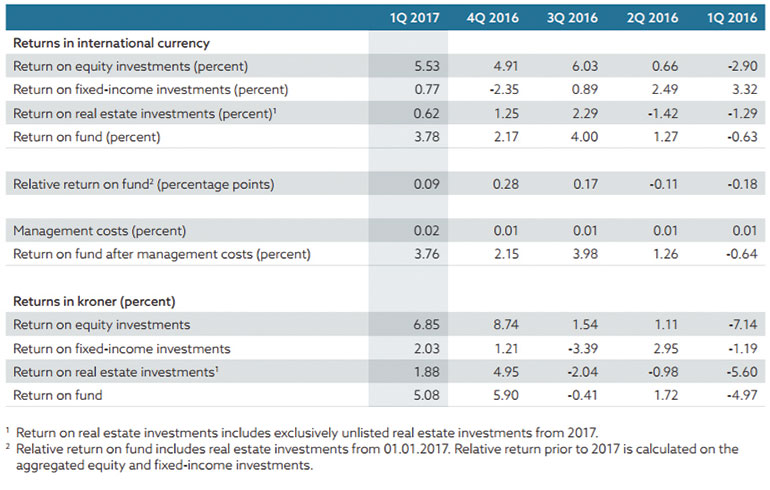

Unlisted real estate returned 0.6% in Q1 2017 for Norges Bank Investment Management, the world’s biggest sovereign wealth fund

The fund returned 3.8% overall, with contributions of 5.5% and 0.8% from its equity and fixed income investments respectively.

The fund had a market value of 7,867billion kroner at the end of the quarter, and had an allocation of 64.6% to equities, 32.9% to fixed income and 2.5% in unlisted real estate.

Measured in local currency, rental income net of operating expenses made a positive contribution of 0.9% to its real estate return, while changes in the value of properties and debt contributed 0.5%. Currency movements made a contribution of -0.8%.

The management mandate for the fund was amended on 1 January 2017 and its real estate investments no longer form part of the strategic benchmark index, which now consists exclusively of equities and bonds.

To send feedback, e-mail alex.peace@egi.co.uk or tweet @egalexpeace or @estatesgazette

To send feedback, e-mail alex.peace@egi.co.uk or tweet @egalexpeace or @estatesgazette