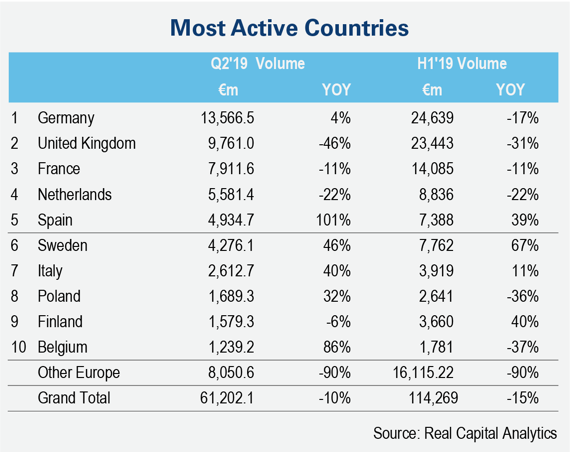

Escalating fears over the economic impact of Brexit drove a 31% decline in UK property investment in the first half of the year.

There was €23.4bn (£21.5bn) invested into UK property, according to Real Capital Analytics’ Europe Capital Trends.

Tom Leahy, Real Capital Analytics’ senior director of EMEA analytics, said: “The political process surrounding Brexit is clearly unsettling investors in the UK market, who are becoming increasingly risk averse.”

The report found a slowdown across Europe, with volumes down 15% to €114.3bn.

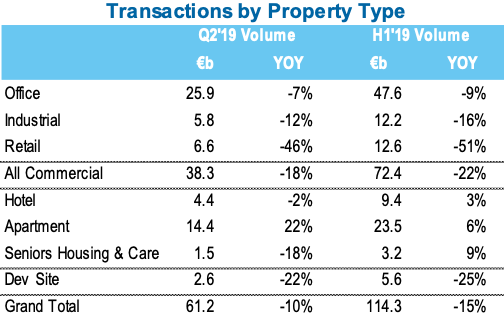

Commercial property investment fell 22% during the period, with €72.4bn making up two-thirds of the total transacted.

Retail (-51%), industrial (-16%) and offices (-9%) were the hardest hit sectors.

However, residential markets bucked this trend with €36.1bn of investment up 5% year on year.

This was primarily driven by €23.5bn of investment in apartments up 6%, overtaking retail as the second largest investment sector.

RCA reported further growth in senior living and care (9%) and hotels (6%).

Leahy added: “These ‘beds’ sectors are benefiting from structural market factors, and are now attracting around a third of all the investment capital being placed in European property.”

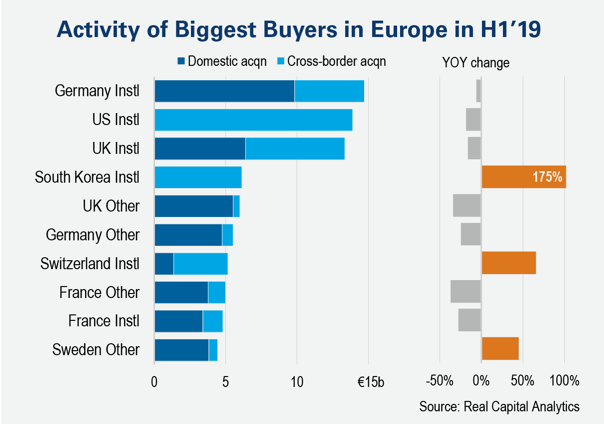

The bulk of funds came from German institutions with almost €15bn invested, followed by US and UK institutions.

China and Hong Kong were notably missing from the rankings, with domestic capital restrictions drying up spend compared to previous highs of 2017.

To send feedback, e-mail emma.rosser@egi.co.uk or tweet @EmmaARosser or @estatesgazette