Great Uncle Bulgaria and his fellow Wombles may soon be getting new neighbours. Although no plans have (yet) been announced to develop on the suburban rail/Underground/tram interchange at Wimbledon, just a few stops along the District Line, Transport for London hopes to transform a redundant Underground depot next to Parsons Green station into a mixed-use development, with more than 100 homes.

Great Uncle Bulgaria and his fellow Wombles may soon be getting new neighbours. Although no plans have (yet) been announced to develop on the suburban rail/Underground/tram interchange at Wimbledon, just a few stops along the District Line, Transport for London hopes to transform a redundant Underground depot next to Parsons Green station into a mixed-use development, with more than 100 homes.

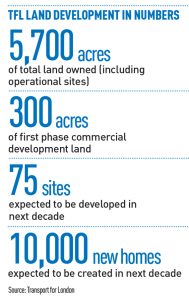

The scheme is just one of the first tranche of projects (see box) that are part of the transport operator’s Property Partnerships programme, which aims to generate £3.4bn in non-fares commercial revenue by 2023. A good chunk of that cash is expected to come from property development, much of it residential. To provide the necessary expertise, TfL last year hired former Land Securities executives Francis Salway and Lester Hampson. They, together with TfL commercial development director Graeme Craig, whittled down a list of more than 50 developers who will be able to bid to develop sites as they come forward. Earlier this year the 13 developers who made the cut were announced and will have exclusive bidding rights for the next decade.

When it comes to flagging up exactly where development is likely to take place, TfL is decidedly coy. Apart from a handful of schemes, no details of potential sites have been released.

However, the market may not have to wait that long to find out more, as Hampson, now the organisation’s property development director, hopes that the programme will move forward pronto: “The first 75 sites are likely to come forward really quickly. For each site there will be a mini competition [for bids from the 13-strong panel] and we are aiming for one of those every two months.” Some may suggest that half a dozen schemes a year is hardly speedy, but Hampson points out: “These are big (£100m-plus) projects. If you rush development you can lose sight of key things.”

How TfL will crystallise its returns is not clear. Hampson admits that exit strategies are still being worked through. What is certain is that TfL’s share of the profits will be reinvested in the transport network. The £1bn cost of the Northern Line extension to Battersea, for example, will be partly funded by the commercial development above Nine Elms station, which won planning consent last month.

“As each development is completed there is the potential for TfL and its partner to retain any part or use,” notes Matthew Evans-Pollard, planning and development partner at Deloitte Real Estate, which advises the organisation on its property strategy. “TfL may just take receipts or a profit share and directly reinvest into the transport network, or it could put them into a property portfolio or even create a PRS portfolio. All those decisions will be taken on a site-by-site basis.” However he suspects the majority of sites are likely to be sold on completion.

The five projects expected to start construction this year will be litmus tests for the working relationships between TfL and its property partners. Some property commentators expect those relationships to be sorely tested. One, who prefers not to be named, praises the commercial division of the transport operator, but brands the operational division as “an absolute shambles”, describing how a developer client was forced to wait several years before a single insurance clause could be agreed.

TfL’s Hampson deftly avoids answering whether he recognises that disconnect in his organisation, and instead points out: “Insurance and indemnities are the most difficult things to agree – the most important thing is to get the right answer.”

Richard Upton, deputy chief executive at U+I, one of TfL’s official property partners, has little time for developers who expect to get land given to them to build on problem-free. “You have to understand there are multiple stakeholders,” he says.

Back in Wimbledon, Tomsk and Orinoco would surely agree.

What does the market think?

As London tackles the question of whether to grow up or out to meet population growth, the prospect of building up, on and around transport infrastructure is broadly welcomed. Questions of whether residential occupiers will be disturbed living over operational transport nodes are roundly dismissed.

“We understand how to mitigate quite hostile characteristics like vibration, noise, brake dust and pollution – it is not really that complicated,” explains Hiro Aso, head of transport and infrastructure at architect Gensler.

TfL’s broad assertions of a high proportion of affordable housing are widely queried. Savills planning director Nick de Lotbiniere says: “Viability is likely to be an issue – it is not cheap to raft over tracks.” BNP Paribas Real Estate director Samuel Blake adds that lease lengths may be shorter than developers prefer (150 years, rather than 999) to allow access to infrastructure below. And Knight Frank’s joint head of residential development Ian Marris argues: “The focus should not just be on housing but also on places around these hubs for, say, affordable retail units.”

Early redevelopment sites (*Due to start by March 2017)

Nine Elms

Where Northern Line (extension), Zone 2

What Development above the new Nine Elms Tube station including 332 new homes (25% affordable), 57,400 sq ft of offices, 6,590 sq ft of retail, a new public square, play space, pedestrian and cycle connections, cycle parking and disabled car parking.

When Planning consent for above ground space granted March 2016; planning consent for Underground station expected later in 2016. Completion expected to tie in with planned station opening in 2020.

Northwood*

Where Metropolitan Line, Zone 6

What Development next to Northwood station will deliver 127 new homes (20% affordable), a new Tube station, a new bus and train interchange, plus new retail and public realm.

When Planning application under consideration.

Parsons Green*

Where District Line, Zone 2

What A former London Underground depot next to Parsons Green Tube station, presently used as workspace, would be redeveloped to provide 119 new homes (40% affordable), plus

new retail, workspace and restaurants. The development will enable the

opening of three arches for commercial use.

When Planning application under consideration.

South Kensington*

Where Circle, District & Piccadilly Lines, Zone 1

What Refurbishment of station and retail arcade, plus new residential and retail space.

When To be offered to Property Partners in 2016.

Kidbrooke*

Where suburban rail, Zone 3

What Potential for up to 400 homes, plus retail and workspace, in 20-storey tower next to Kidbrooke station. Joint with Network Rail.

When Scoping report presented to Greenwich council September 2015. To be offered to Property Partners in 2016.

Landmark Court, Borough Market/London Bridge*

Where Zone 1

What Potential for 200,000 sq ft mixed-use development.

When To be offered to Property Partners in 2016.