COMMENT Prior to the Covid-19 pandemic, the retail sector was already undergoing a transformative period. A host of big-name retailers that had failed to adapt were gradually disappearing, and the make-up of the high street saw a fundamental change. Inevitably, the past year has accelerated this transformation and several well-known retailers have announced plans to close for good.

In Birmingham, the pandemic has seen the city centre left with two very large, department-store-shaped holes, with John Lewis and Debenhams both failing to reopen post-lockdown.

Of course, the second city is not alone. As well as permanently closing eight of its stores, John Lewis announced plans to convert almost half of its Oxford Street flagship into office space, in an attempt to return to profitability. Meanwhile, the closure of Debenhams’ 49 shops will impact cities across the UK, and House of Fraser has also announced store closures.

Location, location, location?

Still, the prominence of these Birmingham stores – flagships at the Grand Central and Bullring shopping centres respectively – coupled with the fact that John Lewis’s Birmingham store is barely five years’ old, highlights the very real problem that city-centre retail is facing. So, what does the future hold for assets such as these?

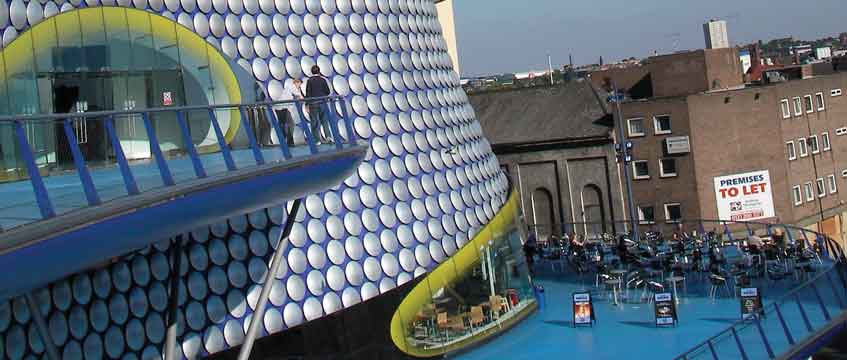

Though the doors of Birmingham’s Debenhams will remain closed, at the other end of the Bullring is Selfridges (pictured), resplendent in its iconic silver discs, which reported sales up by 7% to more than £1.9bn in the year to February 2020 and a “resilient” performance in the face of the pandemic. And while other retailers were battening down the hatches, Selfridges was investing in its digital offering, creating a cinema and toy department in its Oxford Street store, and revamping its Manchester accessories hall.

These large-format stores boast similar city-centre locations, yet the outcome could not be more different. So, why the discrepancy?

Clearly, a well-located shop is no longer the golden ticket it once was. Companies such as Selfridges also provide a strong, relevant proposition that puts the guest at the centre of their offering, with a focus on relevance and experience. Selfridges on Oxford Street, with its show-stopping atrium, well-chosen mix of brands, varied catering options and entertainment space, is a perfect example of this.

Large-format assets still have a role to play in the future of retail, but retailers need to accept that their floorspace should not be devoted entirely to sales. Stores today are as much a marketing tool to boost online traffic, a place where customers can interact and connect with products and brands, and logistics hubs, enabling click and collect and easy returns.

Indeed, we only have to look to the likes of Made.com, Matchesfashion.com and cult beauty firm, Glossier, all of which recently moved from online-only to physical stores – not to mention Asos and Amazon being named as potential new occupiers of the iconic London Topshop building – to understand that there is still real value in well located, bricks-and-mortar stores.

Nonetheless, the popularity of online shopping means that stores today need less of a physical footprint. So, it is likely some former department stores will be carved up into smaller units for independent retailers or converted into hotel, office, residential or leisure space.

Destination shopping

Meanwhile, those stores in the best retail locations may be of interest to online giants creating wow-factor spaces that cement their brands in our consciousness and create emotional connections with their customers. They may also attract traditional large-format out-of-town retailers, which are increasingly recognising the need to be closer to their young, urban and often carless customers. Ikea, for example, has already opened city-centre stores in New York and Paris.

Undoubtedly, the retail sector has been hit hard by successive lockdown measures, but out of crisis comes opportunity – a chance to reform retail, embracing technology and enticing people back into city centres with exciting new concepts that hone in on the customer.

Eric Decouvelaere is head of retail EMEA at CBRE Global Investors