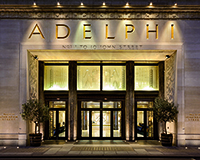

Blackstone has refinanced Art Deco landmark the Adelphi Building, WC2, with a new £360m loan from Morgan Stanley.

Blackstone has refinanced Art Deco landmark the Adelphi Building, WC2, with a new £360m loan from Morgan Stanley.

The new three-year facility replaces Morgan Stanley’s original £190m acquisition loan on the 330,000 sq ft, Grade II listed building, which Blackstone bought in late 2012 for £265m.

The original facility was a milestone deal at the time, representing Morgan Stanley’s return to UK commercial property lending. It was priced at around 400bps over Libor and was subsequently syndicated to AIG, Bank für Arbeit und Wirtschaft, Insight Investments and Aalto Invest.

Blackstone has since completed a major refurbishment of the lower six floors of the building, which cover 156,000 sq ft.

Just over 100,000 sq ft of the refurbished space was leased prior to completion last month and Blackstone has now kicked off the second phase of the refurbishment, totalling 124,000 sq ft, on floors seven to 11.

The building is valued at around £515m, meaning the latest loan reflects an LTV of around 70%.

It is thought to have priced at a margin slightly in excess of 200bps – highlighting both the value added to the building by Blackstone and the substantial improvement in the debt market over the past two years.

The loan also includes a capital expenditure facility to help finance the second phase of the refurbishment.

Tenants in the first phase of the refurbishment include creative co-working operator Neuehouse and accountancy trade body the ACCA.

The quoting rent on the space was £75 per sq ft, but rents on the upper floors – work on which is expected to complete in the second quarter of next year – will be considerably higher.