Every two years the Centre for Effective Dispute Resolution (CEDR) produces its mediation audit: a survey of the civil and commercial mediation landscape to track trends. Its latest report is based on 336 responses received from mediators based in the UK, representing more than 50% of the individual membership of the Civil Mediation Council. Although some areas remain constant, others show that this is still a growing industry.

Contribution to the economy

In these days of uncertainty, mediation seems to be doing its bit to keep the economy buoyant. Excluding mega cases (which can significantly distort the picture), it is estimated that the value of cases mediated each year is £11.5bn (up from £10.5bn in 2016), saving businesses around £3bn a year in wasted management time, damaged relationships, lost productivity and legal fees. With an estimated total fee income for the mediation industry of £30m, that is a 100:1 return on investment for the UK economy.

20% growth in mediations

CEDR also estimates that, after what appeared to be a slowing down of growth in 2016, the number of commercial mediations has increased by 20% on 2016 (from 10,000 to 12,000 pa). However, most of this growth has come from scheme mediations such as those supported by NHS Resolution, the Court of Appeal and other courts. Scheme mediations have grown by 45% in two years and now account for 37.5% of all mediations. There has been growth of ad hoc referral cases but this is relatively modest, at 9%. As before, most of these (70%) are through direct referrals.

Is it still working?

While in 2016 there was a reported dip in the number of mediations settling on the day, this seems to have righted itself, with 74% settling on the day and 15% settling soon after mediation – an aggregate of 89% (2016: 86%).

The report also refers to “accounts of many mediators and lawyers that the value of the process goes far beyond the binary question of whether or not settlement is achieved, and that many less tangible impacts, such as clarifying the issues and narrowing areas of difference, are also of real importance”.

There are reports of an increasing resistance to joint meetings, particularly at the start of the day, which seems to be driven largely by lawyers who argue that no purpose is served by such meetings, given that the parties are already familiar with each other’s cases.

This is a view that most mediators do not appear to accept (including this one). Opening meetings need to be handled carefully but, in my view, are rarely a negative thing and often lead to lengthy, frank discussion, which can produce huge time savings.

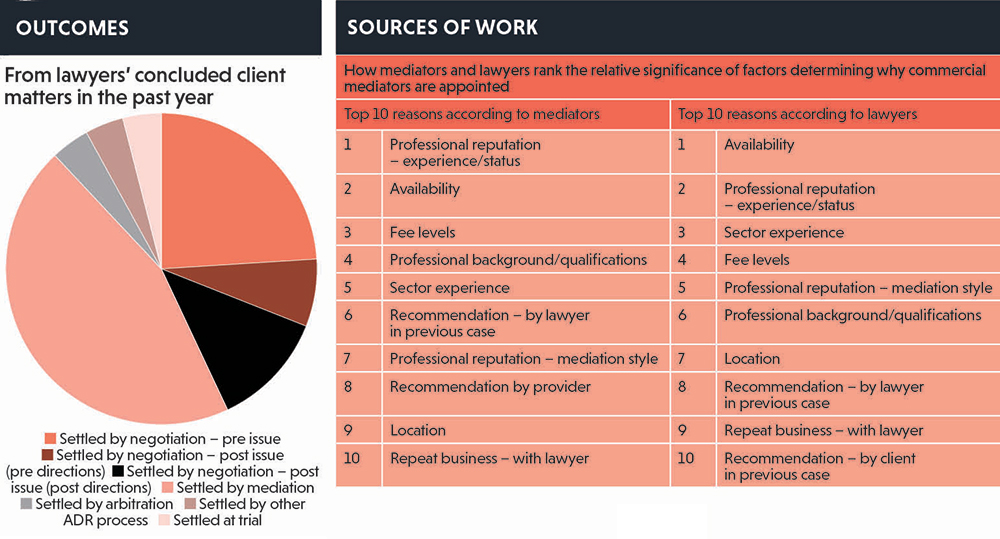

An interesting aspect of the survey of lawyers is illustrated in the breakdown of the client matters they have worked on in the past year (see below).

This shows that mediation is by far the method by which most cases settle. Considering this is still a relatively new concept, it shows how effective it has been in becoming part of the “norm” in civil litigation.

The mediators: diversity (or not)

In total, 38% of mediators describe themselves as “novice” or having some/limited experience (doing no more than four mediations a year). The remaining 62% describe themselves as “advanced” mediators who are “reasonably” or “very” experienced. Of those advanced mediators, 60% describe themselves as “full‑time” (up on 40% in 2016) although, as the report says, clearly full-time is a “term of art” since 59% still report undertaking fewer than 10 mediations a year.

The age of the average female mediator is 51 (up from 50 in 2016) and the average male is 59 (up from 56 in 2016). The advanced mediator group is only a year or so older than the average. This shows that mediation is still very much a second career.

It is also still a career dominated by the white male. Just 35% of respondents were women (the same as in 2016), with women in the advanced group being just 24% (down from 29% in 2016). By way of comparison, the report says the Law Society shows that 50.1% of practising solicitors are women.

The report also highlights that just 10% of respondents categorise themselves as being from black, Asian and minority ethnic (BAME) groups (compared with 16.5% of solicitors). Also, there are just 5% of mediators reporting a disability, compared with statistics showing disabled people representing 19% of the working population in the UK. The report states, however, that the 2% of mediators identifying themselves as lesbian, gay or bisexual is consistent with estimates from the Office for National Statistics.

There also seems to be a slight reversal of the trend away from lawyer mediators noted in previous surveys, with 49% of mediators being lawyers, rising to 61% in the advanced group.

How mediators get their work

Mediators have slightly different ideas from the lawyers who appoint them as to why they are selected. Both do seem to agree on the main reasons, albeit not quite in the same order (see Sources of Work box). For those aspiring to break into the market, it would appear that methods such as mailshots, websites, PR (articles and speeches) and directories have little impact. Interestingly, reputation by settlement rate is also low down on the list for lawyers.

How are we all performing?

• Lawyers and clients – getting it right

As with most things, this depends on who you ask. According to mediators, fewer lawyers and clients are performing very well or quite well. In all, 63% of lawyers (down from 69% in 2016 and 71% in 2014) and 61% of clients (down from 64% in 2016 and 62% in 2014) met these indicators.

This is a worrying trend – although if you ask lawyers their view is that 70% of mediators behaved very well or quite well (up from 60% in 2016 and 54% in 2014) and similarly 72% of clients (up from 70% in both 2016 and 2014). Perhaps this mismatch of perceptions could be down to mediators providing an effective buffer of some not-so-good behaviour – which is, after all, part of the reason they are there.

• Lawyers and clients – getting it wrong

There is also still a consistent number of lawyers and clients who are performing less than adequately or poorly, but with more agreement on how many. Mediators report this at 14% for lawyers and 15% for clients (both of which have varied only slightly over the years). Lawyers report 14% of mediators and 10% of clients.

Interestingly, mediators have reported a large increase in two problem areas in the behaviour of client negotiating teams.

While group think (36%), poor negotiation strategy (43%) and over-reliance on advisers (42%) have stayed steady (but still high) in the list of frequently encountered behaviours, inter‑personal conflict within the team has risen from 14% in 2016 to 21% in 2018, and disagreement about strategy has more than doubled, from 7% in 2016 to 16% in 2018. When analysing the comments of mediators as to what advice they would like to give to parties on how to improve their performance and get the most out of the mediation, the theme that prevailed in the report was

for them to “do more preparation”.

There are also reports of lawyers and mediators bemoaning both the late arrival and decline in standards of mediations bundles. Anecdotally, some mediators also refer to there being less “commitment” to the process by teams, including the availability of key individuals and/or information – this again comes down to a lack of preparation.

Mediators

The feedback on mediators is consistent with previous years. In total, 83% were reported as performing very well or quite well (2016: 81%), 13% adequately (2016 – 14%) and 4% less than adequately (2016: 5%).

In all, though, the results are positive and mediation continues to provide an effective and value for money solution to many disputes.

Click here to download a pdf copy of the full report

Jacqui Joyce is a member of The Property Mediators, whose members specialise in mediating property disputes: www.thepropertymediators.co.uk

You might also be interested in The Agenda: mediation versus litigation – which one has the edge? Listen to the podcast below: