After suffering years of political and economic troubles, Belfast has a new air of confidence.

After suffering years of political and economic troubles, Belfast has a new air of confidence.

As the city improves its tourist draw, visitor numbers are on the up and an imminent cut to corporation tax is likely to attract significant inward investment. Developers are responding with a new wave of activity in its retail and leisure sector that is commanding plenty of attention.

But as investors clamour to make the most of Belfast’s new-found buoyancy, where are they looking to place their capital? And can demand keep up with the growing supply?

Bedroom boom

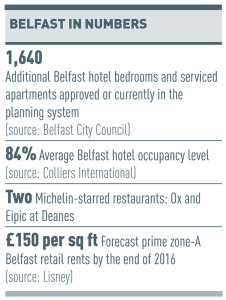

The first new wave of development has focused on hotels. According to Belfast City Council, planning permission has been granted for more than 1,100 hotel bedrooms and serviced apartments, with proposals for an additional 518 currently in the planning system.

Projects under construction this year include a 179-bedroom Hampton by Hilton hotel at Bruce Street, the conversion of office building Windsor House into the 216-bedroom Grand Central hotel, and the redevelopment of the old Harland & Wolf drawing office into the 120-bedroom Titanic hotel.

According to the Northern Ireland Hotels Federation, Belfast could see a 29% increase in hotel bedrooms by 2018 as operators look to exploit a booming visitor economy.

Belfast City Council chief executive Suzanne Wylie says: “Our new conference facility, Belfast Waterfront, is forecast to generate 50,000 delegate days a year. We expect 2 million people to visit the city in 2016 and have a target of doubling tourism spend by 2020.”

Belfast City Council chief executive Suzanne Wylie says: “Our new conference facility, Belfast Waterfront, is forecast to generate 50,000 delegate days a year. We expect 2 million people to visit the city in 2016 and have a target of doubling tourism spend by 2020.”

Visitor numbers across Northern Ireland have been boosted by key attractions such the Titanic Belfast exhibition and a tour of the settings used in the HBO TV series Game of Thrones.

In addition, a reduction in the corporation tax rate in 2018 is forecast to attract significant inward investment and boost hotel demand from the corporate sector.

The council has commissioned analysis which shows that, to meet projected visitor demand, Belfast will need an additional 1,500 hotel bedrooms by 2020.

Prospective investors will no doubt be encouraged by the performance of the city’s existing operators. Colliers International research reveals that Belfast enjoyed the highest increase in hotel occupancy levels in the UK in 2015, rising to 84% from 81% in 2014.

“The key drivers are clearly there for Belfast and we see real opportunities for further growth,” says Dermot Crowley, deputy chief executive of Dublin-based hotel group Dalata.

Dalata is opening the 206-bedroom Maldron hotel on Brunswick Street in central Belfast. The 14-storey hotel, developed by McAleer & Rushe, is expected to complete in early 2018.

But given the scale of hotel development across Belfast, isn’t there a danger of oversupply?

“With viability and funding issues, they won’t all be deliverable,” says Crowley.

Belfast’s agents generally concur. According to CBRE, there is a potential pipeline of around 3,900 additional hotel bedrooms, which would more than double the current room stock in the city.

“There is probably demand to justify only 2,000 rooms, after which we are likely to reach saturation point,” says Brian Lavery, managing director for Belfast at CBRE. “But it is still not an easy market in which to get finance and we don’t expect to see oversupply within the next couple of years.”

Restaurants and retailers

Not only are Belfast’s leisure credentials fuelling investment from hoteliers, restaurant operators are also looking to claim their slice of the cake.

The market has traditionally been dominated by local operators, but in the past year or so, major brands have added Belfast to their shopping list.

“We’ve got Wetherspoon keen to open more Belfast pubs and an array of restaurant brand requirements,” says Osborne King director Mark Carron. “Five Guys has opened in Victoria Square, Marco Pierre White has opened a steakhouse in the Park Avenue hotel, while the likes of Carluccio’s and Jamie’s Italian want city centre space.”

Zizzi is set to open at Victoria Square, and Ed’s Easy Diner, Byron and Prezzo are among a list of operators scouring the city for appropriate units.

Lisney director Nicky Finnieston says: “It’s now an issue of finding the right stock and delivering more space.”

Lisney is acting on behalf of administrators at KPMG in finding a buyer for Belfast’s beleaguered leisure scheme Odyssey Pavilion. Finnieston says: “It will soon have a well-capitalised owner and will provide space for a dozen restaurant units, alongside the cinema and other leisure uses.”

A lack of suitable supply is also supporting the case for new development in Belfast’s retail market.

Improved retailer sentiment and a favourable rates revaluation in April 2015 have combined to attract a number of new entrants.

Belfast’s CastleCourt shopping centre signed Yours Clothing and Schu Kids, while recent arrivals at Victoria Square include Michael Kors and Boux Avenue.

According to Lisney, retail vacancy rates fell to 12.5% in 2015, down from 19.8% the previous year. The reduction is supporting rental growth. At prime shopping centre Donegall Place, which has recently secured lettings to the likes of Gap and Skechers, rents are forecast to reach £150 per sq ft zone A, an uplift of more than 25% since the start of 2015.

“There is now a lack of available units, which would definitely support further retail development,” says Savills director Paul Wilson.

That development is likely to be focused to the north of the city, where developers are keen to exploit the new £250m Ulster University campus. By 2018, 18,000 students and staff will be located in the city’s Cathedral Quarter, providing a major boost to footfall.

In 2014, NewRiver Retail acquired Newtownabbey’s Abbey Centre shopping mall to the north of Belfast city centre.

“We saw great potential and have experienced very high levels of demand,” says NewRiver director Emma Mackenzie. The centre has secured 10 lettings since 2014. Next and Dunnes Stores are upsizing their units, while the centre has welcomed new names including Pandora, Trespass and Uberfone.

Yet the sleeping giant of Belfast’s retail and leisure offer remains the 12-acre strategic site Riverside Exchange. Since its change of ownership earlier this year, all eyes are on how it will be brought forward.

In 2012, Leaside Investments gained planning permission to deliver a £400m redevelopment of the Royal Exchange site, incorporating 1.4m sq ft of mixed-use space. It was hoped the project would provide a new shopping quarter to complement Victoria Square, and with the potential to attract John Lewis.

However, Leaside failed to deliver and new owner Castlebrooke Investments now intends to give the project a new lease of life.

Colliers International managing director Jonathan Millar is working with Castlebrooke on plans for a revised scheme and hopes to have a new planning application submitted by the end of the year.

He says: “The market has moved on since the original consent was granted and we are looking at how the development can reflect that change.”

Wilson insists the scheme must remain ambitious in exploiting new opportunities, such as the new campus just 100 metres from its boundary, as well as growing demand for A3 and office space. He says it is likely to comprise around 1m sq ft of mixed-use space. Around 300,000 sq ft of that will be retail, including a 150,000 sq ft department store.

Belfast City Council’s Wylie is hopeful John Lewis can be persuaded to come on board. She says: “It would be fantastic for Belfast and help meet our desire to attract more aspirational retail to the city centre.”

Local leisure operator to open second Belfast hotel

Beannchor Group, which owns a leisure portfolio across Belfast, is responding to rising demand with the construction of a £4m hotel called Bullitt.

The group is already familiar with the workings of Belfast’s hospitality scene. It owns the five-star Merchant Hotel together with a range of pubs, bars and pizza restaurants.

The group is now transforming the Lagan House building between Victoria Street and Ann Street into a new hotel due to open in October.

The hotel’s name was inspired by the classic Steve McQueen film and its design will be influenced by the 1960s. The first phase will incorporate 43 bedrooms, with a further 30 planned to open at a later date.

“We wanted something with a bit of personality,” says Beannchor finance director James Sinton. “It will provide an alternative concept to compete with the three- and four-star market.”

The operator has been encouraged by the recent surge in hotel occupancy levels, the rise in the number of tourists and the potential to attract more conference delegates.

For Sinton, the key for Belfast’s hospitality sector is to invest and integrate itself with other uses across the city.

He says: “Hospitality has to be intertwined with all other forms of development so they are symbiotic. We need to differentiate the city centre and give people a reason to visit.”