Perceptions are a funny thing, sometimes mirroring reality and at others being way off the mark. It seems to be more a case of the latter in the central Leeds office market, where a flurry of grade-A buildings totalling nearly 560,000 sq ft are due to complete this year. This gives the impression that the city will have a plentiful supply of shiny new space.

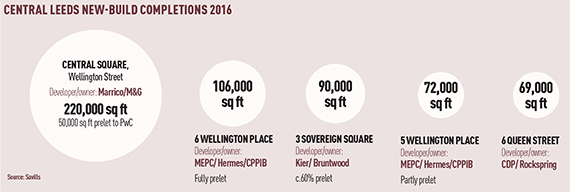

Perceptions are a funny thing, sometimes mirroring reality and at others being way off the mark. It seems to be more a case of the latter in the central Leeds office market, where a flurry of grade-A buildings totalling nearly 560,000 sq ft are due to complete this year. This gives the impression that the city will have a plentiful supply of shiny new space.

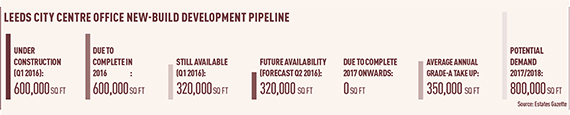

But do the maths and it becomes clear that come this summer, there is likely to be less than a year’s supply of prime accommodation up for grabs (see panel and infographic overleaf), with little in its wake.

“There’s certainly potential for a lull in the pipeline,” says Jeff Pearey, head of JLL’s Leeds office.

Surprisingly, unlike Manchester and Birmingham where developers have started on large schemes that won’t complete until 2018, at present no brand-new space is scheduled to appear in Leeds in 2017 and beyond.

“The headline figure of a large amount of space worries people,” admits the head of Savills’ Leeds office Paul Fairhurst. “So we’re unlikely to see developers push the button on big schemes right now – people are getting nervous.”

Tom Gilman, managing director of Kier Property North, which is working on one of the schemes completing this summer, agrees. “Developers and investors will want to see how that space is absorbed before making a decision,” he says.

The signs are that it could go faster than many expect. Already 25,000 sq ft is under offer to professional services firm Baker Tilly at Marrico and M&G’s Central Square and further deals are believed to be bubbling under at all of the big four schemes under construction.

Could a sudden drop in availability be the catalyst for a new wave of development? Rod Mordey, European director of Rockspring, owner of

soon-to-be-completed 6 Queen Street, isn’t convinced: “We aren’t looking to do any further development in Leeds, but if we were, we’d be a bit cautious.”

“Developers have long memories of when Leeds had considerable oversupply, especially the cycle before last,” adds CBRE senior director Jonathan Shires. “It’s a question of whether they will chase elusive prelets or build speculatively.”

He points out that there are several potential central sites, some of which have detailed planning consent and so are ready to go.

Top of the list (and widely tipped to start construction before the end of this year) is Hermes and CPPIB’s 3 Wellington Place which could deliver 110,000 sq ft. Other contenders include: the next phase of Town Centre Securities’ Riverside (140,000 sq ft) and BAM’s Latitude Yellow (157,000 sq ft).

One factor that would strengthen the case for further new development is rental movement.

“Leeds is struggling to get past £27 per sq ft and, with build costs going up, we really need them to be at £29,” says Alan Syers, portfolio director at local developer Evans Property Group.

Agents aren’t optimistic of that happening anytime soon, especially as two large refurbishments which will complete next year – Bruntwood’s City House (120,000 sq ft) and Knight Frank Investment Managers’ Benson House (73,000 sq ft) – are expected to keep prime rents competitive.

Out of town

This month, Network Rail is putting the finishing touches on Kirkstall Forge railway station which will whisk commuters to and from central Leeds in around six minutes. It’s likely to be another year and a half, however, before workers will arrive at their desks in the office element of Commercial Estates Group’s mixed-use development next to the station. The first 110,000 sq ft (of 300,000 sq ft of offices planned) is under way, with the maiden 45,000 sq ft prelet agreed to leasing and fleet management company Zenith last month.

The scheme is an important barometer for the Leeds out-of-town market, which was savaged during the recession. Confidence has returned to the extent that Scarborough Properties and Legal & General are speculatively building Paradigm 3175, a 32,000 sq ft office block at their well-established mixed-use Thorpe Park development, which will complete this November. Scarborough is hoping its “spec ’em and let ’em” mantra will pay dividends, though local agents question whether occupiers will pay upwards of £22 per sq ft for new space, when good quality second-hand space is available for £18.

Scarborough consultant Mark Jackson is optimistic. “We hope to let Paradigm before completion and then move on to Plot 2 where we’re likely to be making the case for another building similar in size to Paradigm. We’re not competing with Leeds city centre, we’re offering a location that’s right for northshoring and footloose requirements.”

Investment

The surprise announcement last summer that Legal & General had bought a 50% stake in Scarborough Group’s out-of-town Thorpe Park development for £162m highlights how willing investors are to consider opportunities that not too long ago they may have ruled out. This flexibility is being driven by a simple overarching factor: lack of prime city centre stock.

“In the past 12 months there has been no grade-A product sold,” confirms Knight Frank partner Graham Foxton. Which means that arriving at an absolute prime yield for Leeds offices (ie a new development, with a blue chip covenant and long lease, in a top location) is largely hypothetical.

Market consensus suggests the figure is 5.25%, behind Manchester and Birmingham, but on a par with Bristol.

F&C UK Property Fund’s purchase of 26,000 sq ft at 15-16 Park Row for £9.3m provides an indication of where values are at, even though that deal, which achieved a yield of just under 5.5%, took place a year ago. If the covenant was better and the building had been redeveloped, rather than refurbished, it would certainly have hit 5.25% suggest local investment agents.

They also report that institutional funds are becoming increasingly selective. That means big-ticket deals in Leeds are unlikely to come up often, but when they do, prices paid will be keen, though possibly not quite as competitive as recent deals in Manchester and Birmingham. “We’re probably 25-50 bps behind as we are a smaller market,” concedes Foxton. “But if something comes up I think we’d all be pleasantly surprised by the figure achieved.”

Similarly, owners of nearly prime offices who bought opportunistically in the past two years could achieve windfall profits of 20% upwards if they chose to sell now to the increasingly broad range of investors who are putting in speculative offers in the hope of achieving off-market deals. Many will be disappointed, reckons Foxton. “A lot of landlords won’t sell as they believe they’re getting a level of return they can’t find elsewhere.”

A Brexit-induced lull in activity is expected to be over by this summer, after which prospects for the next 24 months are mixed. Adam Cockroft, director at Cushman & Wakefield, says: “Buyers are likely to come from UK institutions at the larger end of the lot size scale, whereas the mid-market is still likely to be the reserve of private equity-backed specialist asset managers looking to add value.”

Overseas investors, increasingly common in regional investment markets, may also bid on larger lots – if product becomes available. The crop of developments completing this year are unlikely to come to market anytime soon, so until developers start the next wave of redevelopment schemes, many investors may have no choice but to shop away from Leeds.

South Leeds

While Leeds City Council is promoting a collection of sites near the River Aire as one of Europe’s largest regeneration areas, local office market professionals are at best lukewarm about the area. Covering some 320 acres, it includes Holbeck Urban Village, the former Carlsberg brewery site at South Bank Central and Leeds Dock.

How much potential there is for future office development within the broad range of mixed uses planned is unclear, which may explain a lack of excitement in office circles. Last summer’s announcement by Sky that it will move a whole department into a 70,000 sq ft technology hub at Allied London’s Leeds Dock is viewed positively, but seen as a one-off rather than a precursor of deals to come, with suggestions that the area is likely to see more growth as an education sector cluster.

Two months ago Carillion won planning consent for its £80m 2.9-acre Tower Works scheme in Holbeck Urban Village, which includes 90,000 sq ft of offices, but it isn’t clear when that space will be delivered. Even vaguer is what uses will appear on the 22-acre former Carlsberg brewery site, purchased for around £35m last autumn by Vastint, the property arm of IKEA.

Some agents warn that the Leeds terminal of the proposed HS2 and HS3 high-speed rail lines could cause significant disruption in the area, although a route and terminal area has already been planned for. Once those plans are clearer, the South Bank might see a development boost similar to that seen in Birmingham’s Eastside.

“Historically, Leeds has developed out in a semicircle to the north of the city centre,” says JLL lead director Jeff Pearey, “and I can see that flipping over to the South Bank.”