Almost £600m of shopping centre deals have been agreed this week as Grand Central in Birmingham and Festival Place in Basingstoke were snapped up by retail heavyweights.

Hammerson is the preferred party to buy Grand Central for around £325m – a yield of just under 4%. It is understood that talks are ongoing on whether Hammerson will be backed by its joint venture owners of the nearby Bullring, TH Real Estate and CPPIB.

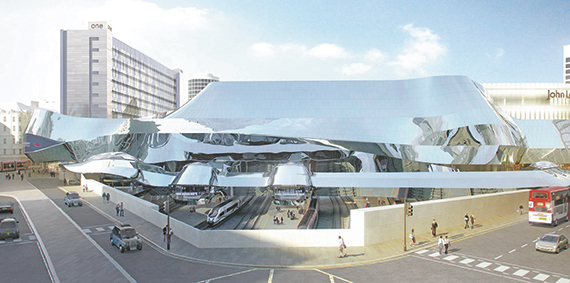

The centre, which opened on Thursday, is located above New Street Station and anchored by a 250,000 sq ft John Lewis. It is owned by Birmingham city council and Network Rail.

Hammerson fought off competition from British Land and Grosvenor.

AEW Europe has secured a deal to buy TH Real Estate’s 1m sq ft Festival Place.

AEW Europe, which is understood to be fronting the Teacher Retirement System Of Texas, edged ahead of Savills Investment Management and Capital and Regional with a £290m bid – a circa 6% yield.

TH Real Estate is selling the centre on behalf of its parent, TIAA-CREF, for which it also manages funds. TIAA-CREF bought the centre from Grosvenor Festival Place Fund in 2011 for around £285m.

It has 175 shops including Marks & Spencer and Zara and has a 2,770-space car park.

Cushman & Wakefield is selling Grand Central; CBRE advised Hammerson and TH Real Estate; Lunson Mitchenall acted for AEW.