The global construction market is huge, with forecasts indicating it will exceed $24tn (£19tn) in 2021. But it is vastly technologically underserved. When we talk about real estate, we rarely look at construction in isolation, but focusing on this side of the industry can shine a light on some of the wider issues within the sector.

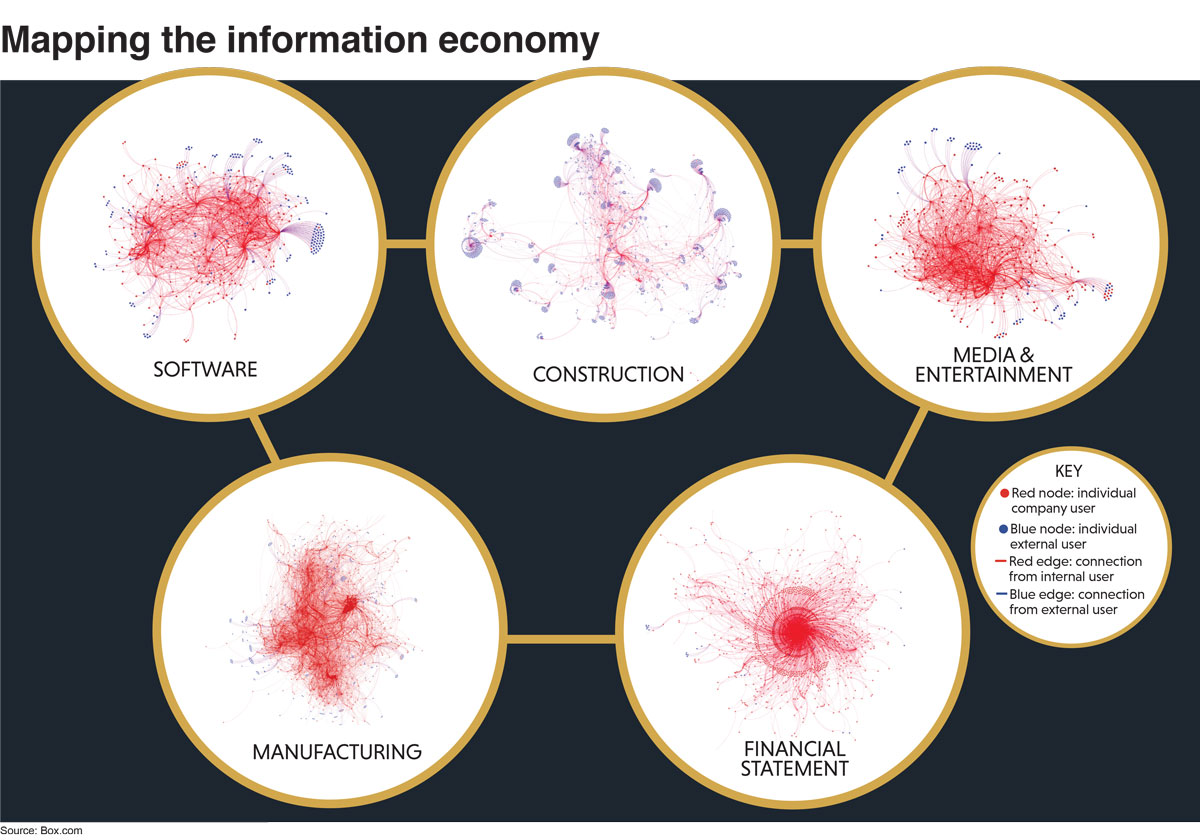

Box.com has mapped the information sharing between internal and external counterparties. Thicker red lines represent more frequently shared information. It is not a coincidence that companies within the construction industry share significantly less information internally and externally than other industries, including manufacturing.

This is not for lack of innovative start-ups entering the space. Rather, the stakeholders in this process continue building the same as has been done for nearly 100 years because of generational preferences, lack of R&D spending, geographic challenges, and fragmented management.

McKinsey Global Institute estimates that less than 1% of construction company revenue is spent on technology, making it the second least digitised industry behind agriculture. This is because the ecosystem largely consists of firms that cannot afford the time and money to invest in digitisation. McKinsey claims that construction productivity has grown only 1% over the past two decades, compared to 3.6% in manufacturing.

Until owners and contractors embrace the collection, analysis, and sharing of data, we won’t see meaningful improvement in construction productivity.

Chris Stephenson is partner at Concrete VC