It was not long ago that the chancellor was setting out how the UK’s corporation tax rate was due to become one of the lowest in the world. One pandemic later and that has all changed, with corporate tax rates set to increase to 25% in 2023. This, added to non-resident landlords becoming subject to UK corporation tax on capital gains, means the level of tax drag on investment returns is set to increase.

Recent changes to the capital allowances regime, including the super-deduction in the last budget, now means that the majority of construction-related expenditure, whether for a new build, refurbishment or fit out, will attract some form of tax relief through claiming capital allowances.

The key tax planning point is to ensure that the expenditure is claimed at the highest rates of relief available, ensuring the maximum tax allowances are achieved, to help mitigate tax costs.

Who can claim?

Capital allowances is a form of tax relief which can be claimed by all tax-paying entities, corporates, partnerships and individuals, providing the basic entitlement principles are met. A property trader cannot claim such allowances, nor can entities that are not subject to tax, such as registered charities and UK pension funds.

Qualifying expenditure

The nature of the expenditure must be capital, so it must provide an enduring benefit or improvement as opposed to a repair, which can be treated as a revenue expense. Claims can be made on second-hand acquisitions, but this requires the right questions to be raised as part of the buying due diligence process before contracts are exchanged. Often, the replies to commercial property standard enquiries state that there is nothing to claim, but the onus here is on the buyer to challenge the position to establish if there are any unclaimed capital allowances that can be passed across. A capital allowances election may be needed to ensure allowances are not lost and contractual protection should be sought to require the seller, post-completion, to assist the buyer with claims for allowances on the plant and machinery acquired.

An understanding of the historical ownership of any property acquired and the timing of expenditure on it qualifying for capital allowances is needed – and this is where a capital allowances specialist is required. They may be able to identify new entitlements to claim where rules have changed, even when the relevant contract is silent on capital allowances.

Development expenditure

Since the introduction of structures and buildings allowances (SBAs) in 2018, most construction expenditure will qualify for some form of tax relief.

But to know at what rate requires a detailed knowledge of the capital allowances rules. With the introduction of temporary “super” capital allowances in the last budget, the number of rates at which allowances can be claimed has increased. Allowances can now be claimed at 150%, 130%, 100%, 50%, 18%, 6%, 3% and zero.

Claiming allowances can be complicated by the fact that the cost information provided by sellers/contractors may be inadequate and this is where a capital allowances specialist can apply their surveying skills to undertake a more detailed valuation exercise.

It is essential that allowances are claimed at the correct rate or this could slow down the rate at which tax relief is available. Further, as allowances can, in certain circumstances, be clawed back on a disposal as part of the capital gains calculation, making the correct allocation of expenditure is critical.

Type of property

All commercial property assets qualify for capital allowances; only your own dwelling home is excluded. In the case of build to rent and student accommodation, it is only the flats or bedrooms themselves that must be excluded – the landlord can still claim on those qualifying fixtures within the common areas.

Opportunities to be seized

With corporate tax rates increasing to 25% in 2023, capital allowances can greatly help to mitigate the potential for that rising tax bill. Even when there is no taxable income to offset, it is possible to disclaim and roll forward some of the allowances to a future taxable event. In most cases there is also no time limit to make a claim – if you have incurred the expenditure and still own the plant and machinery, you can go back and claim on historic expenditure.

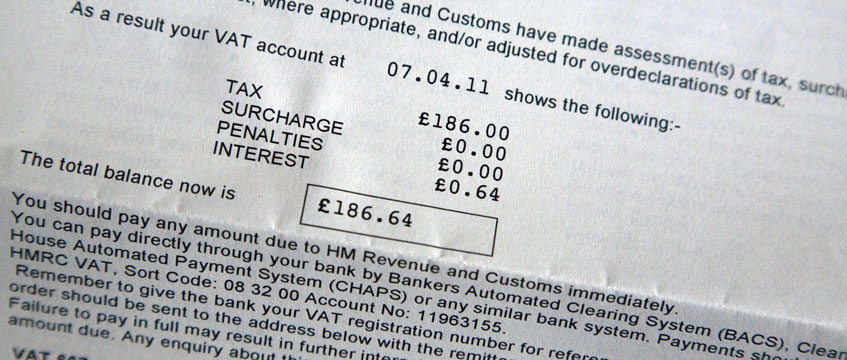

Claiming capital allowances is not aggressive tax planning and is accepted by HM Revenue & Customs. It is vital on transactions that these are not given away at heads of terms stage when the capital allowances position may not be known or known fully. Always make sure that your lawyer inserts the requisite contractual provisions into the transactional/development documentation to protect your position and maximise the allowances that are transferring/can be claimed.

Example of available allowances: comparative first-year cash savings based on £100,000 of qualifying expenditure

|

Type of allowance/writing down rate |

Corporate tax rate at 19% |

Partnerships/individuals tax rate at 45% |

|

Super-deduction at 130% |

£24,700 |

N/A |

|

Annual investment allowance* at 100% |

£19,000 |

£45,000 |

|

Special rate allowance at 50% |

£9,500 |

N/A |

|

Plant and machinery at 18% |

£3,420 |

£8,100 |

|

Integral features at 6% |

£1,140 |

£2,700 |

|

Structures and buildings allowances at 3% |

£570 |

£1,350 |

Alex Barnes is a partner at BDB Pitmans and Nolan Masters is a director at Veritas Advisory