Auction houses expect an upturn in market confidence after next week’s General Election.

Uncertainty created by the national vote on 8 June has made some investors nervous, particularly those with small portfolios, auctioneers said.

This effect has been demonstrated by dips in the success rates at the largest sales.

Overall, the percentages of lots sold at auctions across the UK have held up, but sales in London have been less successful in terms of the percentage of lots sold.

There was a fall of 8.5 percentage points in the capital during the three months to the end of April compared with the same period last year, according to figures from Essential Information Group.

Individual auction companies have reported reductions in their success rates. Allsop’s commercial sale on 23 May recorded a success rate of 71%, less than the firm’s average for this year of more than 80%. Acuitus’s auction on 25 May also achieved a 71% rate, compared with 88% for the previous sale in March.

George Walker, commercial auctioneer and partner at Allsop, said after his firm’s recent sale: “Raising more than £94m across 124 transactions shows a tremendous depth of investor appetite at a time when there is some political uncertainty in the air.”

Figures remain positive

He added: “The figures from UK plc remain positive and ahead of expectations, with rising levels of inflation generally predicted to be a temporary phenomenon. These figures give investors continued confidence to invest in better-let assets with long leases and reliable tenants.”

Walker said that once the General Election was behind us, he anticipated continued appetite from cash-rich private investors eager to enhance returns on their portfolios, where the value of cash deposits is eroded on a daily basis in the bank.

Allsop residential auctioneer and partner Gary Murphy said his firm’s residential sale on 25 May achieved a success rate of 80%, and raising nearly £73.4m, the firm’s highest total for more than a year.

“There has been a softening of success rates across the industry. We had to be very careful which lots we took to the room, and pay particular attention to pricing. Lots have to be sensitively priced,” he said.

“There is an oversupply of new-build in central London and concern that there is less foreign investment in the capital’s high-value lots,” he said.

Murphy said that owner-occupiers were still finding it difficult to get on to the property ladder, but added that demand from tenants was supporting the market.

Acuitus raises £37m

Acuitus’ chairman and auctioneer Richard Auterac said he was pleased with the result of his firm’s recent sale, which raised £37m with six lots going for more than £2m, because “the caution [of investors] could have been more severe than it was”.

“Success rates are down,” he said, “but serious investors who have the money still want to buy. Their understanding of property is so deep that they are less phased by the uncertainty.

“The big lots are where the biggest competition with other methods of selling is. When we get £2m-plus properties, we show that we can compete with private treaty and in much quicker time-scales. We still have a good lending market as well,” he added.

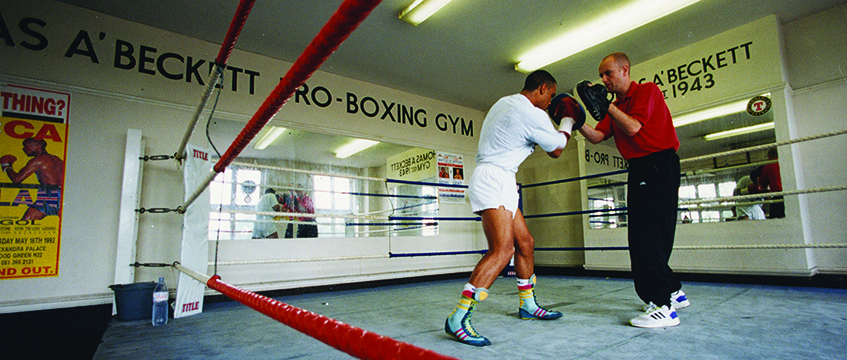

At the Acuitus sale, the Thomas A’ Becket pub on Old Kent Road, SE1, (pictured), where legendary boxer Henry Cooper trained, sold for £2.4m, equating to a yield of 5.5%.

Auterac was confident that auction success rates would recover.

“Rates will go up once the market bounces back,” he said. “I have a great belief in the market and how it adjusts.”

He added that it was important that supply matched demand and that it would take a month or two before it was clear which properties were selling best.