Property yields have the potential to tighten by up to 50bps, leading to capital value growth of 10% in 2017, but investment activity and supply growth could put a stop to that, according to a note from Capital Economics.

Growing stability and occupier demand have created the conditions for yields to fall by up to 50bps, in contrast to expectations last summer, the research showed.

The FTSE 100 (VIX), the index measuring implied volatility, fell to a record low of 6.4 last week – compared to about 26 on the day of the EU referendum. Looking at historic patterns, a fall like this could correlate with a 30 to 40bps tightening in yields from the current 6.2% to 5.8% over the next three quarters.

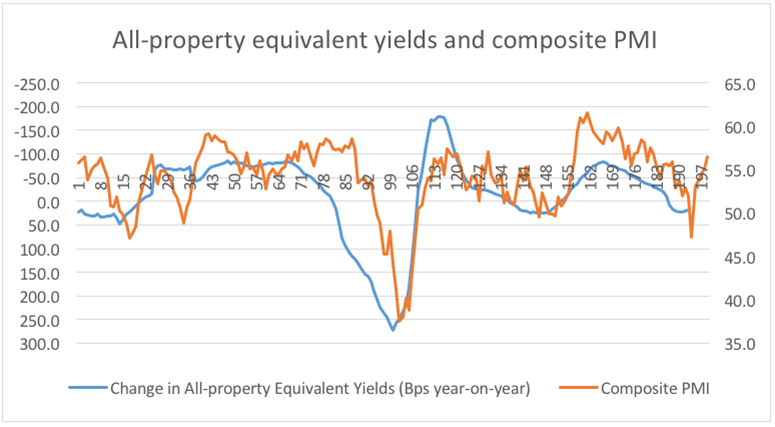

Meanwhile, the Purchasing Managers’ Index, which is indicative of occupier demand conditions, hit 55.1 in February, which is historically in line with yields falling by 50bps over the next six months.

The note said that assuming yields fall by up to 50bps and rental value growth is 1%, capital values would grow by between 6% and 10% – above the 2% forecast in the IPF Consensus for 2017.

However, it added that the PMI only accounts only for demand, not supply. This means that although demand is likely to increase in the short term, leading to compressed yields, the supply side will have to respond with more available space. Over time, this will lead to smaller rental growth and limit falling yields.

Investment activity has also been low, with CBRE reporting a 19% fall in investment volumes in London last year. Capital Economics said that while activity might be held back by a lack of liquidity, low yields have not historically been associated with low investment.

Eduardo Gorab, UK property economist at Capital Economics, said: “In all, we cannot rule out a positive yield surprise, particularly if the economy continues to confound expectations. But in light of the more hawkish tone from the MPC, and the fact that property yields already look pretty low, we suspect that investors will be reluctant to bid yields lower this year.”

To send feedback, e-mail karl.tomusk@egi.co.uk or tweet @ktomusk or @estatesgazette