The size of short-term bridging loans grew by 49% in the two months after the EU referendum despite volume growth in the sector levelling off.

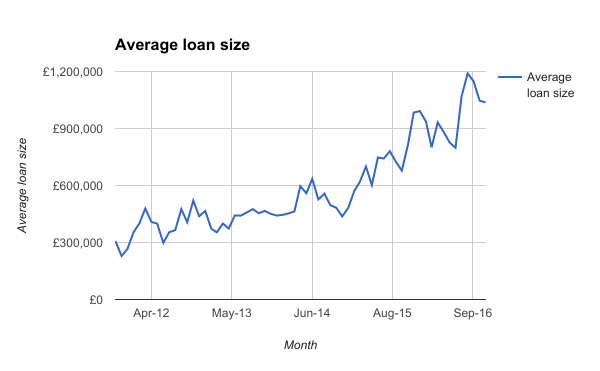

According to West One Loans’ latest Bridging Index, property investors borrowed on average £798,198 per loan in July. That figure jumped to £1.2m in September before coming down to about £1m at the end of the year.

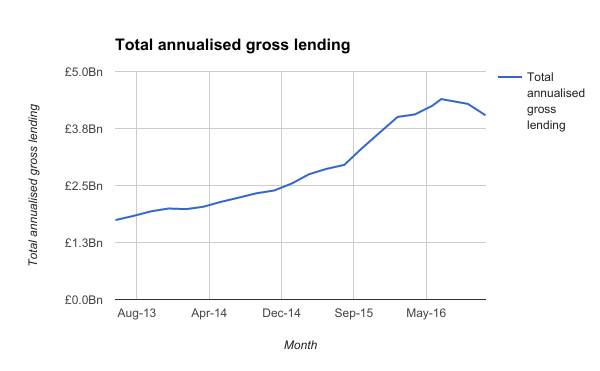

The annualised total value of loans peaked in July at £4.4bn before falling to £4bn in the 12 months to December.

According to the study, there was a surge in the second quarter with £742.6m of loans done as borrowers rushed to complete deals in the lead up to the stamp duty rise. A 17% fall to £613.1m followed in Q3.

Although there was a drop in the annual total recorded at the end of 2016, the Association of Short-Term Lenders reported that its members saw a 26% increase in activity in the fourth quarter. West One Loans said it expects upcoming reports to show an uptick in activity because there is always a delay in processing loan data.

Stephen Wasserman, managing director of West One Loans, said that although uncertainty made smaller borrowers take a pause in the third quarter, larger investors were more likely to stay active. That meant that total volumes were down, but the average size of loans grew.

He said: “Some of the larger property professionals saw an opportunity to purchase stock that they may not have been able to buy prior to the referendum at levels they were happy to buy at. As with most things, when there’s some kind of uncertainty, the professionals are able to capitalise on that.”

The steady growth in the volume of bridging loans in the UK, which has more than doubled from the £1.7bn recorded in 2013, has driven costs down.

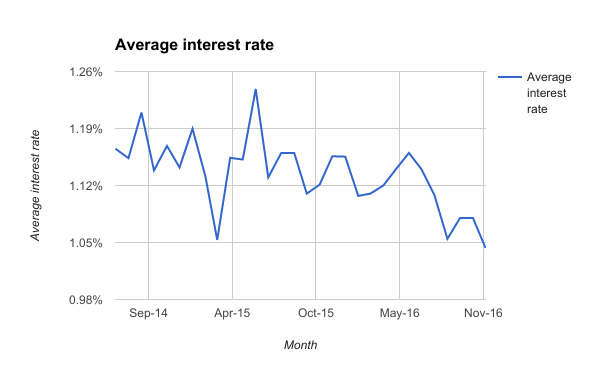

Monthly interest rates have stayed below 1.25% for more than two years and have now fallen further to just below 1.05%, partly because of the Bank of England’s base rate cut in September and partly because of competition between loan providers.

Wasserman said: “As bridging finance becomes more professionalised and seen as a good source of finance, there are more entrants in the market, more competition, and more drive to work with the best clients.

“It’s no longer the last resort; it’s now a commercial decision that a lot of our property investor clients are taking.”

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette