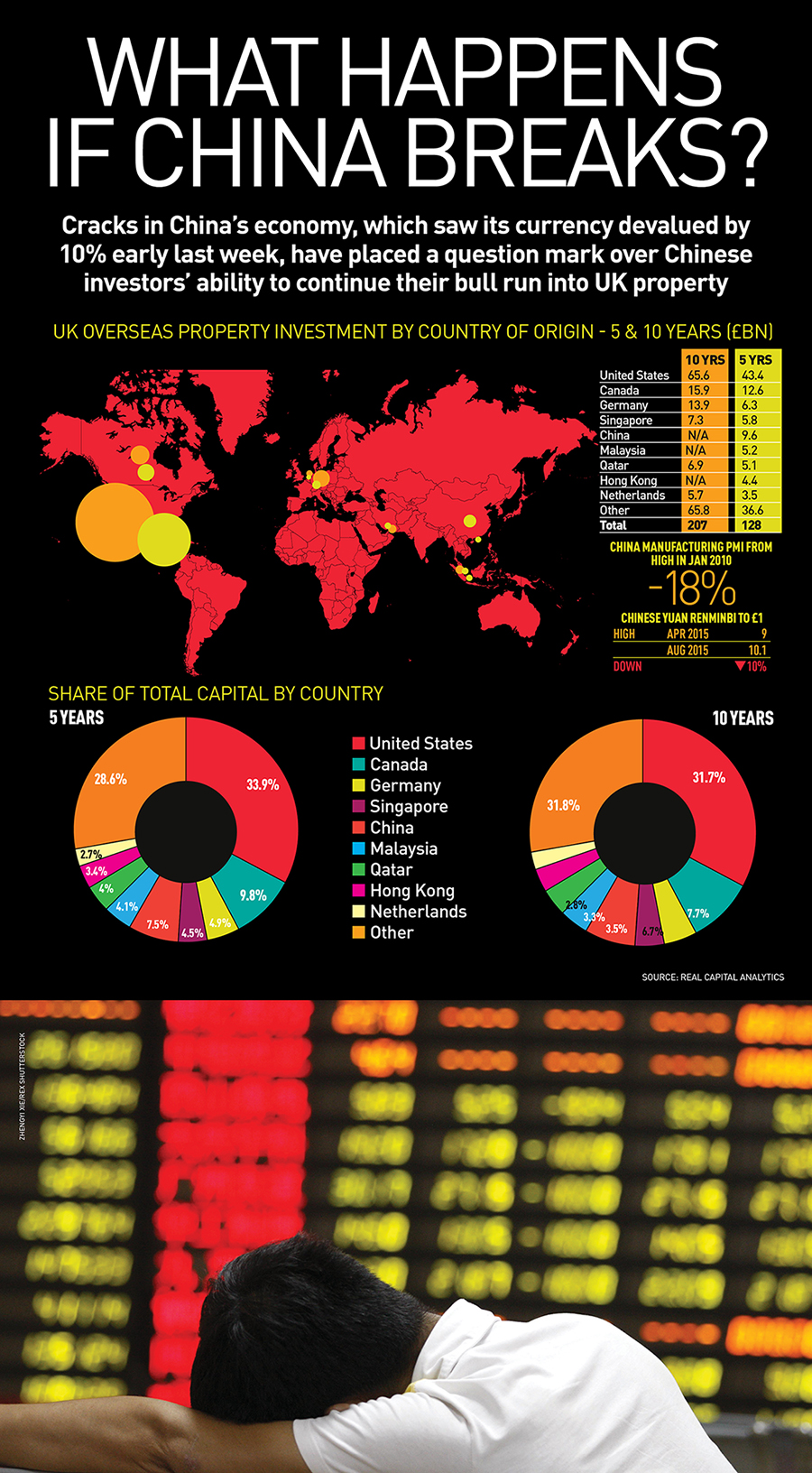

From a standing start a decade ago, more than £20bn of Asian cash has been invested in the UK in the past five years, with a quarter coming from China, according to BNP Paribas Real Estate.

Chinese investors made up 7.5% of all capital invested in the UK over the past five years – 50% more than the amount from Germany. If growth continued at the same rate, Chinese cash would overtake Canadian, German and Singaporean investment in a decade to become the second most important source of capital into the UK.

Simon Durkin, head of UK research at BNP PRE, said Black Monday had been a knock to confidence but fundamentals in UK property remained strong. “This is different to the last financial crisis, which emanated from a huge personal overleverage in the US housing market. We are not seeing that in China and hence the need for the big pension funds to continue to diversify their portfolios,” he said. “It is important not to have a knee-jerk reaction to what is currently short-term volatility.”

Private capital placement may take a more immediate hit as London purchases, particularly in the residential sector, suddenly become more expensive. “Development can only take place at a certain price, and where this is underwritten by selling off-plan to Chinese investors we may see a bit of mothballing, but if the world fell off the edge of a cliff you would want your money in bricks and mortar,”said Durkin.