CBRE’s purchase of Global Workplace Solutions gives the firm a massive new income stream from facilities management. David Hatcher examines the draw of the sector

Whenever property advisory firms have been linked with buying facilities management businesses in recent years it has been the subject of much amusement and sniggering from brokers. “You’re turning into a bunch of bog cleaners,” is the typical jibe.

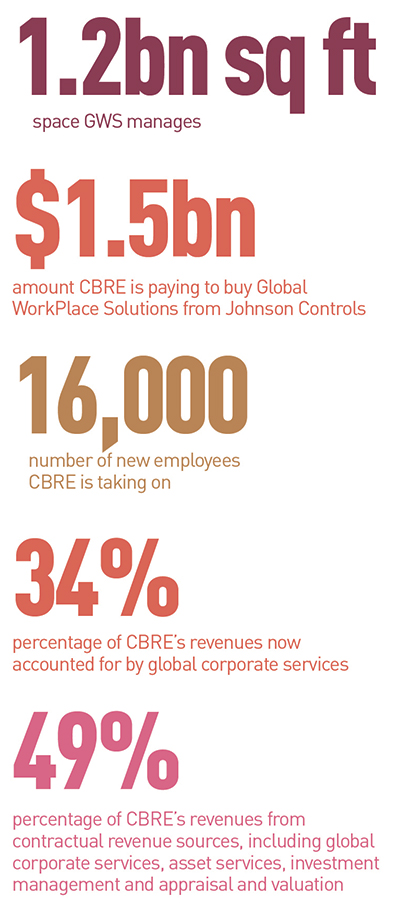

But to the bosses engineering these deals, expanding this area of their businesses is anything but a joke. CBRE’s $1.5bn (£1bn) deal to buy Johnson Controls’ Global Workplace Solutions business last week was the clearest statement yet of just how serious the world’s biggest property advisory firms are about facilities management.

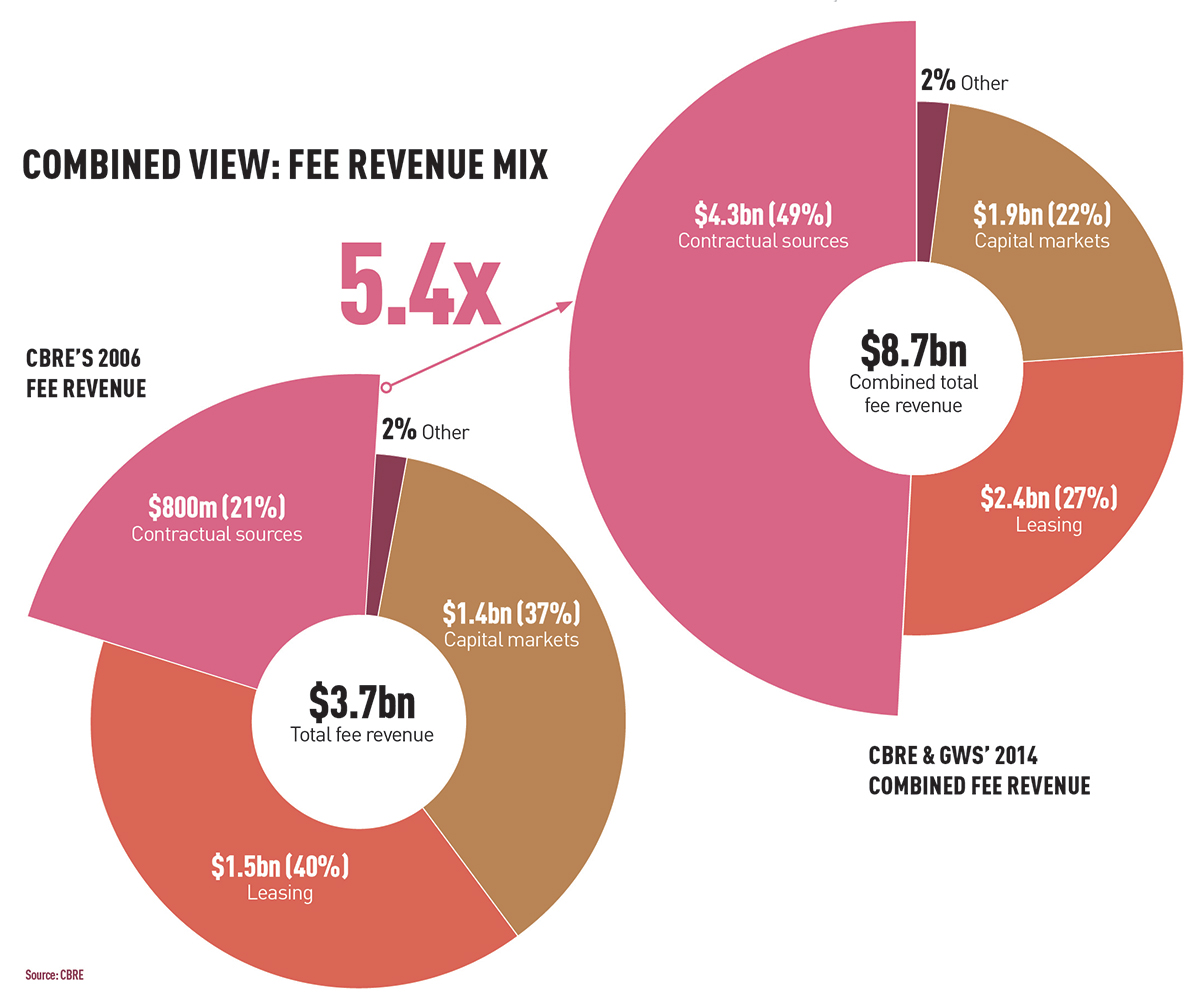

As a result of the deal, its global corporate services line now makes up 34%, or $2.9bn, of CBRE’s total fee revenue. This dwarfs leasing at 27% ($2.4bn), and capital markets, which amount to 22% ($1.9bn).

CBRE chief executive Bob Sulentic says: “The deal balances our business and makes our income stream more secure. It gives us an opportunity to cross-sell transactional business and gives us an opportunity to have great long-term relationships with some of the most important companies in the world.”

The stock market agrees with Sulentic’s theory. CBRE shares rose 5% on the back of the deal and while large transactional fees may be eye-catching, shareholders clearly prefer steady income generation.

On average, GWS’s contracts with its clients are for five years and the business has an average length of relationship with them of 12 years.

Sulentic is, however, keen to highlight the advantages of the deal for CBRE’s big fee-earners.

Cross-selling and using the new client base that CBRE has gained access to is perhaps more easily said than done; and not ramming down their throats the additional services on offer is key to success, according to Sulentic.

“The focus is to keep doing exceptional work for clients in the areas where we are already working for them, such as facilities and project management and technical services. If we do that then they will become confident in us in other areas – we are not racing at them saying ‘buy our transaction services’,” he says.

The expansion into FM is largely driven by a desire from clients to have a “one-stop shop” for their property needs.

DTZ’s merger with engineering and FM giant UGL in 2011 epitomised this, with the FM business of UGL and DTZ being merged into a new property unit. When the decision was taken to demerge the property unit from UGL’s engineering business in 2013 the new DTZ was subsequently seen as a more attractive proposition for clients and prospective owners, with private equity firm TPG ultimately buying the business for $1.2bn last summer.

“The trend of clients wanting fewer suppliers and a one-stop shop for outsourcing really is a reality,” says John Forrester, EMEA chief executive at DTZ. “Organisations that can offer all of the day-to-day services surrounding a building can achieve a great position in the outsourcing world, which is growing and will continue to grow globally.”

To illustrate the point, CBRE’s top 30 clients increased the amount of business they do with the firm by 98% over the past four years.

“Clients are buying from us on an account basis, across geographies and across product lines – that is the direction we are moving in. Clients want you to have top-tier services and that needs to be in all geographies and across all product lines, and you need to deliver well everywhere to make it work,” Sulentic says.

Bill Concannon will continue as chief executive of CBRE’s global corporate services arm, while GWS president John Murphy will become the division’s chief operating officer. Regional leaders of the business have yet to be determined.

Norland Managed Services, the technical engineering services business for commercial buildings, which CBRE bought in December 2013 for £265.5m, also forms part of the division in Europe.

CBRE has yet to announce whether there are to be any redundancies or overlaps, but in a presentation to analysts made on the morning the deal was announced it said there would be $35m of “expected cost synergies”.

Of the 5bn sq ft of space the combined CBRE and GWS will manage, only 1.2bn sq ft is in EMEA. While the one-stop-shop solution is popular in the US, creating a successful model in Europe is less straightforward.

“It is quite straightforward to do in the single legal and single language world of North America, but in Europe it is a lot harder, especially when you are competing to do businesses more cheaply than those on the ground in different individual countries,” says Forrester.

Despite these challenges, Forrester says the stockmarket’s preference for steady income over lumpy transactional fees will see facilities management shape the way advisory businesses operate in the future.

“Organisations with FM-type income have a higher valuation on the stock market. Recurring income and long-term contracts are seen as much more valuable than doing lots of investment deals. That is one of the reasons why businesses are being driven more towards consistent income streams.”

This is unlikely to be the last move a property services firm makes for an FM business and CBRE’s great rival JLL is eager to expand its capabilities.

“There is a strong global trend for real estate outsourcing to unlock value and productivity. Our growing investment in FM over the past few years has created great results for our clients and has enabled us to create a market-leading integrated solution in which we will continue to invest,” says Vincent Lottefier, JLL’s global director and chief executive of corporate solutions, EMEA.

One rival real estate advisory chief executive says they doubt there are many more targets of the scale and quality of GWS it would be possible to buy in Europe and that further consolidation in the FM sector is likely needed before any further mega-deals with property advisory firms.

Sulentic says: “All the big companies in our sector are trying to do it and it is known that is where the clients are headed. We all need to do it. This deal gives us a big advantage though, and I don’t think that what we’ve got now is easily replicable.”