Barratt has put a prime portfolio of more than 300 London flats up for sale, as it looks to take advantage of the wave of money looking to enter the UK’s private rented sector.

Barratt has put a prime portfolio of more than 300 London flats up for sale, as it looks to take advantage of the wave of money looking to enter the UK’s private rented sector.

The flats, which are spread across four of the housebuilder’s uncompleted schemes, have an end value of £320m were they to be sold on the open market, though investors are likely to look for a discount for buying in bulk.

Cushman & Wakefield has been appointed to oversee the process.

The sale will be a litmus test for the central London residential market, which has seen demand stutter in recent months.

This week JLL downgraded its central London residential development growth forecasts, saying it expected to see the value of new-build developments decline by 3% in 2016, as opposed to its previous estimate of a 1% increase, and Morgan Stanley downgraded Capital & Counties from equal weight to underweight, citing an assumed “10-20% fall in new build high-end residential pricing in 2016”.

An exit for Barratt would help it derisk its portfolio and take advantage of institutional rental money trying to enter London. It is the first time the firm has offered such a large portfolio for sale in the market.

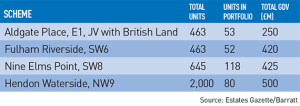

The portfolio consists of units at Fulham Riverside, SW6; Nine Elms Point, SW8; Hendon Waterside, NW9 and Aldgate Place, E1, which Barratt is developing with British Land (see table).

However, the flats were not initially designed for the purpose-built rental market, and are dispersed around the developments. Only the block in Nine Elms Point is unbroken.

Any sale would have similarities to the deal between M&G Real Estate and Berkeley in 2013, which saw the pension fund buy 534 flats scattered around the South East for £105.4m. These assets then formed a seed portfolio for M&G’s new residential fund.

The London market has proved increasingly inaccessible for PRS operators. According to the IPD UK Annual Residential Index for 2015, net yields now average less than 2% in central London.

• To send feedback, e-mail alex.peace@estategzette.com or tweet @egalexpeace or @estatesgazette