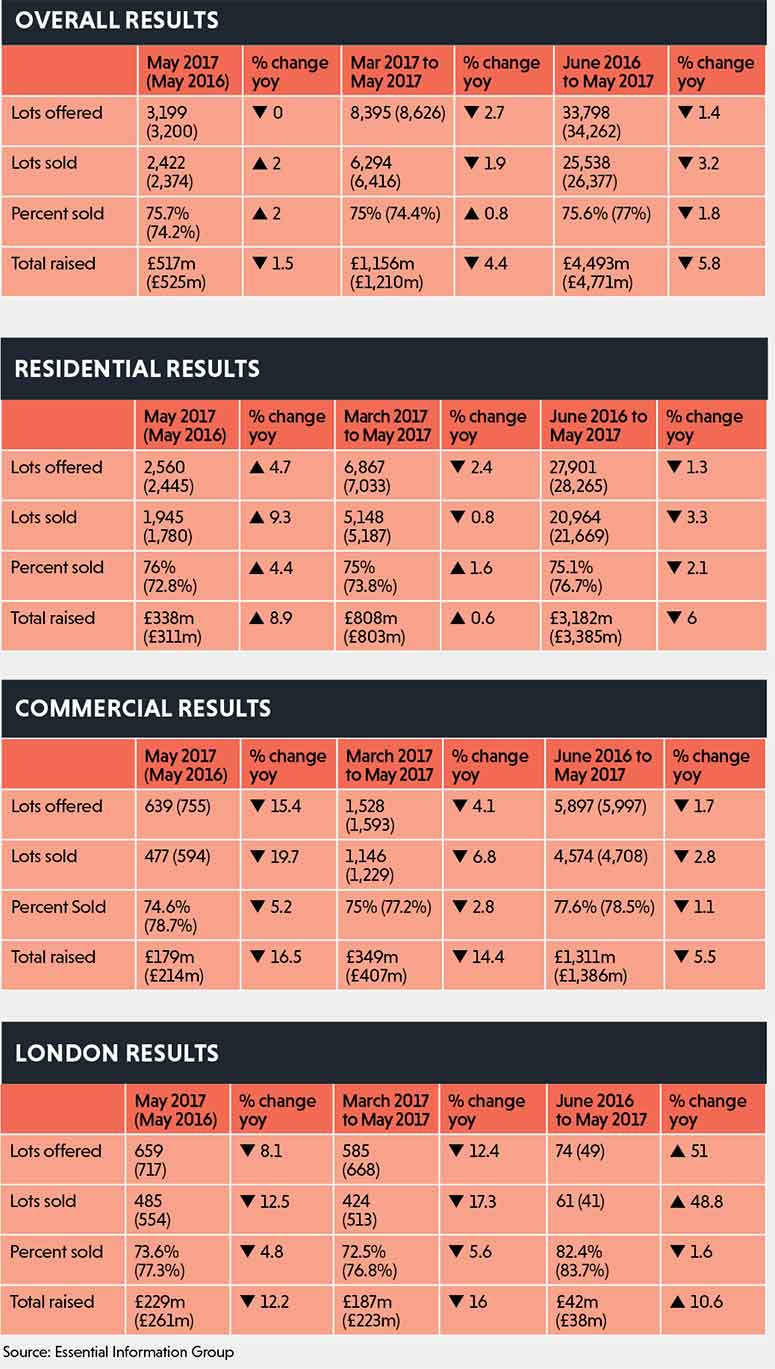

The total raised at residential auction rose by 9% to £338m last month, in the first sign of year-on-year growth so far in 2017.

Data from Essential Information Group shows that the total raised improved on a strong month the previous year: the May 2016 total of £311m reflected a 25% increase on the same month in 2015 – despite the new Stamp Duty Land Tax surcharge introduced for residential investments on 1 April last year.

However, most months since then have shown a year-on-year fall in the total amount raised and May’s rise is the first since November.

The number of lots offered last month rose by almost 5% to 2,560 compared with May 2016 and lots sold climbed by almost 10%. The success rate improved from 72.8% to 76%.

Rory Daly, chief executive of Midlands and North West network SDL Auctions, said the figures reflected strong confidence from both buyers and sellers. “We held two auctions in May, raising £11.9m in total,” he said. “Our July auction is set to be the biggest yet held in Birmingham, beating our previous record of 138 lots.

“Whether the latest election result and the onset of two years of Brexit negotiations will hit confidence remains to be seen, but we saw little reaction to the referendum result last year.”

Nick McLachlan, auctioneer at Surrey-based residential specialist Harman Healy, said it would take a few more auctions before it was clear where the market was heading. Harman Healy’s auction on 6 June achieved a success rate of 85%, raising £2.2m from 16 sold lots, and he expected the sales rate to increase to 90%.

EIG figures for commercial auctions show a different story to residential. The total raised was £179m, a drop of 16.5% on the same time last year. In the three months from March to May commercial lots raised 14.4% less than they did in 2016.

The number of lots offered was down by 15.4% and the number of lots sold dropped by almost 20%. EIG managing director David Sandeman said: “This month it appears very much a tale of two sectors, with notable differences in the performance of residential and commercial lots.

He said that the residential sector had performed “amazingly well”, but that there was some concern about the performance of commercial sales.

“One hopes that this was merely a blip in what has otherwise been a reasonably steady year to date for commercial auctions,” Sandeman said.

Last month’s commercial performance pulled the overall total raised across the auction sector down by 1.5% from £525m in May 2016 to £517m from almost exactly the same number of lots offered.

Commercial auctions have not seen a year-on-year monthly rise in the total raised since December and most months over the past year have seen a decrease.

However, the picture is different again in London with the residential total raised over March to May dropping by 16% to £187m on the same period last year, and the commercial total rising by 11% to £42m.

David Callaghan