JLL’s EMEA operating income fell by 45.3% to $79.1m (£63.3m) in 2016 as the company was hit by a slowdown in the UK caused by the EU referendum.

It said the “decline in profitability was UK-focused and driven by the decline in capital markets transaction volumes” with $35m of capital markets fees in 2015 not recurring in 2016.

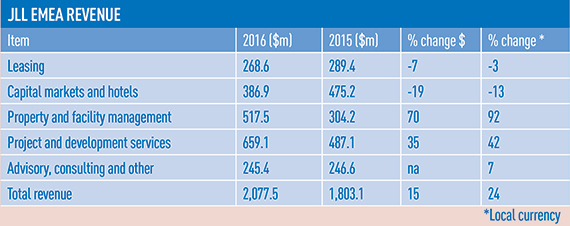

EMEA revenue held up well with a 16% increase in fee revenue in local currencies to $1.5bn. Property and facilities management revenue grew by 92% in local currencies but capital markets and hotels slumped by 13%.

Globally revenues grew by 14% to $6.8bn but net income fell by 20.1% to $318m. The company said that margin declines reflected an increased investment in technology and data, a shift towards annuity businesses and a decline in LaSalle Investment Management’s equity earnings.

Christian Ulbrich, chief executive said: “We will be focused on translating our increases in revenue and strategic investments into accelerated profit growth.”

• To send feedback, e-mail david.hatcher@estatesgazette.com or tweet @hatcherdavid or @estatesgazette