You will struggle to find these towns in the top 400 or even top 500 shopping destinations. With populations ranging from 10,000 to 20,000 – and catchments not much larger – they are among the thousands of small towns that have dropped off the retail map.

You will struggle to find these towns in the top 400 or even top 500 shopping destinations. With populations ranging from 10,000 to 20,000 – and catchments not much larger – they are among the thousands of small towns that have dropped off the retail map.

But not for much longer.

Fancied by buy-to-let residential investors looking for a new source of income, and buoyed by signs of a reversal of the big-towns-only strategy of multiple retailers, smaller towns are beginning to appeal. It’s not just thanks to the quaint high streets, and nostalgia. This is the result of hard-nosed, commercial decisions.

Fancied by buy-to-let residential investors looking for a new source of income, and buoyed by signs of a reversal of the big-towns-only strategy of multiple retailers, smaller towns are beginning to appeal. It’s not just thanks to the quaint high streets, and nostalgia. This is the result of hard-nosed, commercial decisions.

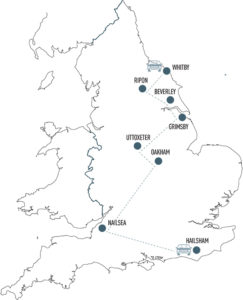

First, let’s take a trip to Whitby on the North Yorkshire coast (pop: 13,000).

Whitby is nobody’s idea of a top retail destination (despite a modest summer tourist trade) yet Carter Towler’s Chris Lewis says there is a quiet revolution under way here and in other small Yorkshire towns.

Lewis, an associate in the Leeds office, is advising Israel-based Firnley Properties on its 50-unit portfolio spread across Yorkshire’s small towns, Jersey-based Storey Group with another 60, and local players Bridge House Properties with 30 units in places such as Ripon (population 16,000) and Whitby. Tenants include McDonald’s franchises, banks and Ladbrokes, with a generous smattering of charity shops.

“The appeal is stability,” says Lewis. “It is about maintaining values.”

Rents in Whitby haven’t moved for a decade – and if they do, the direction of travel may be down rather than up – but yields are between 6% and 8%, and it’s a solid risk-spreading proposition.

The prospect of above-the-shop residential conversions is adding to the small-town appeal.

“Look at Bridge House’s work in Whitby. They have converted the space above Yorkshire Bank, Baxtergate, and are looking at a rent of £350 per month,” says Lewis. This happily compensates for retail rents in the town which hover around £35-£40 per sq ft.

Travel down the North Sea coast to vastly bigger Grimsby, and the comparison is instructive.

In Grimsby (pop: 88,000) more than a fifth of shops are vacant (22.3% according to the Local Data Company, up from 21.5% in 2015). Grimsby is the seventh-emptiest retail destination and – to cap it off – recently voted worst in Britain. Very unfair, cry locals, but clearly something has gone wrong in this medium-sized town, something that the smaller towns have escaped.

Rupert Guy, partner at KLM Retail, also has an interest in Whitby. The town’s Costa Coffee shop, priced at £680,000 and with a yield of 7%, is part of the Dodeca Portfolio of 12 properties. It includes the Boots store in Oakham

(pop: 11,000), Specsavers in Uttoxeter (pop: 13,000) and Country Casuals in Beverley (a monster among small towns – pop: 46,000). Marley Pension Fund is asking £8m, and it was under offer as EG went to press.

“Two things have changed to make small towns appealing,” says Guy. “Affordable rents are the key, because it has meant more independent retailers and a more exciting retail offer than the mid-size towns. At the same time we are all doing more local convenience shopping.

“Investors have changed, too. As George Osborne closed down the buy-to-let residential sector, those investors diverted their resources into small-town retail. We have seen more of them at auctions, and it’s getting competitive at £250,000 up to £1m. At the same time, the returns on other fixed-income assets have been poor over the past four to five years, which has also pushed them into small towns.”

The cannier investors buy over a wide geographic area (the more naïve buy locally), but all have realised the potential because small can be beautifully rewarding. As Guy explains: “Investors have woken up to the fact that many of these small towns are effectively commuter towns. It’s an hour by train to Grantham or Bath, and the smaller towns and villages around have picked up as a result.”

For proof, come to the north Somerset coast where Ellandi has invested in Nailsea (pop: 15,600), once proudly independent but now a Bristol commuter town. It bought the 140,000 sq ft Crown Glass Centre in 2009 at a distress price, a yield of about 7.5%.

Ellandi property director Mark Robinson explains: “These are everyday places, thriving places, and their retail scene will not be eroded by the internet. They provide convenience shopping, and always will do.”

Small towns are “misunderstood and undervalued” by investors, who are busy scouring the country for the handful of opportunities in the £10m-£14m bracket, says Robinson.

Providing investors realise local management really must be local, they would be onto a winner, says Robinson.

And so to Hailsham (pop: 20,000), the final destination in our whistle-stop tour of England’s small towns. Steam Rock Capital, backed by Catalyst Capital, bought Hailsham’s 56,000 sq ft open centre last year. After a £100,000 brush-up, new tenants are signing up, lease renewals are going well, and rents are rising – from £30 per sq ft to £35-£40 in zone A.

“Rents like that are quite punchy for a small town,” says Jonathan Kingshott, director at Lee Baron. “Investors know there are opportunities in small towns because national brands are taking a renewed interest in these locations. Retailers would go into smaller towns if they could find the right space, which often they can’t.”

Nick Symons, partner at MMX Retail, has spotted the same trend. “Retailers would go there if they could find space suitable for their formats. Maybe they are starting to look further down the retail hierarchy, and at the same time as they are consolidating into the top 200 locations they are extending their formats into smaller units in smaller towns – a two-tier strategy.”

Next, which has taken 15,000 sq ft in Churchmanor’s Chequers scheme in Huntingdon, could be heading that way, says Symons. “This could be a good moment to buy into smaller schemes,” he muses. Plenty of wise investors will be taking his advice.

The financials

The financials

Retail turnover strictly limits rents. Turnover of £300,000 would be good, and licensed premises might rise considerably higher, but small catchment makes it almost impossible to grow much.

As a result, top rents in small towns are not very high: £50 per sq ft zone A would be sky-high, and most would be £30-£40 per sq ft, with plenty below.

Yields tend to hover between 6% and 7%, some rising to 8%. But yield may not be a good measure, some investors warn.

Dominic Gibbons, managing director at Wykeland, developers of the 163,000 sq ft Flemingate in Beverley (pop: 46,000), explains: “You need a long-term hold strategy, which could mean five to 20 years, depending on circumstances, and in those circumstances yield isn’t a good guide – it will fluctuate over time. Look instead at the holding return. We focus on holding returns of 9-10%.”

A local shop for local people…

Beware: small town retail is a local business.

“Apart from the bigger investors, generally owners have one or two units in several different towns, and we are looking at portfolios of £200,000 to £500,000 in seven or eight units. They tend to be not quite standard buyers – often they are buying in a town because they live there,” says Chris Lewis, associate at Carter Towler in Leeds.

“They have often taken a gamble and let units to friends, and often the approach to property management has been very casual – but that is changing.”

Pricing in the small-town market can be eccentric. Local vendors can be reluctant, their hand forced by death, divorce and distress. Local buyers may have special interests, such as consolidating an existing portfolio, buying a neighbouring site, trouncing a rival, irrational enthusiasm for a town’s commercial prospects, or simply wanting to be the local Mr Big.

SEE ALSO:

EG‘s Winter edition of the Retail & Leisure supplement – this season includes:

- Alternative retails

- The growth of the UK’s designer outlet sector

- How smarter technology is about to deliver smarter data for landlords

- Why people are jumping for joy at the newest leisure craze