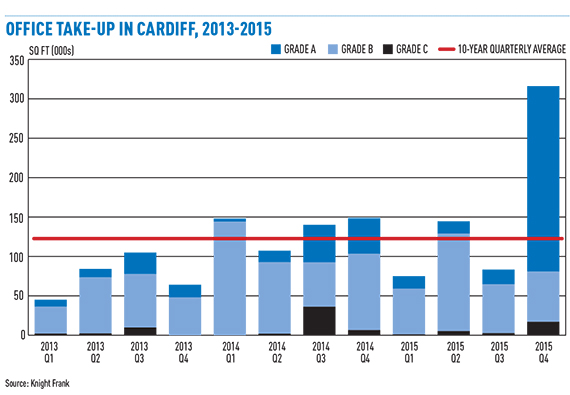

Is Cardiff’s office market a sleeping giant that is now waking up? The city has historically been associated with cheap rents and steady, if not rapid, take-up, with an average of 475,000 sq ft over 10 years.

Is Cardiff’s office market a sleeping giant that is now waking up? The city has historically been associated with cheap rents and steady, if not rapid, take-up, with an average of 475,000 sq ft over 10 years.

The public sector, rightly or wrongly, has got involved in development in the past – but that, too, is changing.

A burst of lettings activity from indigenous companies has pushed take-up levels to their highest for four years. In Q4 2015 alone, 316,000 sq ft was let, 74% of it grade-A space, according to Knight Frank.

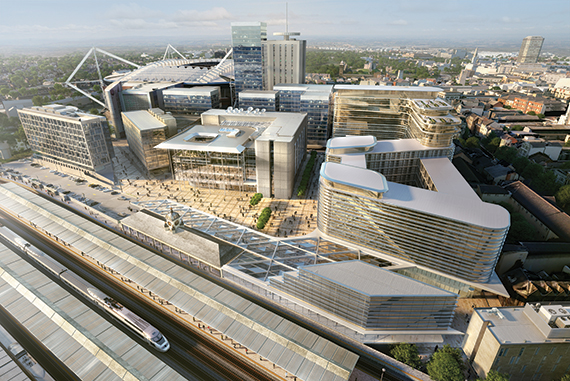

The BBC’s landmark deal for a new 150,000 sq ft headquarters for BBC Wales in L&G and Rightacres’ Central Square scheme boosted take-up figures, but availability of city centre grade-A space has dropped to just 22,000 sq ft. Developers have responded, with cranes now dotting the skyline.

More deals are imminent. Car finance company MotoNovo is in exclusive talks to move from its out-of-town premises to take 70,000 sq ft in the 135,000 sq ft 1 Central Square. The building completes in March and has a quoting rent of £24 per sq ft. And the Cardiff School of Journalism is in advanced talks to take 30,000 sq ft on a 15-year lease at 2 Central Square, which totals 100,000 sq ft and completes next year. Both are advised by Cooke & Arkwright.

Record rents expected

With deals soaking up stock, agents are confident that rents will continue to rise, making Cardiff even more attractive to private-sector developers. Headline rents are expected to hit £25 per sq ft this year, a new record for the city.

A further sign of growing confidence is the Welsh Assembly government’s decision to sell its site on the south side of Callaghan Square, which has planning permission for 90,000 sq ft of offices. Knight Frank has been appointed to market the site, which the government acquired from MEPC for £7.2m in 2013. A further 185,000 sq ft is being developed at Central Square, which completes in 2017, and JR Smart’s Capital Quarter on Tyndall Street, which is due to start construction this spring.

Work is also expected to begin this year on the demolition of Marland House and the adjacent car park in Central Square to accommodate Cardiff’s new mixed-use Interchange building, which could also deliver 275,000 sq ft of offices and will link into Cardiff Central station.

And there is no sign of demand abating. Deloitte has appointed Cushman & Wakefield to search for 40,000 sq ft to facilitate its expansion in the city centre. The requirement follows a deal for a 41,000 sq ft delivery centre at 6 Park Street last June.

HM Revenue & Customs has also confirmed plans for a new regional centre in Cardiff, which is likely to see the organisation move out of its current Ty Glas tax offices in the Llanishen suburb to larger premises in the city centre – potentially requiring 250,000-300,000 sq ft of new space.

To plug the gap until new space comes on-stream next year, some developers are undertaking refurbishments, such as the 51,000 sq ft St Patrick’s House, close to Cardiff Central station, 40,000 sq ft at 2 Kingsway, and 17,000 sq ft in Haywood House North, Dumfries Place.

Secondary rents are also rising on refurbished space. Agents on St Patrick’s House are quoting £20 per sq ft and at 2 Kingsway the quoting rent is an all-time high of £23 per sq ft.

Ben Bolton of Cooke & Arkwright says conversion of secondary office stock to student housing has mopped up supply, pushing up rents. “Suddenly these newly promoted headline figures don’t seem such a scary prospect,” he says. “A few years ago, you could be looking at headline rents on grade-A space at £20 per sq ft and rents on secondary stock at only £10 per sq ft, but the gap is closing.”

While there has been much for Cardiff’s office market to celebrate, most deals have been local churn and it must now attract more inward investment, such as Texas-based Alert Logic, which chose a base at Capital Quarter (pictured)two years ago instead of relocating to Belfast.

While there has been much for Cardiff’s office market to celebrate, most deals have been local churn and it must now attract more inward investment, such as Texas-based Alert Logic, which chose a base at Capital Quarter (pictured)two years ago instead of relocating to Belfast.

On paper, there seems to be plenty for Cardiff to shout about: cheaper rent than neighbouring Bristol, which is expected to hit £30 per sq ft this year, and proximity to Cardiff’s talent pool of 70,000 students – which is expected to grow (see box).

John Newton, partner at Tuffin Ferraby Taylor, says Cardiff is “crying out” to land another big-name employer like Admiral Insurance, a long-term bastion for the city.

Cushman & Wakefield’s Rhys James adds: “A lot of the take-up has been from indigenous occupiers shuffling around. The government says it is speaking to a large number of potential occupiers, but until you have a big employer coming in, you have to query how effective the measures to market Cardiff have been.”

Infrastructure is the other fly in the ointment. Gary Carver, director at Savills, says a proposed M4 relief road, designed to ease traffic flow between Cardiff and Newport, and the Metro, which will upgrade the 130-mile Valley railway, are essential to attract occupier.

Infrastructure is the other fly in the ointment. Gary Carver, director at Savills, says a proposed M4 relief road, designed to ease traffic flow between Cardiff and Newport, and the Metro, which will upgrade the 130-mile Valley railway, are essential to attract occupier.

Network Rail’s £5bn plan to modernise the Great Western main line and its South Wales branch, including electrification and station upgrades, will also improve connectivity to Cardiff, but is not due to complete until 2018 at the earliest. A solution to infrastructure issues could be in sight if a City Deal can be agreed (see p74).

For now, Cardiff’s office market has deals, rental growth and development. The giant is indeed stirring.

The war for talent

Universities in Cardiff and south Wales are poised to expand, increasing the potential talent pool for businesses.

Most recently, Cardiff Metropolitan University announced plans for a new media campus in partnership with Chinese media firm Phoenix TV which is expected to attract 2,000 students.

The University of South Wales, advised by JLL, has purchased a four-acre site from Dunedin and Brockton at Treforest for sports facilities, and the University of Wales Trinity Saint David has bought Admiral Group House in Swansea from Irish developer Kilbeg for £11.9m.

The University of Wales, advised by JLL and Rowland Jones, has plans for a £100m waterfront campus in the city’s SA1 development.

In 2014, Cardiff University announced a master plan to boost its teaching and research facilities, partially funded by the issue of £300m bonds.

Justin Millett, director of capital markets at JLL, says: “Universities in Wales have been involved in key disposals and acquisitions as part of their estate strategies, with each engaged in development projects to enhance and transform their estates. It is an exciting and dynamic time for the region’s higher education sector.”