Britain is benefiting from outbound Chinese real estate investment which has climbed to $33.7bn (£21bn) since the global financial crisis, but the US remains most attractive.

The UK follows the US as one of the top destinations for Chinese real estate investors, which have ploughed $33.7bn into the sector globally from 2008 until June this year.

According to new research from Cushman & Wakefield and Real Capital Analytics, spending has grown from a mere $75.2m in 2008 to $5.1bn in the first half of 2014 alone – nearly as high as all of 2012.

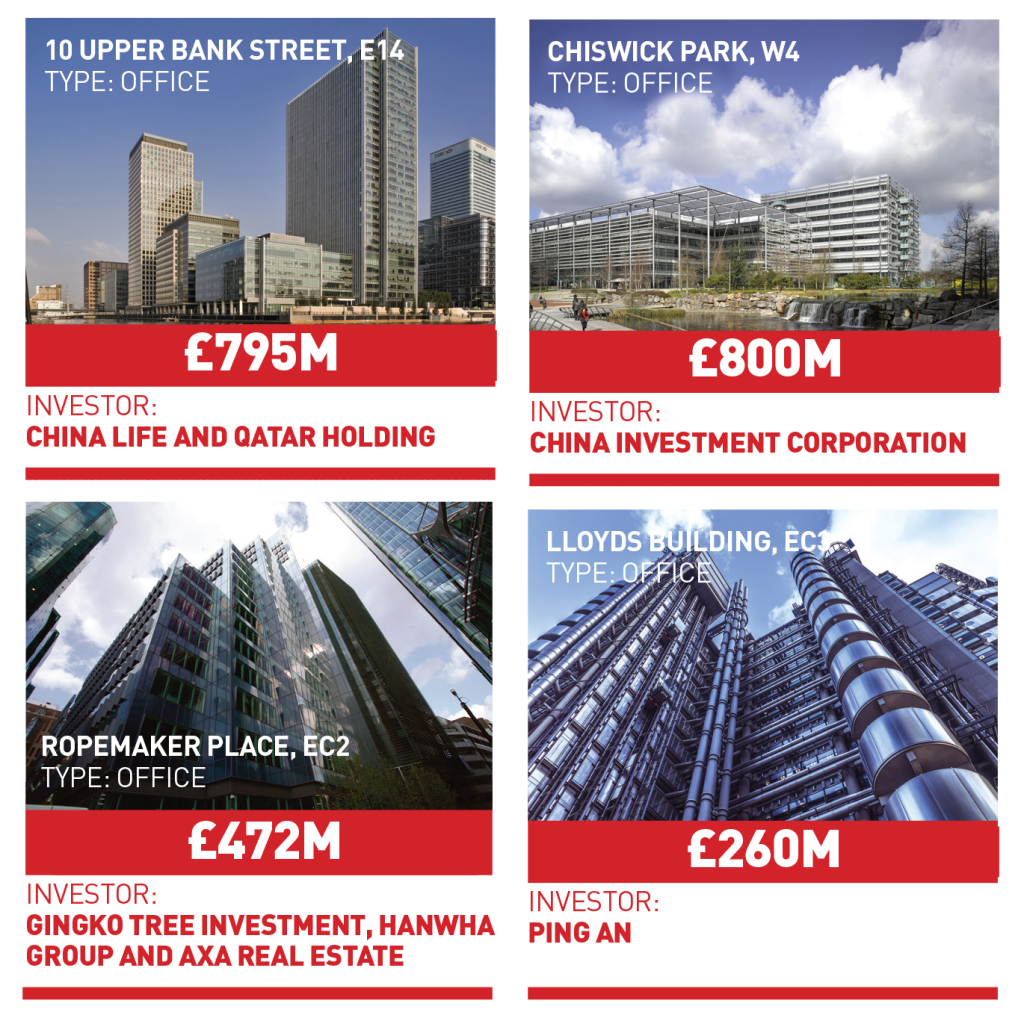

Britain is the first stop for investors in Europe, which has taken 24% of total outbound investment over the period. Some 29% has gone to North America. London took almost two-thirds of the European spend as far eastern investors snap up trophy assets including Ropemaker Place, EC2.

Offices have been the favoured sector for the six-year investment drive, which according to C&W has been driven by rebounding economies with a rising renminbi, cooling domestic markets alongside increasing liquidity, diversification of risk and policy changes clearing the way for outbound investment.