Almost a decade on from the financial crash and following a tumultuous year, have investors finally learned to prepare for potential changing fortunes? Karl Tomusk reports

A bumpy, unpredictable cycle awaits UK property – but it is a cycle investors are ready for, according to a study by BNP Paribas Real Estate and Ipsos MORI.

The company’s Cycology report, which combines data from surveys of 29 investors, occupiers and academics, argues that although recent and upcoming political events are leading the cycle into uncharted and uncertain territory, investors have learnt to handle the

unknown.

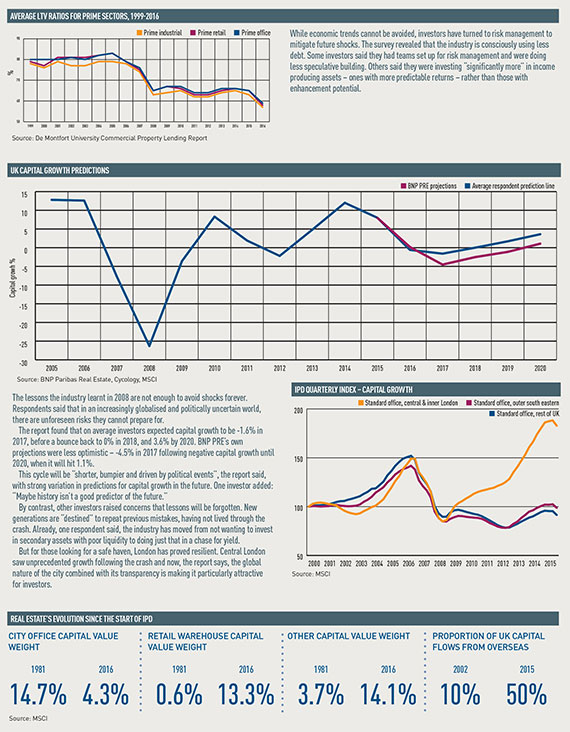

Almost a decade on from the global financial crisis, risk management is a priority for the industry. Banks have cut down their exposure to speculative development, propcos are focusing more on recurring income than capital value growth, and LTV ratios have plunged since their peak in 2004.

But regardless of how many lessons have been learned since the financial crisis, the report says, the future is fraught with changes that cannot be predicted.

Elections across Europe, technological advances and an ageing population leave both the industry and the outside world in limbo.