A rare large-scale portfolio of ground rents underpinned by high-end London residential property is being offered by Ballymore.

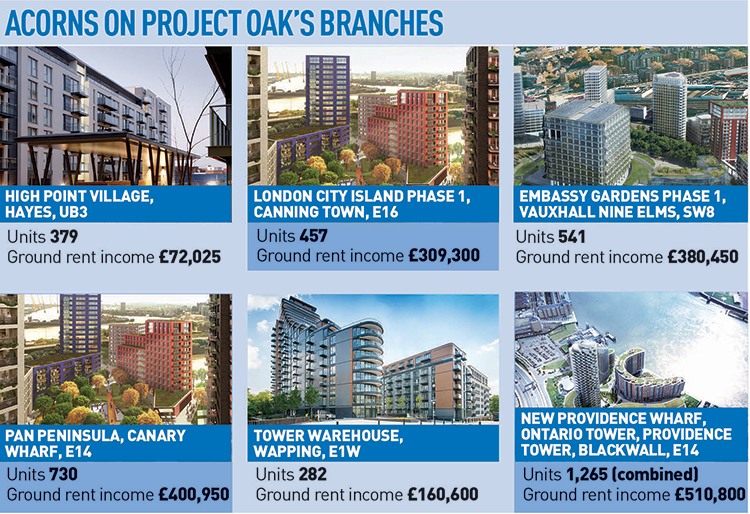

The Project Oak portfolio contains receipts from 3,654 units across eight of the housebuilder’s sites, including Embassy Gardens in Vauxhall, SE8, and City Island in Canning Town, E16.

Total annual income from the sites, three of which are still under construction, will be £1.8m. The sale is expected to attract bids in excess of £65m, meaning a yield around 2.8%.

Ground rent investments at such a scale are infrequently disposed of but CBRE, which is advising Ballymore, expects Project Oak to attract insurers, pension funds and other investors with long-term liabilities to match.

Arthur McCalmont, director at CBRE, said that owing to the scarcity of large holdings, sales of ground rents tend to be of a much smaller size – around £2m-£3m. As a result, the sale of such a large portfolio could set yield levels for the rest of the market.

Berkeley Group sold a portfolio of about 10,000 ground rent leases across 60 sites for £99.8m last year. However, Oak is one of the first such deals in which the units are concentrated into a few key assets and are being sold on the open market.

Under the terms of the deal, Ballymore will sell only the income from the ground rents, and will not relinquish management of the assets.

John Mulryan, Ballymore’s managing director, said this would allow it to maintain the quality of its developments.

“We have come up with a way of selling the investment, the income, while maintaining the control of the freehold and maintaining quality. We will continue to manage the estate and the people who have bought from us,” he said.

• To send feedback e-mail alex.peace@estatesgazette.com or tweet @egalexpeace or @estatesgazette