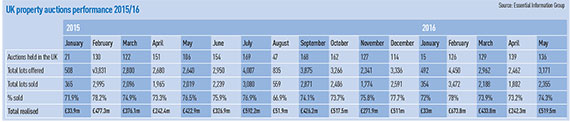

It’s been a thunderous start to the auctions year. After a quiet January, the residential market surged into life in February ahead of chang es to stamp duty in the March Budget with 25-year-old records for lots offered and sold being broken. By the end of March, the number of lots offered and sold were up 18% on the same quarter a year earlier. The amount raised from residential sales increased by 28% during the same period.

es to stamp duty in the March Budget with 25-year-old records for lots offered and sold being broken. By the end of March, the number of lots offered and sold were up 18% on the same quarter a year earlier. The amount raised from residential sales increased by 28% during the same period.

And if the commercial market could not match that performance – lots offered and lots sold were both down 18% on March 2015 – sums raised were not to be sniffed at. Commercial receipts were up over 21% during March, and by almost 30% in Q1.

Nevertheless, with Brexit-driven market uncertainty rife, higher rates of stamp duty for investment properties in place, and new energy standards taking effect, can such strong activity be sustained? It was against this backdrop that last month Estates Gazette gathered some of the leading lights of the business to review the year so far and look ahead to the rest of 2016 and beyond.

“While you have low interest rates and plenty of cash out there, this market is set to run,” said Allsop partner Patrick Kerr, sounding a clarion call for real estate’s credentials. “On the commercial side it is about quality of income, low interest rates and alternative investments. Where else would you put your money? Would you put it in the stock market? Would you put it into bonds? The stock market is relatively volatile and interest rates are going to go up in the future, and at that point the bond bubble is going to burst.”

Savills’ Chris Coleman Smith said the Budget’s 3% increase in stamp duty had penalised smaller investors and he acknowledged a “relaxation” in the residential market. But he played down the impact of politics: “There’s so much built into Brexit but it will come and go and life will go on. After Brexit, I think sellers will be a little more forthcoming but I can’t see it having much odds. The last two years in the residential market have gone up and up, and you just can’t keep on going.”

Allsop partner Gary Murphy drew a distinction between the two issues. “Stamp duty and Brexit are two different things. Stamp duty is a cost. Brexit goes to confidence. And if confidence is dented, horrible things can happen.”

Peter Cunliffe, director of Acuitus, said he had seen no indication that Brexit was having an impact on the market and that uncertainty in other markets was to property’s benefit. “Money is very available and there’s every indication that that’s going to continue. While buyers can borrow, while occupier demand for commercial space continues to be positive, it’s all good news. And I’m confident that’s going to continue.”

Lambert Smith Hampton’s Oliver Childs went further, to say uncertainty around Brexit might open doors for auctioneers. “That’s an opportunity for the auction market to expand its market share with stock that perhaps otherwise would be sold into portfolio,” he said.

But everyone present acknowledged challenges ahead. James Emson said stamp duty changes had caused a spike in activity. And he predicted that the gradual withdrawal of tax relief for buy-to-let landlords from next April would cause further properties to be brought to market.

“At the beginning of the year, we did see buyers coming along and probably paying more than they did in December or November to avoid 3%. We had our first auction after the changes and it was still busy. Next year, tax relief withdrawal will start affecting the number of properties coming to the market – there will be an increase.”

And for Kerr, the elephant in the room was changes to energy standards: from April 2018, it will be unlawful to let residential or commercial properties with an EPC rating of F or G. “We looked at our catalogue. About 20% of lots on our catalogue would be unlettable under the new rules. I don’t think the market has woken up to that yet. I think it will.”

Multi-channel march

Online is set to have a more profound impact on the auctions business in the years ahead.

“The one area where online auctions will succeed is where the market is truly global and you can harness that competition in an online space – then I can see online really powering,” said Allsop’s Gary Murphy.

“But should we be robbing our in-room stock and putting it online just to prove a point? I’m not sure that’s the right strategy. Online and in-room auctions can co-exist. We all have online auction bidders in our rooms and they co-exist nicely with proxy bidders, telephone bidders and people who come. We have multi-channel auctions.”

The Essential Information Group’s David Sandeman played down the difference between channels. “Whether it’s sold by someone with a gavel in front of a rostrum or an electronic one, the competition element is still there and I think we are going to see growth in certain asset classes,” he said.

“A game-changer”, was the view of LSH’s Oliver Childs. He said: “I do think it could happen quite quickly. But I think it has to be done sympathetically. As long as we can provide that tool and give the duty of care we give in our ballroom sales, I think the market will decide how much of a game-changer it is.”

To send feedback, e-mail damian.wild@estatesgazette.com or tweet @DamianWild or @estatesgazette