• Opportunities to trade are disappearing as investors take a long-term view

• £700m of student portfolios on the market as big players squeeze the newcomers

To be successful in the student accommodation market, you have to amass an empire. By building scale, the theory goes, you create efficiencies and a replicable, recognisable brand that will click with students.

If you can’t do that, you might as well call it a day and sell up.

Two major portfolios will be sold before the end of this year; each representing the seller’s exit from undersized platforms and an increasingly scarce opportunity for purchasers to bulk up.

“Liquidity in the market has never been better,” says Jo Winchester, director of student housing at CBRE. “It suffers from lack of product rather than lack of investor appetite.”

The £400m Mansion portfolio was put up for sale earlier this year and is being sold by MSAF through Knight Frank following a flood of requests for redemptions by investors in the fund in which it sits. Bids for the 25-asset portfolio are due on 24 July.

But now to the market is a portfolio from Avenue Capital, the US investor at the front of the queue when student accommodation provider Opal was dissolved in 2013. It quickly deployed more than £300m into the sector, but has not made any new purchases since 2014, unable to achieve dramatic scale. The result is that it is expected to put its portfolio up for sale by the year-end. It is unlikely to be a bad get-out, however, given the appetite for the sector.

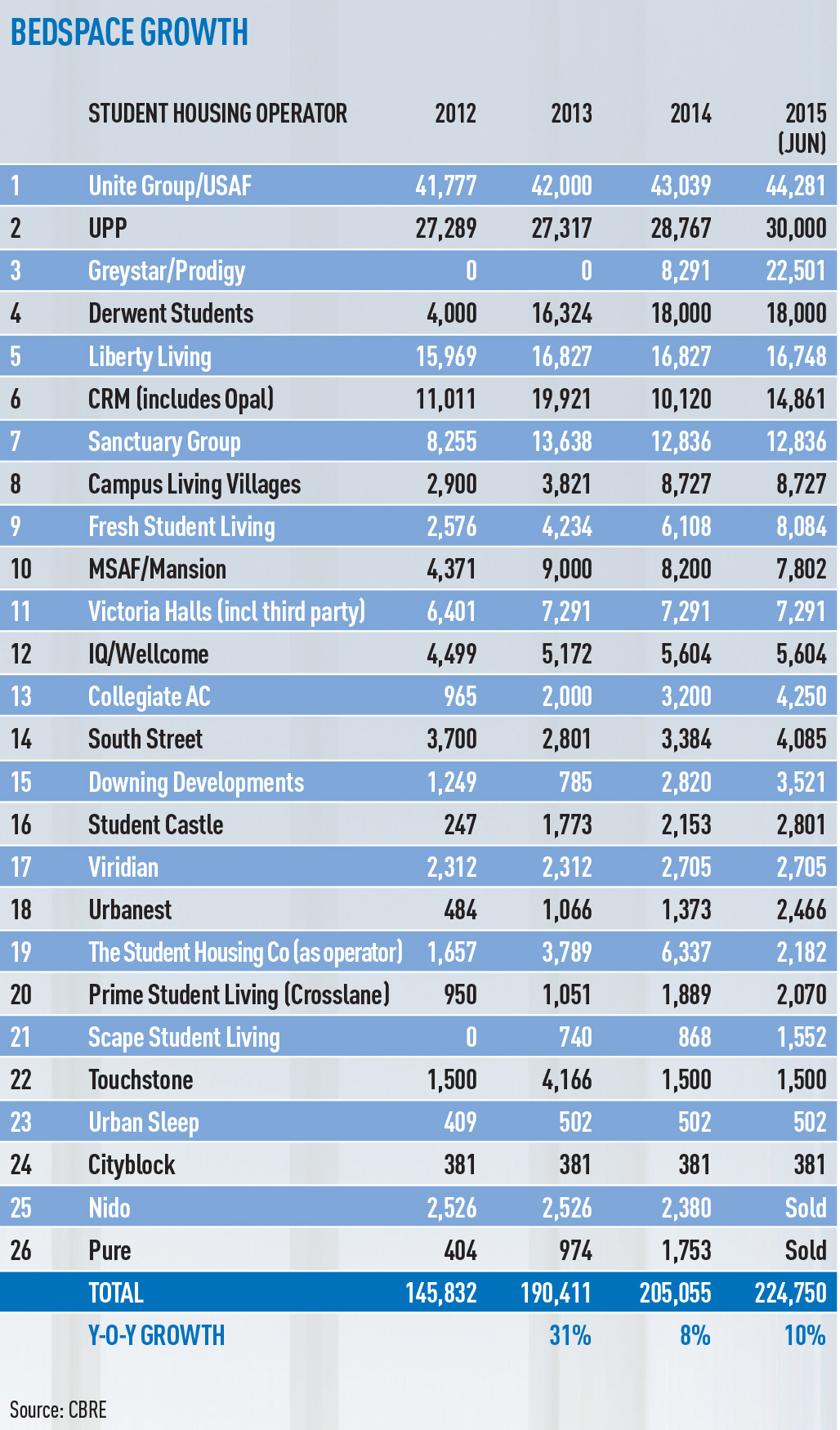

There has been £4bn of student housing transactions so far this year, according to CBRE, and the total looks set to grow as the big aim to get bigger and the small consider giving up the game. Brett Lashley, managing director of Greystar, which has rocketed up the rankings of the larger student operators (see table), says scale is intrinsic to its strategy. It has invested £2.2bn in creating a branded portfolio of 22,501 beds in the past 18 months.

“Scale creates operational leverage and allows us to deliver superior service and amenities with the aspirations of our brand,” says Lashley. “We spend more in some areas, but leverage our scale to reduce purchasing, administrative and marketing expenses, so that the quality of our offering to residents is never sacrificed.”

Greystar has not been the only one to pile in this year. CPPIB bought Liberty Living’s portfolio of 40 assets for £1.1bn and Letter One paid £532m for Carlyle’s Pure, 2,170-bed portfolio of London assets. And the UK’s most established player, Unite, with more than 44,000 beds, continues to expand, buying the eight-asset AUB portfolio for £271m.

But such opportunities to add bulk are becoming rarer.

Marcus Roberts, director of student housing at Savills, says: “In terms of scale and trying to get into the market quickly, there are not many opportunities left to trade.

“The investors that are here are looking for a long-term hold, rather than stabilising and then looking to exit.”

The opportunities that do emerge are likely to come from shorter-term, private-equity players, with Blackstone’s Victoria Student Halls an obvious candidate to go up for sale in the next couple of years.

Richard Simpson, managing director at Unite, says: “I think private equity will continue to look for an exit, waiting for the cycle to be most favourable.”

Immediate growth will require battling for the big portfolios currently on the market, using development expertise to build and deliver bespoke stock, or to start running the rule over competitors and taking an M&A approach.