In or out? While politicians and commentators argue about the repercussions of the June European Union referendum result – whatever that may be – the residential sector is already concerned at the possible damage that will be done in the period before the vote itself.

In or out? While politicians and commentators argue about the repercussions of the June European Union referendum result – whatever that may be – the residential sector is already concerned at the possible damage that will be done in the period before the vote itself.

“The challenge we see has less to do with the referendum and a lot more to do with the uncertainty that the conversation is generating for investors. It is imposing a modest layer of risk that needs to be considered by investors,” says Adam Challis, JLL’s head of residential research.

“We are concerned that fault lines are already showing across the political divide at a local and national level as politicians swear allegiance to either the ‘in’ or ‘out’ camp. This political manoeuvring will slow down decision making and drag attention away from the critical shortage of housing,” says Nick Vose of planning consultancy Iceni Projects, which works with housebuilders and local authorities.

However, some within the sector predict that even if the UK were to leave the EU, the instability surrounding the establishment of new trading, investment and labour mobility relationships would be contained – most say up to two years maximum.

“[Brexit] is unlikely to have a major impact on confidence in the wider UK housebuilding industry as the majority of its sales are to domestic, not foreign, buyers. Moreover, the enduring undersupply of new homes in the UK means activity levels are unlikely to be affected, as demand and pricing levels remain robust,” says Alan Brown, chief executive of housebuilder CALA Group.

“Either outcome will not change the fact the UK is not building enough houses. This shortage, coupled with ongoing [house] price inflation – between 6.4% and 9.7% during the past year, means the fundamentals of the UK market should remain attractive to housebuilders even in the event of Brexit,” says Brown.

That doesn’t mean the industry is indifferent to the result, however. There are plenty of siren voices warning that leaving the EU would create problems.

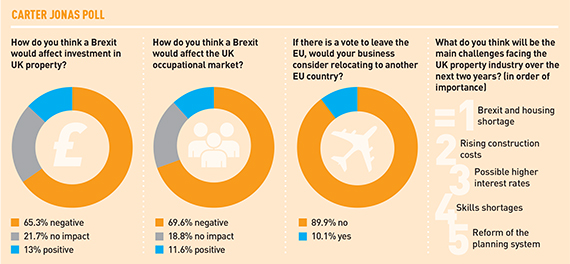

Results of a poll by Carter Jonas, covering 69 of its clients in the construction industry as well as commercial agents and residential sector players, show a two-to-one vote in favour of staying in, with sizeable concern that Brexit would hit investment, at least in the short run. A similar survey by accountants Smith & Williamson showed that 85% of UK real estate firms are against Brexit.

“There is a distinct uneasiness about leaving the EU. Only around a fifth of those polled – 22 % – believe that a Brexit would have no effect on investment, while just 13% think that it would have a positive impact,” says Darren Yates, head of research at Carter Jonas.

That concern seems particularly strong in two areas: labour supply, and the high-profile but statistically small prime central London construction market.

The Chartered Institute of Building, while identifying the absence of industry apprenticeships as the core problem, has already warned that tighter regulation of migration would damage construction activity. “If Britain does vote to leave, the industry could well struggle to have sufficient labour to build the homes this country desperately needs,” says CALA’s Brown.

Meanwhile in the capital – where up to 85% of some prime apartment schemes are purchased by overseas buyers, many of them off-plan and so assisting builders’ cash flow – there is also concern.

Rob Perrins, managing director of Berkeley Group, told the Reuters news agency at Christmas: “My concern would be around inward investment in London. If it retained less influence and fewer jobs, it would grow less quickly, so it would actually need fewer homes built.”

There is also the lower-profile issue of housebuilders who target British buyers overseas, most usually in Spain. Taylor Wimpey, for example, has operations on the Costa Blanca, the Costa del Sol and the island of Mallorca with a customer base primarily of British purchasers.

Although buying in the EU might be no more difficult if the UK exited – non-EU citizens can buy unhindered in most EU countries now – there may be more red tape post-Brexit, making property purchase less appealing.

Nigel Lewis of A Place In The Sun magazine says Britons wanting to live in the EU permanently may face “integration rules” such as being obliged to speak the host nation’s language. Meanwhile, holiday home buyers might have to apply for a visa to visit their property “which would mean more intrusive questions about how long you were going to stay, your income and health cover”, says Lewis.

While such issues exercise the public and residential industry alike, one other issue is perhaps escaping the attention it deserves: whatever the result of the referendum, the UK requires more homes – and soon.