Venture capital continued to pour money into technology businesses in 2018. Some $254bn was invested globally last year, compared with $174bn the year before. While the US continued to attract the majority of investment, Asia came a close second, thanks to a wave of $1bn+ mega-deals.

Last year, we saw significant funding rounds from proptech companies, including Indian budget hotel firm OYO ($1.1bn), online agent OpenDoor ($400m), residential platforms Compass ($400m) and Nested ($156m) and off-site construction company Katerra ($134m). The common thread in most of these was the presence of Japan’s SoftBank leading the round.

As the traditional real estate sector continues to familiarise itself with this new wave of technology companies, we are starting to see proptech being defined more broadly – increasingly framed around technology related to the whole built environment – complementing future trends in the worlds of mobility, work, retail and financial services.

This is encouraging newer real estate companies to become multi-faceted, operating across various aspects of the built environment, with a desire to better understand how people use space in all aspects of their lives.

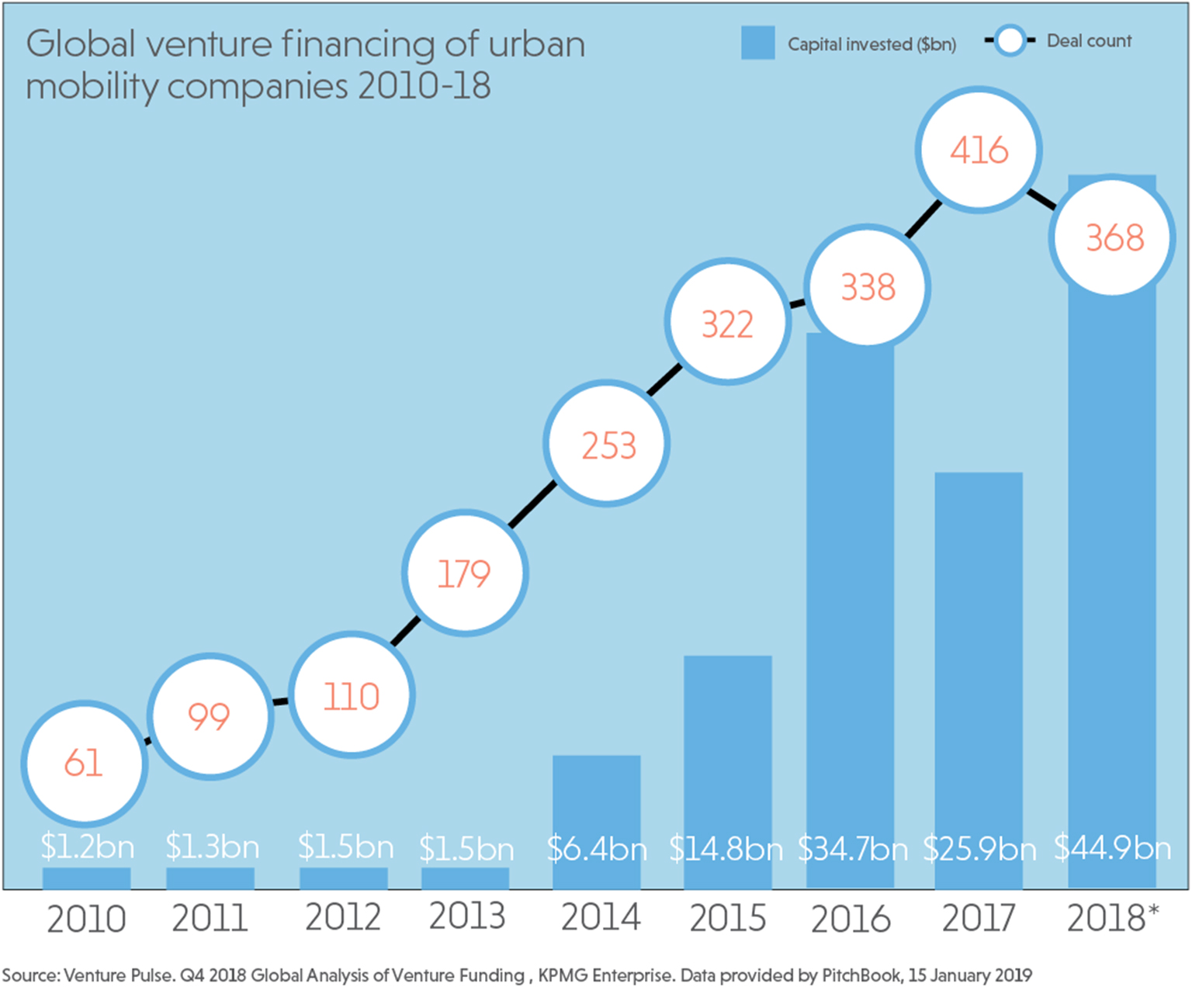

Mobility is another important area for real estate right now. It is the thread that ties together all aspects of the built environment, and this is something that venture capitalists have recognised (see graph). Transportation and urban mobility was one of the biggest investment sectors during 2018, attracting funding across autonomous driving, ride-hailing and alternative energy vehicles.

That being said, we are still in the early stages of mobility-as-a-service, and there is a bumpy road ahead for both incumbents and new entrants. It was only last year that we really saw the challenges of “bike graveyards” in China, where Bird and Lime had to shift all of their dockless scooters to other cities during the winter due to decreased use in bad weather, and Ofo withdrawing its dockless bikes from many UK cities due to low demand and vandalism.

I see these as short-term hiccups. In the long run – a more typical real estate time horizon – mobility will play an increasingly important part as we plan new developments. It is a trend that the industry needs to start taking much more seriously.