Student accommodation transactions reach record levels as investors move into development to boost returns

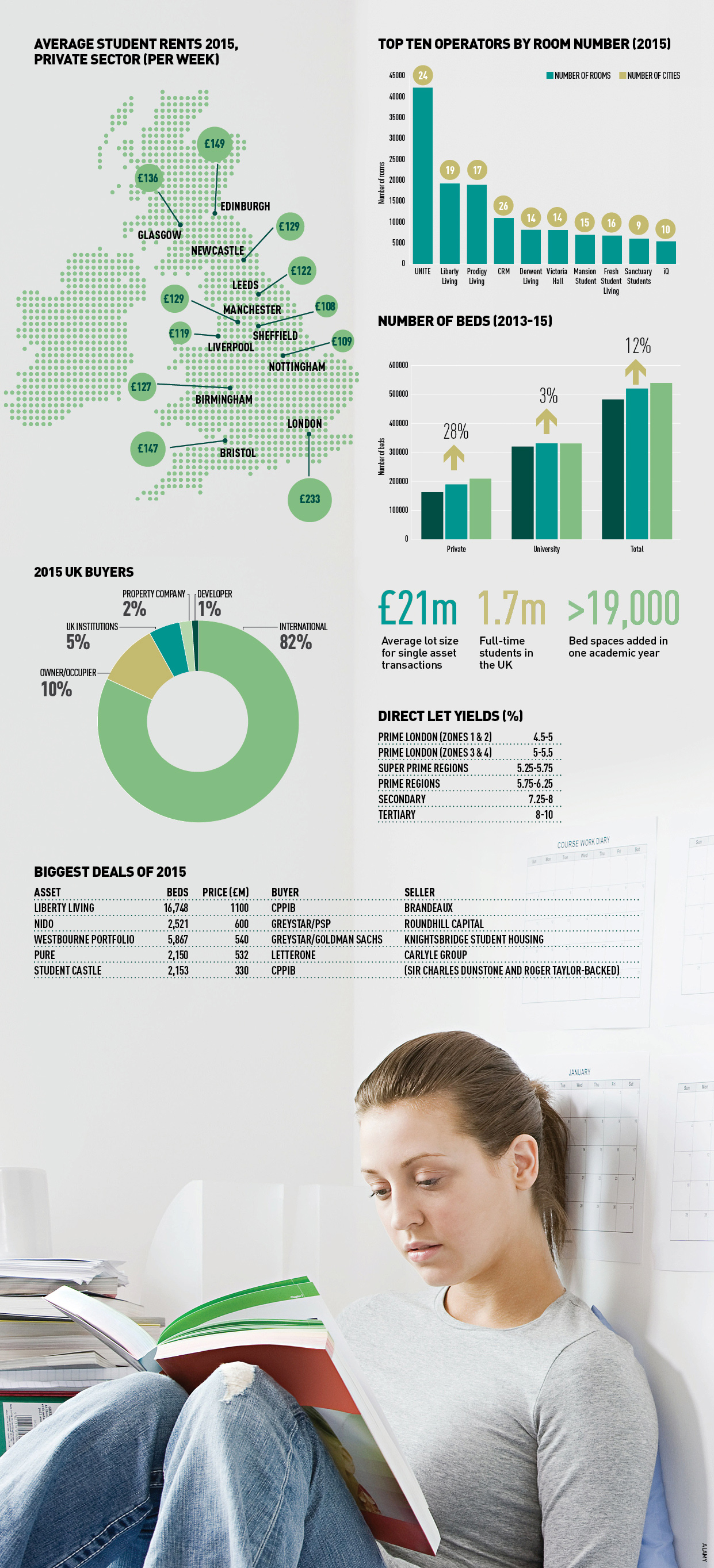

A record £5.1bn of transactions took place in the UK student accommodation market last year, a colossal increase on the £250m average achieved between 2005 and 2009.

Despite two increases in tuition fees in the past six years, student numbers and investor interest has continued unabated.

However, to gain acceptable returns, investors are now moving up the risk curve and into development.

As a result, in some markets there are lingering concerns of oversupply and as Cushman & Wakefield observes, although the average student-to-bed ratio overall in the UK stands at 2.1:1, in areas such as Liverpool this is down to 1.4:1.

Mike Mitchell, senior investment director, Cushman & Wakefield, said: “Investors are attracted by buoyant student demand and real rental growth and we expect supply of bed spaces to increase in 2016.

“Similarly, there are a number of new entrant investors that have missed out on portfolios this year and are still seeking investment opportunities in this space.

“We expect to see at least two new investor entrants to the UK market in 2016.”