Agents pick the most significant Deals (for the six months to end of May)

Unit DC 1, Prologis Park Midpoint, Minworth, Birmingham

Unit DC 1, Prologis Park Midpoint, Minworth, Birmingham

Type of deal Industrial leasing

Developer Prologis

Tenant Syncreon

Size 127,500 sq ft

Rent £6.35 per sq ft pa

Chosen by Nick Waddington, senior director, industrial and logistics agency, BNP Paribas Real Estate

For a number of reasons my choice is Prologis’s letting of the DC1 unit at its Prologis Park Midpoint scheme to the global logistics provider Syncreon. Firstly, this deal confirms that developers willing to commit to speculative development of industrial and logistics buildings in the right locations can be rewarded with early transactions. The letting of DC1, for example, was agreed well before its practical completion date, which is not due until September 2015. As Syncreon will be servicing a Jaguar Land Rover contract from the property, the deal also confirms the continuing growth and importance of the automotive sector to the Midlands regional market.

Finally, the transaction underlines the continued rental growth we are now seeing in the region with rents having moved on nearly 20% over the past 12 months. The headline rent achieved on this particular property is a record rent for a unit of this size in this location.

7, 8 & 10 Brindleyplace, Birmingham

7, 8 & 10 Brindleyplace, Birmingham

Type of deal Investment

Vendor Tritax

Purchaser Verwaltungsgesellschaft für Versorgungswerke

(CBRE Global Investors)

Size 300,553 sq ft

Value Circa £130m

Chosen by James Bladon, associate director, investment, DTZ

The sale of 7, 8 & 10 Brindleyplace represents the most significant office investment transaction during 2015 so far. Verwaltungsgesellschaft für Versorgnungswerke, a German pension fund, paid a price reflecting a net initial yield of 5.74% for the three linked buildings which are predominantly let to Royal Bank of Scotland with an average unexpired term certain of just under nine years. The deal illustrates the growth in investor confidence in the UK regions generally, and Birmingham in particular. It also proved prescient with the subsequent announcement that HSBC had decided to locate the headquarters of its ring-fenced retail and business banking operation in the city. The extent of this confidence is further demonstrated by the lot size, which is not an isolated example but part of a trend towards greater financial commitments to the market. These are larger than anything seen in the boom that preceded the global financial crisis.

Park Lane, Minworth, Birmingham

Park Lane, Minworth, Birmingham

Type of deal Freehold purpose-built facility

Developer Bericote Properties

Purchaser Asda

Size 120,000 sq ft

Price Undisclosed

Chosen by Carl Durrant, director, industrial & logistics, JLL

I am highlighting Asda’s acquisition of a new dark store which is being constructed at Minworth because I consider it to be a prime example of a wave of urban logistics deals being seen around the city. Rapid urbanisation and the shift from suburbs to cities is influencing the way retailers think about their logistics strategies. This is creating increasing demand for a variety of different types of distribution property closer to the more densely populated cities. Delivery time is a key differentiator between retailers and, as result, we are seeing a clear move from them towards vying for key strategic sites which enable faster delivery times into major conurbations such as Birmingham. The South East and London have already experienced this trend and, as this deal demonstrates so perfectly, it is one that is moving further north. All of this proves speed is clearly of the essence on every front when it comes to delivering to increasingly digital-savvy consumers.

Approval for HSBC

Approval for HSBC

Planners gave the go-ahead for HSBC’s new headquarters building in Birmingham. The 210,000 sq ft office block forms part of the first phase of the £400m Arena Central project.

Brum investment boost

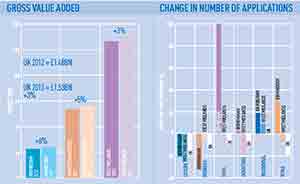

Birmingham attracted £789.2m of investment deals last year, according to Bilfinger GVA’s Regional Investment Market Outlook. The firm also showed US property ownership in the city doubling to 8.5% in its annual Who Owns Central Birmingham? report.

Selly site sold

The site of the former Selly Oak Hospital has been bought by Persimmon Homes South Midlands which is planning a £100m housing scheme there.

Delph adds PRS to portfolio

Delph Property Group has bought Queensbridge Homes’ 61-unit scheme at Carver Street in Birmingham’s Jewellery Quarter for £9m.

Midlands promotions

The Midlands office of Bilfinger GVA made 10 director-level promotions.

Enterprise extension

Prior to the general election, chancellor George Osborne said Birmingham’s city centre enterprise zone would be enlarged by a future Conservative government.

Slow start to 2015

Slow start to 2015

Birmingham’s PRS sector was making slow progress early in 2015 with companies such as Grainger, Willmott Dixon, Generate Land and Patrizia still not pursuing interest in the city.

EG gauges the trials and tribulations of Birmingham’s property market