Agents pick the most significant deals (six months to end of July)

Sherbourne House, Manor House Drive, Coventry

Landlord Mapeley

Tenant Bennetts Insurance

Size 15,000 sq ft

Rent £15 per sq ft

Chosen by Andrew Berry, associate director, Cushman & Wakefield

Coventry is the second-largest office centre in the West Midlands, after Birmingham. But unlike Birmingham, the lack of suitable sites in the central core has forced much modern development to out-of-town business parks. The success of these business parks has been to the detriment of the city centre. For the first time in nearly a decade, the opportunity to acquire central, grade-A accommodation was presented in the shape of Sherbourne House. Following lettings totalling nearly 30,000 sq ft to Sitel and Staysure, Bennetts acquired the final 15,000 sq ft. Not only were these the largest lettings in Coventry city centre for some considerable time, proof of an underlying appetite for well-specified, city centre premises, but the Bennetts deal is also likely to create more than 1,200 jobs that will provide further support for local businesses and, hopefully, raise the profile of Coventry’s city centre office market to the same level as that of its business parks.

Colmore Plaza, Birmingham

Vendor Carlyle Group

Purchaser Ashby Capital

Size 310,000 sq ft grade-A offices

Price Circa £140m

Yield 6.25%

Chosen by Ben Kelly, director, capital markets, JLL

The Colmore Plaza transaction has sent a very confident message to the market. It was the largest investment deal in Birmingham this year and the first acquisition by Ashby Capital outside London. While the property is one-third vacant, stock availability is extremely limited and tenant demand is robust and increasing. Ashby Capital believes this presents a strong mixture of ingredients to generate growth and performance. It has an opportunity to add value with an asset management plan in place to enhance the building, with an enlarged reception area and communal café being among improvements planned. There is a lot of positive sentiment in Birmingham now, with the opening of the revamped New Street station and Grand Central, with Paradise to follow, the effect of HS2 and office take-up reaching a 28-year high in Q2. Investors like Ashby are realising that the regions, and cities like Birmingham, offer strong key indicators.

Arena Central, Broad Street, Birmingham

Developer Miller Developments

Occupier HSBC

Size 212,000 sq ft

Price Undisclosed

Chosen by Carole Taylor, partner, Vail Williams

My choice is the preletting of 212,000 sq ft of prime grade-A office space on a turnkey, long-leasehold basis to HSBC at Arena Central. This is a very sizeable deal and one of the biggest single lettings in central Birmingham to date. More importantly, it is kick-starting a development that has been mooted for many years. It sits at a prominent gateway onto the inner ring road and the city centre and will complement the major Paradise Circus redevelopment nearby. Combined, these schemes will be instrumental in extending the city core offering. Moreover, it is another major letting to a financial institution following the significant letting to Deutsche Bank at Brindleyplace last year and it therefore further reinforces Birmingham as an important financial centre. It also delivers good news for the regional employment market as it involves the relocation of more than 1,000 jobs from London, which is tremendous news for the city.

Brum retail on track

Brum retail on track

A new-look New Street station and Grand Central shopping centre above it were being unveiled in Birmingham last week. Meanwhile, British Land, Grosvenor and Hammerson were said to be battling it out to buy the retail asset for £310m.

Airport plan takes off

Ostrava Properties, owned by Rigby Group, appointed agents to market plans for a 650,000 sq ft manufacturing and distribution facility at Coventry Airport.

Merry Hill stake for sale

Queensland Investment Corporation put its 50% stake in Dudley’s Merry Hill shopping centre up for sale, through CBRE, at £500m.

Record activity in Brum

Birmingham city centre office lettings in Q2 2015 saw the most activity ever. The Birmingham Office Market Forum reported 500,000 sq ft of space transacted in 40 deals. Knight Frank research showed more enquiries than any other regional city.

Titan plans in Telford

The HCA submitted a planning application for about 600,000 sq ft of industrial and warehouse development, known as Titan 640, at Telford, in Shropshire.

Birmingham bulldoze wish

Birmingham bulldoze wish

Some aspects of Birmingham’s urban landscape came in for criticism from leading architects, who raised concerns about a lack of context, too many glass boxes and too little public realm – also expressing a desire to bulldoze New Street’s signage and kiosks.

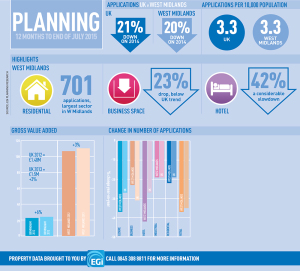

EG gauges the trials and tribulations of the West Midlands property market