Murmurs of sinking property values have done little to shake real estate’s reputation as a secure investment in unstable times.

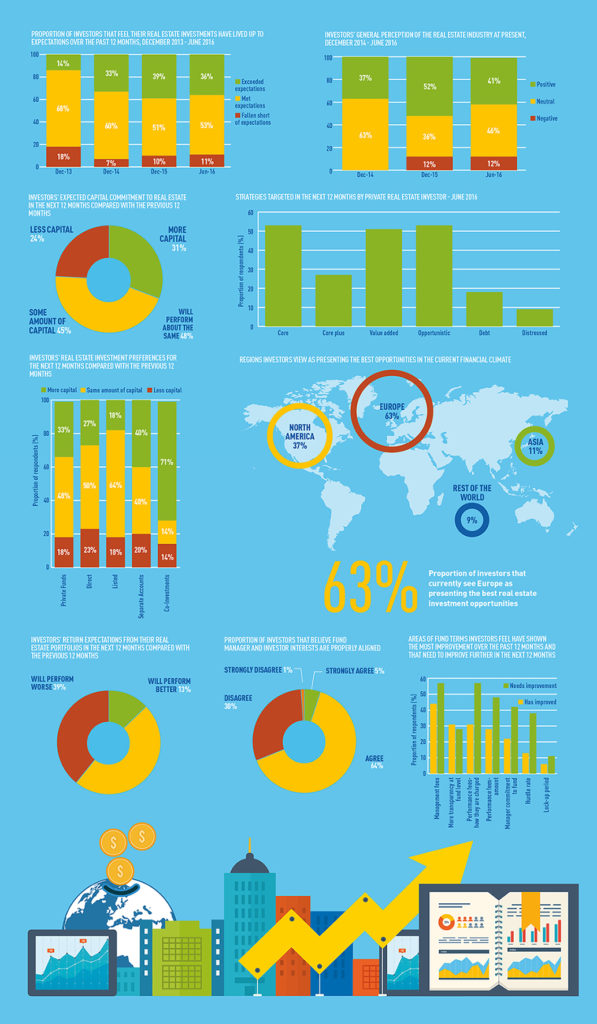

In Preqin’s Investor Outlook H2 2016, a survey of 162 real estate investors showed that despite only 13% of respondents believing that returns on their portfolio will rise in the coming year and 39% thinking they will fall, 31% expect to increase their capital commitments in property in the same time.

Antonia Storey, research manager for institutional investors at Preqin, said that considering the strength of property in the past year, real estate performing worse in the coming year does not mean it will perform badly.

She said: “Distributions from private real estate funds over the past 12 months have been strong and so investors have remained satisfied with their real estate investments.”

With volatility creating opportunity, over half of respondents said they are targeting opportunistic and value-added assets. Nearly 10% are also going after distressed property, up from 5% in December.

“Real estate performing worse next year does not mean it will perform badly”