The property crash of 2008 hit the United Arab Emirates hard, fast and with catastrophic results. All signs point to the region being back in business, but what evidence is there to show that history won’t repeat itself? Joanna Bourke travelled to the UAE and Bahrain to find out

Emirate-by-emirate guide to investment and development opportunities >>

Interview: Aldar chief executive Mohammed Khalifa al Mubarak >>

Reassurance. Ultimately that’s what everyone is looking for when it comes to investing, or indeed working, in the UAE property market.

And there is no shortage of people offering it. From the developers to the agents – the message on the ground is “it will not happen again”.

“It” is of course the spectacular property crash of late 2008 into 2009. One of the fastest, steepest and most dramatic in history. A crash that saw Dubai house prices slump by an extraordinary 40% in the first three months of 2009 and resulted in half of all construction projects in the UAE, totalling £401bn, being suspended.

So while the Emiratis may insist the region is back in business, what evidence is there to back up these claims? After such staggering losses just five years ago, it will take more than a few words of encouragement to prove that sufficient measures have been taken to avoid another spectacular crash.

History repeating?

The cause of the crash – which hit Dubai the hardest – is easy to identify, with hindsight. And some might argue it was just as easy to predict at the time. A combination of cheap finance, huge numbers of properties sold off-plan and a surge in price rises fuelled the collapse. And this pain is still evident in Dubai, where many developments remain visibly stalled.

But Steven Morgan, chief executive of Cluttons Middle East, believes investors have been more cautious this time around. He explains: “In 2003-2008 there was a significant amount of stock oversupply, but since 2008, we have not had the same number of homes or offices being released, so now we do not have a supply or demand imbalance.”

Values are certainly increasing across a variety of sectors, including the residential rental market, where they leapt by 16% in Sharjah and by 51% in Dubai last year. And in the office district in the heart of Dubai, rents rose by 13% last year and by a further 10% in Q1 2014.

Faisal Durrani, international research and business development manager at Cluttons, which is the biggest property agent in the Middle East, says: “2013 was no doubt an exceptional year for Dubai’s economy, with a surge in activity translating into a sharp rise in the number of jobs being created across the emirate.”

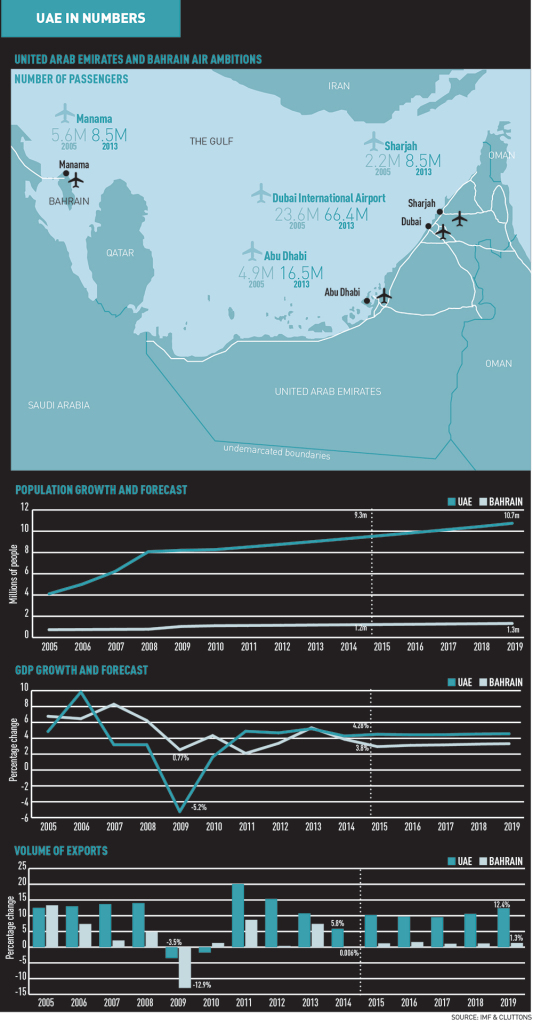

In Dubai and Abu Dhabi, GDP increased 4.9% and 4.8% respectively last year, underpinned by an exceptional turnaround in the emirates’ property sectors. The 2013 growth rate was more than double the 1.7% rise in the UK and forecasts from the IMF predict the combined 2014 UAE rate of 4.28% will rise steadily to 4.58% by 2019. In comparison, the UK’s 2014 figure of 3.2% will slow to 2.4%.

Supporting the growth

More positive signs come from the external factors underpinning UAE growth this time around.

Predicted population growth across the region will increase demand for both new homes and commercial space. Cluttons has forecast the population in Dubai will surpass 2.3m by the end of 2014, up 4% on last year, while in Abu Dhabi the figure will rise from 2.5m to more than 2.6m.

With the influx of population, one other major factor that will boost real estate in the UAE is the mass improvements to airports on the way, which will significantly increase passenger numbers to the UAE (see map). There is the $32bn (£20.4bn) phase 2 at Al Maktoum International Airport in Jebel, which will deliver a further annual passenger capacity of 120m, while Dubai International Airport’s expansion plans will see it topping out at close to 100m passenger capacity before the end of the decade.

Durrani says: “Aviation has historically been a significant pillar in Dubai’s economy and this looks set to be further bolstered. The residential sector will no doubt be a long-term benefactor of the significant rise in the number of jobs being created, with both lettings and buyer demand set to rise significantly as the number of households in the city increases. However, it is the commercial sector that stands to benefit the most in the short to medium term.”

In the past four weeks alone plans for the tallest twin towers on a new multi-billion-pound development have been unveiled in Dubai, in Abu Dhabi the world-famous US department store Macy’s has revealed it will open a 205,000 sq ft store, and in Sharjah proposals for a new 25m sq ft village were launched.

While real estate in the UAE seems as flamboyant as ever, Morgan is confident that the market – and certainly Dubai – is not heading for a repeat crash.

He says: “The catalyst for the Dubai fall was the global crash, but the world has moved on since then. In Dubai the population has grown, the city has grown and infrastructure has grown. Dubai has matured significantly.”