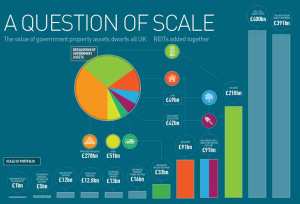

The government’s investment property portfolio is valued at more than £13bn – making it larger than British Land, the UK’s largest REIT, which totals £12.8bn.

Values of assets held specifically for rental revenue or capital appreciation were revealed last week in the Whole of Government Accounts report, which gives a complete overview of government property assets.

The figure pales in comparison to the £49bn of land held by the government, £90bn held in residential property and £200bn of “buildings” on the government’s books.

It showed that government’s property assets had a combined value of more than £400bn – more than all the UK REITs combined.

But the huge figure was still only just enough to cover the pensions liability of the NHS, also revealed in the report, at £391bn, and is itself just a fraction of the government’s total pension liabilities of £1.3tn.

The sheer scale of the publicly owned property estate was revealed in two government reports last week.

The State of the Estate report said £1.4bn had been made since 2010 from the sale of publicly owned assets and £625m had been saved annually through reduced running costs.

It said that since 2010 more than 2,000 properties had been sold and that the size of the government estate had been reduced by more than 20%.

But this still leaves more than 91m sq ft of assets – the equivalent of 1,200 football pitches – and includes only properties in the Civil Estate.

| Portfolio statistics | |||

|---|---|---|---|

| 2010 | 2012/13 | 2013/14 | |

| Number of properties | 7,213 | 5,469 | 5,195 |

| Area (sq ft) | 115m | 97m | 92m |

| Annual running costs | £3.1bn | £3bn | £2.9bn |

| Sq m per employee (FTE) | 13 | 11.9 | 11.3 |