A portfolio of local shops has attracted more than 200 bids in Allsop’s first online commercial auction.

Six of the eight lots offered were sold, raising a total of just over £1m for owner the Local Shopping REIT. The REIT has been disposing of its assets since 2013 in order to repay debt and return remaining capital to shareholders.

Internos, now Principal Real Estate Europe, was appointed to liquidate its 600-plus portfolio and in turn instructed Allsop to carry out major portfolio sales and individual disposals through private treaty and auction.

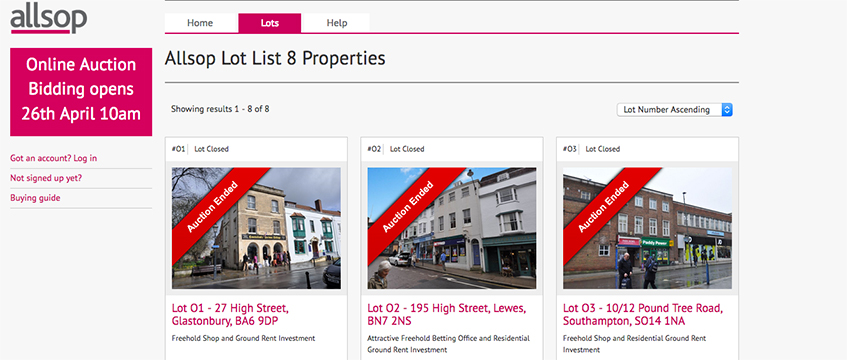

The latest portfolio was offered exclusively online yesterday (26 April).

A takeaway pizza shop and maisonette in Salford, Manchester, part-let to 2020 and producing £17,000 pa, generated the most intensive bidding war: 49 bids were placed by seven bidders. It sold for £211,000, having been listed with a “reserve not to exceed £150,000”.

Similarly, a vacant shop and residential ground rent in Eastbourne producing £150 pa saw five bidders place 45 bids. The property was listed with a “reserve not to exceed £25,000” and finally sold at £54,000.

The highest price achieved was for a Betfred bookmakers and residential ground rent investment in Lewes, East Sussex, listed at £235,000 and producing £21,100 pa. It attracted 38 bids from five bidders and sold for £277,000. Two shops with two flats and an office suite above, producing £27,000 pa, in Swadlingcote, Derbyshire, made £270,000. The lot was listed at £240,000, and attracted 13 bids.

A vacant shop and flat in Macclesfield, listed at £90,000, sold for £130,000 after 39 bids from three bidders. A café with flat above, producing £10,000 pa, in Grays, Essex, attracted 24 bids and sold for £115,000 against a reserve not to exceed £95,000.

One lot – a shop and freehold ground rent in Glastonbury, Somerset – was withdrawn prior and will be re-offered once a legal technicality is resolved.

A shop and residential ground rent investment in Southampton, Hampshire, part let to a Paddy Power bookmakers, listed at £460,000 and producing just under £46,000 pa, failed to sell after bidding reached £430,000.

Commenting on the proposed sale last week, Rupert Wallman, fund manager at Principal Real Estate Europe, said: “Historically, the UK has been behind the curve compared with other major real estate markets like the US, where online commercial real estate auctions are fairly mainstream.

“While this is going to be the first such commercial auction run by Allsop in the UK, we felt that it was an appropriate platform for us to auction some of the Local Shopping REIT portfolio, and that it would help us lower transaction costs, particularly for smaller lots. In time, we believe online auctions will grow into an important marketplace for UK commercial property.”

To send feedback, e-mail julia.cahill@egi.co.uk or tweet @egjuliac or @estatesgazette