Neil Sedaka may not have been thinking about property when he sang Breaking up is hard to do. But the sentiment of his 1962 hit is certainly echoed in the difficulties experienced by both sides when office leases have run their course.

Neil Sedaka may not have been thinking about property when he sang Breaking up is hard to do. But the sentiment of his 1962 hit is certainly echoed in the difficulties experienced by both sides when office leases have run their course.

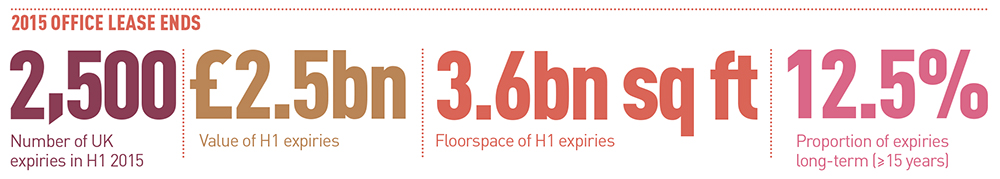

And those problems are set to mount this year, as leases signed during the happier earlier years of the new millennium fall in. Using EGi data, legal firm Irwin Mitchell calculated that there will be a significant rise in office lease ends during 2015 (see panel).

Although, in theory, the process of ending an office tenancy should be straightforward, the reality is that the issue of dilapidations – the cost of returning the building to the state it was in when the tenant rented it – often leads to disagreements.

Whether these are resolved quickly or turn into disputes that eventually head towards court depends on the ability of both sides to be flexible. “Ultimately, it often comes down to horse trading. Neither party comes out joyous as it normally ends as a compromise,” says Chris Perrin, partner at Irwin Mitchell’s Manchester office.

Conflict may be avoided altogether if a landlord does not claim dilapidations – which may be the case if the property is about to be redeveloped to more modern offices or converted to residential or another use.

However, there is a common acceptance in the market that there will normally be some kind of claim. Deloitte Real Estate partner Mike McChesney says: “Usually this is an end-of-relationship situation – the landlord will want as much as they can and the tenant will want to pay as little as they can.”

Industry professionals agree the introduction of a dilapidations protocol two years ago has helped to weed out overzealous claims from landlords, as their surveyor is now required to physically sign off the amount as being accurate. Nevertheless, many add that almost every case they see is inflated and they expect the amount claimed reduced by up to half.

Specialist building surveying firm Malcolm Hollis calculates the average settlement on the 1,300 dilapidations cases it handled last year was £18 per sq ft and it expects the number of cases to rise this year by at least 25%. Partner Mark Hampson says: “Disputes can arise where a tenant with a long lease has carried out a lot of alterations, say adding air conditioning. They may think they don’t need to remove it.”

Although a tenant may have invested a huge amount in their fit-out (lawyers who retain a preference for cellular offices, for instance) this is usually irrelevant at lease-end. Mark Pollitt, executive director at CBRE, says: “There will always be organisations who believe they have improved the space and just do not realise that is not necessarily what the next tenant wants.”

Ultimately, however the onus is on the landlord to prove a loss, and while the law in Scotland is somewhat different (see box), occupiers across the UK have successfully reduced their dilapidations bill to zero. “It is not unreasonable for tenants to ask questions and most are pretty sensible about it,” says DRE’s McChesney.

For occupiers whose leases end before the end of the year, building surveyors and property lawyers alike advise a pro-active approach. Matt Pugh, partner at Leeds-based legal firm 3volution, says: “The worst thing you can do is put your head down and do nothing. If you leave it too late you won’t be able to do repairs yourself as the lease has ended, and even inspecting the building could be difficult as you will no longer have right of access.”

Even when disagreements turn into disputes, very few dilapidations claims – an estimated 0.5% – make it to court, though a sudden hike in fees this year (see box) could see the number rise. However, Neil Gilbert, partner at Bristol-based property consultancy Tuffin Ferraby Taylor, does not expect that to happen. “Far more likely is that we will see parties appointing an independent expert and that is often going to be the best way forward,” he says.

Is Scotland more tenant-friendly?

Is Scotland more tenant-friendly?

Three recent court cases in Scotland suggest that dilapidations claims may play out in favour of tenants.

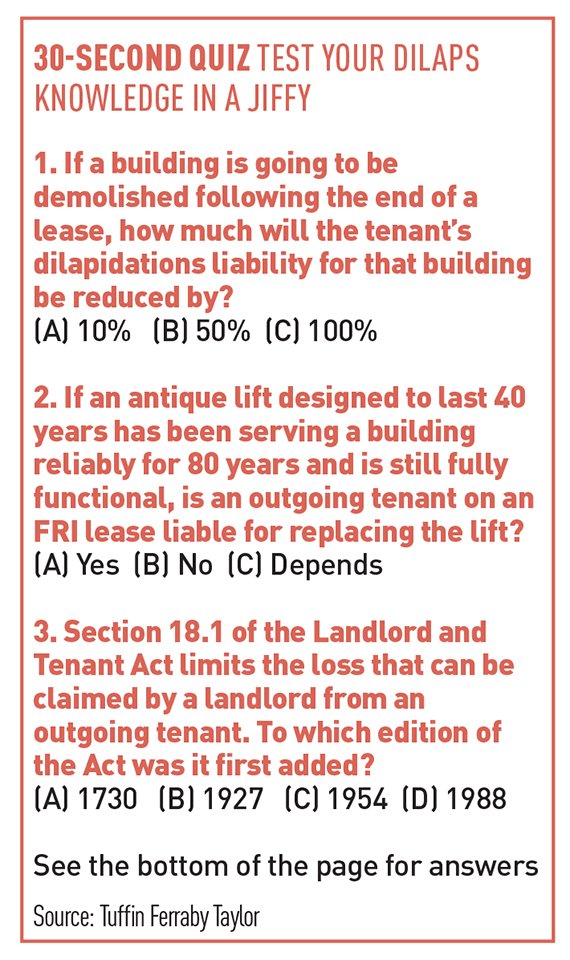

Unlike English law, where dilapidations claims may refer to section 18 of the Landlord & Tenant Act (see 30-second quiz below), Scots law is based on a combination of the lease itself and common law principles.

In the latest decision, handed down in March, Edinburgh city council successfully defended a claim for more than £8m following the end of a lease at Chesser House, 500 Gorgie Road, Edinburgh. The judge did not accept the landlord’s view that it was entitled to the money, irrespective of whether it intended to or had actually carried out work on the building, and agreed with the council’s position that any payment should be limited to loss actually sustained by the landlord.

Andrew Cartmail, senior director of BNP Paribas Real Estate’s Edinburgh office, says: “The recent round of cases is significant as the courts have demonstrated a willingness to apply a more liberal interpretation of the meaning of the lease wording as opposed to a more natural strict interpretation of the lease.”

This is being widely seen as a victory for tenants. Less happy will be landlords who purchased investments with the residue of a long lease in place, hoping for a large dilapidations payout at the end of the lease.

However, before tenants get too cocky or landlords too glum, differences in lease construction mean that neither side should make too many assumptions without looking closely at the paperwork relating to their own buildings. Cartmail says: “Every future dispute will need to be considered on its merits, both in respect of the wording of the individual lease and also the future use of the property in question.”

See you in court

See you in court

In March, with scant warning and despite vocal protests from the Law Society, the Ministry of Justice dramatically upped a wide range of court costs. Designed, so the government says, to more accurately recoup the administrative costs of the court system, legal professionals are particularly incensed that the charges are “front-loaded”, that is, payable at the start, before actual costs are known.

This may be good news for the Treasury, but less so for landlords issuing proceedings for money owed in a dilapidations claim. A fixed charges scale has been replaced by 5% of the total claimed, capped at £10,000. So a claim brought in February for £190,000 would have cost £1,300. Now, it will cost 622% more.

As the Property Litigation Association pointed out in its response to the brief government consultation: “Front-loading of fees hardly encourages parties to settle claims through alternative dispute resolution. A party may find it impossible to persuade the other side to negotiate without first issuing proceedings. Having paid a hefty up-front fee, a party may be more inclined to go through with those proceedings to get its money’s worth.”

The Law Society says it will press the incoming government to review the increased charges.

Quiz answers: 1) C; 2) B; 3) B