The rise of proptech – a term coined to cover a whole series of issues arising from the application of technology to property – is set to cause disruption to all parts of the industry. Indeed, some is already here: think Airbnb or a future Uber or Deliveroo applied to property services. No wonder capital is flooding into proptech start-ups.

Proptech is relevant to anyone who comes into contact with property services:

- Occupiers – those who use property to operate from where property is subsidiary to their business and residential occupiers;

- Traders – those who supply property to users;

- Funders – those who supply money to users and traders;

- Advisers – those who advise all the above.

Residential revolution

Residential is leading in the proptech race and I believe this is due to it being consumer- facing. As consumers, we drive innovation and require faster change. The traditional role of estate agents has already changed immensely as online property portals have transformed how residential property is marketed. Now agents are firmly in the sights of proptech start-ups offering fixed fees for sales, finding and agreeing properties to rent and even managing properties online rather than via a traditional agent. As virtual reality and augmented reality become increasingly common, it may make it less necessary to physically inspect properties before buying or letting.

Office evolution

Some will tell us that this is already well under way, and to a degree it is, but there is no doubt that it is being refined, and that there are innovations aplenty for occupiers.

Agile working allows users to choose where in a building they will be; proptech via the “internet of things” is fast approaching, allowing users’ preferences as to light, heat and ambiance to follow them, flexibly.

Some economists tell us that data is now the most important asset held by any business. Historically, occupiers might buy based on analysis of other people’s data, with the results influencing their location choice. But proptech can help users of property analyse their own financial and customer data to the Nth degree to extract maximum economic return and also help them determine how best to operate their business premises. Advisers can no longer be illiterate about statistics or rely on gut feeling; analysis can be carried out algorithmically or by artificial intelligence.

Work has changed and will continue to change. Industry 4.0, the fourth industrial revolution, is said to be upon us, and that is already having an effect on how things are done. If a factory has no need of staff, why locate it next to people? This provides a whole new source of supply of land, so planning systems will have to change. Again, logistics will be key, as will infrastructure such as uninterruptible power and connectivity.

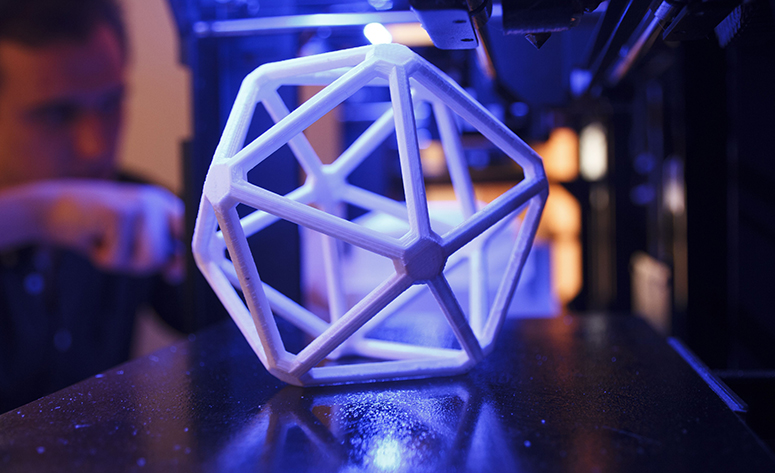

Construction caution

Given the increasing use of robotics in manufacture, and the way in which 3D printing is developing, can we really assume that the construction industry will be immune? Prefabrication is already with us so we can assume assembly will follow – the engineers will be programming this, and the role of the quantity surveyor may well be automated. 3D printing allows the efficient manufacture of bespoke components, so users will be able to have much more tailored buildings. Autonomous vehicles can transport components from manufacture to building site. Robotics or drones can then piece together the components into a whole.

Adviser alertness

Perhaps the biggest potential change is the way in which advisers may advise, with advancements including: autonomous management systems; drones remotely viewing properties for building surveys; automated legal documents prepared by AI; block chain to securely transfer and record registered property interests; big data providing greater price transparency without ties to a particular provider; and parties able to find each other and interact directly rather than being introduced by an agent.

The property industry is often seen as archaic and resistant to change – should it be concerned? To strike a note of optimism, tech platforms can smooth out and speed up complicated processes which provide the property adviser with better tools to advise. While proptech may assist and even replace aspects of advisers’ roles, there is still not substitute for a personal, human touch.

So, what disrupts?

Technological advances have always changed the way we work – ticker tape, telex, faxes, video phones, mobile phones, computers that once filled a room becoming portable and now on your wrist – so it is no surprise that proptech will disrupt the property industry.

It is impossible to guess which ideas will fundamentally change the sector and how property services will be provided in the future but, if you look at the disruptors, they all derive from the bottom up: from users. If there is no use for the land, there is no-one to trade in it, and no way for anyone to make money out of it. Proptech, wherever it enters the chain, disrupts if it enhances use and efficiency of moneymaking and takes the place of an existing way of doing things that shakes up the way in which property is used, provided and funded. The winners don’t have to win the whole market; they only need to disrupt the current.

As for the advisers, it is up to them to see how they can ride the disruptions, learn new skills and provide innovation and disruptive ideas themselves.

James Letchford is a partner at Irwin Mitchell

EG and Pi Labs have launched an exciting new competition for tech firms.

Click here to find out how to get up to £150,000 of investment.