The start of 2016 sees the new RICS Professional Statement for Property Measurement on offices become mandatory as part of the implementation of the new International Property Measurement Standard (IPMS). The big questions are what does this really mean and how will it impact the property industry as a whole, because this is not just something technical that only surveyors need to understand.

The start of 2016 sees the new RICS Professional Statement for Property Measurement on offices become mandatory as part of the implementation of the new International Property Measurement Standard (IPMS). The big questions are what does this really mean and how will it impact the property industry as a whole, because this is not just something technical that only surveyors need to understand.

In “IPMS: an essential initiative” (EG, 19 December 2015, p55), Peter Holland and Alexander Aronsohn looked at the impact of IPMS on the occupier market. But it is important to remember that this is not just an occupier issue; it will have a major impact on the sale and purchase process and how investors manage their global portfolios.

Why do we need IPMS?

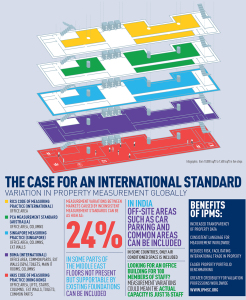

Property investment is now very much a global business, with funds especially having portfolios that are spread across continents. The problem is that many of the leading global markets have their own standards for measuring a property and some emerging markets have no set standards at all. This makes it very difficult for asset and fund managers or investors to compare properties in this portfolio on a like-for-like basis.

In fact, recent research by JLL found the reported size of a building can vary by as much as 24% when measuring to different global standards (see infographic). This can understandably lead to a lack of clarity over exactly what is being bought. The introduction of one universal measurement standard will bring consistency to a process that is becoming increasingly global.

What are the benefits of IPMS?

For global investors, the biggest benefit is the simplifying of data. Investors will be able to benchmark their property portfolios to a recognised standard rather than spending time and effort creating bespoke standards or calibrating and translating reports produced to current standards.

Importantly, IPMS is designed to work alongside existing recognised international standards for accountancy (International Financial Reporting Standards) and valuation (International Valuation Standards), making financial reporting more transparent.

What will change for the UK?

In the UK we have traditionally used the RICS Code of Measuring Practice (CoMP) and switching to the RICS Property Measurement Professional Statement, which incorporates IPMS, will mean a number of significant changes to the measurement reports produced and seen by professionals in the property industry.

For a start the terminology will change, with gross external area, gross internal area and net internal area (GEA, GIA and NIA) being replaced by IPMS1, IPMS2 and IPMS3 respectively. As a result of the introduction of measuring to the “internal dominant face” – a new concept to the UK market – the reported area of buildings will change, with the likelihood being that, on paper, building sizes will increase. This doesn’t mean a building has grown (or shrunk), it is just the basis on which size is reported has changed.

Area change versus value

It is going to be important to remember that although reported building areas will change, IPMS will not directly impact property value because that is established and dictated by local market factors. What it will mean is that because the data that sits alongside a valuation will be consistent across property markets, it will lead to a more transparent basis of how the valuation of assets in a cross-border portfolio relate to each other from one market to the next. The square metre multiplier may therefore change, but the overall value shouldn’t.

Realising that the provision of comparable evidence is important in valuations and rent negotiations, the RICS has acknowledged that for a period of time there will need to be an element of “dual reporting” while the industry gets used to the new reporting system and a bank of comparable IPMS evidence is compiled. This will mean being able to provide the area reported as per CoMP alongside the IPMS area of the property. It is also acknowledged that existing leases will be based on measurement figures derived from an existing standard. There is no requirement to review these leases in light of the release of IPMS, however, IPMS should be adopted for new leases.

The start of something special

A lot has been invested in the creation of IPMS and it has seen over 70 standard setting bodies come together to get behind one single, consistent measurement standard, something that is very rarely seen in the property world. So far IPMS is only applicable to office space, but it will ultimately be rolled out to the residential, industrial and retail sectors to create an even greater alliance.

Tom Pugh is an associate at Malcolm Hollis LLP and was part of the RICS Professional Statement for Property Measurement working group that has implemented IPMS

New terminology

IPMS1

The main difference from gross external area is the reporting of covered galleries and balconies, which currently aren’t included in measurements

IPMS2 – Office

• Perimeter measurements are taken to the ‘internal dominant face’

• Covered galleries and balconies are included in the measurement and reported separately

• Areas can also be detailed on a component-by-component basis

IPMS3 – Office

• Details areas on an occupancy basis

• Perimeter measurements are taken to the ‘internal dominant face’

• Columns are included

• Standard building facilities (corridors, toilets, lifts and stairs) are excluded

• There are no inclusions/exclusions like those contained in the CoMP; limited use areas should be used to detail certain areas that may have a different value

• Covered galleries and balconies for the exclusive use of one tenant are included

• On floors with multiple occupants the area is taken to the midpoint of the partition wall between tenancies