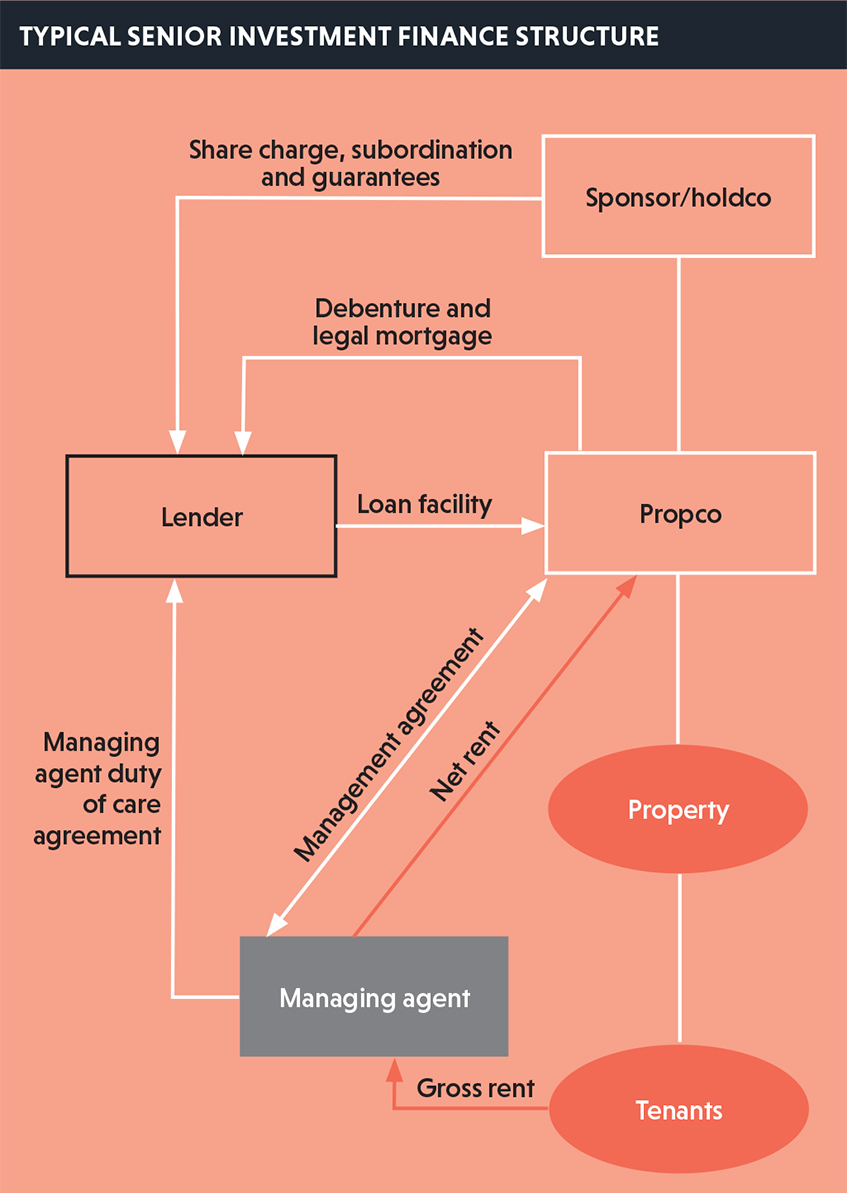

Claire Illingworth and Rohan Campbell offer an overview of a typical real estate finance senior investment loan and highlight key issues to be aware of when considering this type of arrangement

A typical real estate investment finance structure assumes that the borrower will be a property-owning special-purpose vehicle (SPV). The lender will expect to take a fixed and floating charge over all of the assets and undertaking of the borrower, including but not limited to:

■ a legal mortgage over the property, which may be contained within the debenture;

■ a charge over all bank accounts;

■ a charge over property insurance policies;

■ a charge over all occupational leases and rental income thereunder; and

■ any other material contracts under which the borrower has any benefit.

A borrower should note that if any assets to be secured in connection with the transaction (eg the shares in the borrower, the bank accounts of the borrower or the subordinated debt) are situated in, or governed by the laws of, a country outside England and Wales, specific foreign law security is likely to be required.

Control over rental income

The lender will expect to have control over the income from the property.

Typically, the borrower will appoint a managing agent to collect rent from the property pursuant to a property management agreement. The managing agent will deduct agreed fees and amounts relating to maintenance and services in respect of the property and then transfer the net rent to an account of the borrower held with the lender. The lender will control the rent account and use the funds to meet all of the periodic payments due to the lender before transferring the balance to a general account. The borrower will be permitted to use the funds in the general account, provided no default is continuing under the finance documents.

The lender will want rights to instruct the managing agent or terminate its appointment in a default scenario, and direct recourse to the managing agent for breach of its obligations under the management agreement. This is achieved through a duty of care agreement granted by the managing agent in favour of the lender.

Restriction on additional borrowing and security

It is likely that the borrower will have incurred additional shareholder debt or third-party debt funding in order to acquire the property. Unless the loan facility is permitted to be used to refinance all of that third-party debt, the lender will require the relevant creditors to enter into a subordination deed.

The subordination deed will prevent the subordinated creditors from receiving any payments from the borrower in advance of the lender being repaid in full without the lender’s consent.

If any third-party creditor requires security over the SPV borrower or its assets, senior lender consent will be required. If consent is granted it is likely that the lender will require a deed of priority or intercreditor arrangement to be put in place.

Recourse to the sponsor and/or holdco

The lender will usually take a share charge over the shares in the borrower. The share charge gives the lender the necessary powers to sell the shares on enforcement as an alternative to selling the property pursuant to the legal mortgage.

The charge also gives the lender controls over voting rights when a default is continuing. If a charge over shares is taken, the lender will take a charge over any subordinated debt so that the debt can be transferred with the shares on any exercise of the powers of enforcement under the share charge.

Depending on the relationship between the parties, the risk profile of the asset and the track record of the sponsor, the lender may require a guarantee from the sponsor/holdco for the obligations of the borrower. If it is agreed that no guarantee is required, the sponsor/holdco should ensure that the lender’s recourse under any other security it provides is expressly limited to the value of the secured assets.

The asset

The lender will want to know that the property to be secured is wholly owned by the borrower and, to the extent that there are any trust arrangements, would want to understand this. Freehold and leasehold assets can be acceptable security but, if the asset is leasehold, there are additional points to consider.

Consents: whether the asset is freehold or leasehold, the lender will expect all necessary consents to be in place. This includes statutory consents, such as planning permissions or building regulation approvals, as well as third-party consents such as consents required to assign a leasehold asset or enter into security.

Reports: It is becoming common for lenders to request sight of an environmental report and a structural report as a minimum. Further specialist reports may be required depending on the asset. If the reports are not addressed to the lender, the lender will often insist that the report provider provide a “letter of reliance” confirming that the lender can rely on the report as if the report had been addressed to it in the first place.

Length of term: Typically a mainstream lender will not accept a leasehold property as security if there will be less than circa 70 years of the term remaining at the loan repayment date, as there will be a concern that: a) the investment value of the lease will fall as the term decreases further; and b) there may be less appetite among investors to purchase the property should the bank seek to exit.

Forfeiture: A lender will not consider a leasehold property which has a right of re-entry on insolvency to be acceptable security and, if there is a right of re-entry on non-payment of rent or breach of covenant, will expect to see what are known as “mortgagee protection provisions”, which place an obligation on the landlord to notify the lender before taking any steps to forfeit the lease and to give the lender an opportunity to remedy the breach or non-payment.

Insurance: The lender will expect to be co-insured on the building’s insurance policy. The borrower and the bank have different interests in the property and, when co-insured, each party effectively has the benefit of its own insurance policy. Many lenders are no longer comfortable simply having their interest “noted” on the borrower’s policy. The lender’s full insurance requirements will be set out in the loan facility and the borrower’s insurance broker will be expected to provide a letter in which they confirm that the borrower’s insurance policy meets the lender’s requirements.

Real estate finance: a legal checklist

When considering entering into a real estate finance senior investment loan facility, a borrower should:

■ Identify any third-party debt that will remain in the structure following drawdown of the senior loan and any related security requirements. Raise this with the lender early to ascertain the lender’s requirements in relation to the third-party debt and agree carve-outs for any necessary permitted payments to the subordinated creditors

■ Ascertain at the outset whether any guarantee is expected at sponsor or holdco level. If no guarantee is required, obtain agreement from the lender that recourse to the sponsor and holdco shall be limited to the realisation of the assets that are to be secured by those parties in favour of the lender

■ Identify any assets which are proposed to be secured that are situated in, or governed by the laws of, a country outside England and Wales. Be prepared to instruct legal counsel in the relevant jurisdictions and factor in additional time and cost in relation to these matters

■ Identify an appropriate managing agent and confirm with that managing agent that their standard property management agreement is acceptable to lenders generally and that they are prepared to enter into a duty of care in favour of a lender

■ If the property to be secured is leasehold, ensure the remaining term of the lease is sufficient and beware of any unusual or onerous forfeiture provisions in the lease that may be a barrier to obtaining finance

■ Ensure that it has appropriate insurance in place and that its broker is prepared to provide a broker’s letter to the lender confirming that the property insurance policy complies with the terms of the facility agreement and includes all of the standard mortgagee protections

Claire Illingworth is a partner in the real estate team and Rohan Campbell is a partner in the banking and finance team at Irwin Mitchell