisse’s back-office jobs, Bloomberg reported |

| Other jobs could move to Frankfurt | ||

| Goldman Sachs | 6,000 | Increasing operations in Europe, and that could mean moving staff from London |

| Looking into contingency plans but no official numbers yet, vice chairman Richard Gnodde has said | ||

| German newspaper Handelsblatt reported the bank is considering halving its London workforce to 3,000 | ||

| HSBC | n/a | About 1,000 employees “may need to be” relocated from London to Paris, depending on how the negotiations develop, the bank has said |

| JP Morgan | 16,000 | Jamie Dimon, chief executive, said up to 4,000 could move depending on the outcome of the negotiations |

| If there is no clear outcome, the bank could accelerate its move out of London | ||

| Morgan Stanley | 6,000 | President Colm Kelleher has said some people will “certainly” have to move, but no official numbers |

| About 300 staff are expected to move to Frankfurt or Dublin initially, according to Bloomberg | ||

| Nomura | 2,500 | The Japanese bank is looking for a city for a new EU headquarters, with Frankfurt reportedly the frontrunner, the Press Association has reported |

| No decisions on timings or numbers yet | ||

| Royal Bank of Scotland | n/a | The bank has looked at options to expand in the Netherlands, Ireland and Germany, but Malcolm Buchanan, a managing director at the bank, has said it will have access to Europe because of its EU banking license |

| UBS | 5,000 | Alex Weber, chairman of UBS, has said 1,000 UK employees “could be affected by Brexit” |

How likely is this to happen?

These outcomes assume a breakdown in the talks between the UK and the EU, where there is no deal negotiated around passporting.

Roberts says the European regulators take the view that chaos should be avoided and that they should work closely with banks so that they can continue trading. In France, for example, forms for applying for a French banking licence have been translated into English.

Regardless of the outcome, Roberts adds, banks already have contingencies or workaround plans in a worst-case scenario. They might open serviced offices in other parts of the EU with a small team, or they might carry out “back-to-back deals”, where a trade is logged in a European office and transferred to the bank’s UK office through an internal trade.

However, Patterson thinks there are reasons to think the EU will not want to make the transition easy for the UK.

She says: “If they make special deals with the UK, what do they do with Switzerland, with whom the EU has a long-standing trade agreement? Why would the UK have to be regarded as special?”

She says that with the EU’s financial centre in London leaving the union, other member states are vying to become the next centre.

“It’s not a given at all that it is in the EU 27’s interest to extend all the existing passports into a post-Brexit scenario.”

■ Listen to the full podcast with Borman, Patterson and James Roberts, chief economist at Knight Frank.