The fire that broke out at Liverpool’s iconic Littlewoods building, raging through an early September night, was a salutary reminder of the many challenges in developing neglected sites.

Capital and Centric, the developer behind plans to turn the Art Deco building into a £50m Hollywood of the North, has said it is “very optimistic that this isn’t going to set our film studio plans back too far”.

At the time of writing, firefighters had seemed able to confine damage to the floor and the roof, with the walls of the west wing and structure intact. Thankfully, no-one was hurt.

From Grenfell to the destruction of Belfast’s Primark building in August, fire is an ever-present risk. But the coming months will see challenges to the real estate industry come thick and fast.

Each will do much to determine the success and failure of key projects in UK cities.

1. Brexit

The most significant – and negative – impact of all the external factors. M&G has warned central London offices are likely to be most negatively impacted by Brexit.

Barings Real Estate says London is a “hard sell”. There has been an overall slowdown in deals volume as well as total spend, with the number of deals done in London falling by 40% over the past two years compared with the same period before the referendum.

It has helped support regional activity so far: outside London volumes have dropped by only 9%, driven by price.

There’s clear reason why: the capital is expensive. The average outlay for a commercial asset has decreased in the regions over the past two years by 22%, down to £5.2m from £6.7m.

London, meanwhile, has seen an increase in average price – up by 6% in the two years after the referendum vote, from £32.8m to £34.8m – making the capital more than six times as expensive as the rest of the country on face value.

But evidence of a slowing regional market is mounting.

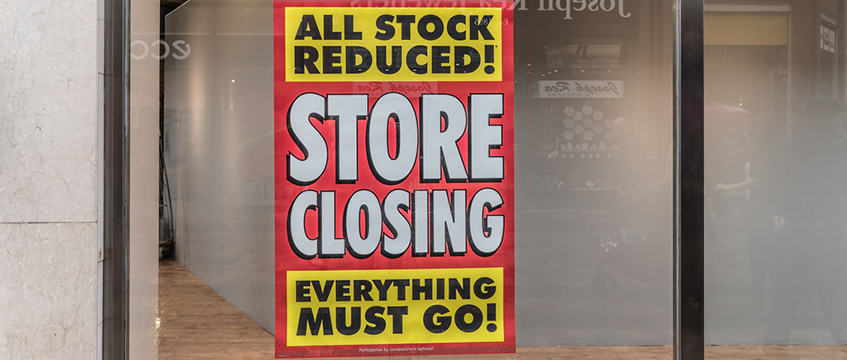

2. The retail crisis

Company Voluntary Arrangements are rife, the high street is visibly suffering and landlords are even being labelled ‘greedy’ (in some circumstances) for requiring rent. Even perennial darlings like John Lewis are feeling the pain.

The government made positive noises about lending to support to the second review of the future of the high street by former Iceland chief executive Bill Grimsey, only to commission another of its own, from shoe repair king Sir John Timpson.

It is an environment that is likely to get worse before it gets better.

3. Infrastructure

There are big decisions to be made. The bill required to begin works on the second phase of HS2 – its northern extension – has been delayed for a year. Paul Griffiths, MD of that phase of the project, is to leave the company.

Ministers will have a lot of work to do to convince regional stakeholders that they are serious about transport investment in the north of England. The autumn Budget may bring clarity.

It may also offer further insight into government support for the mooted Oxford-Cambridge-Milton Keynes Growth Corridor.

4. Tech

Its maturing in real estate has been rapid. And while tech – no longer proptech, please – still has a lot of growing up to do, we have moved on from the days where the industry divided neatly into disruptors and dinosaurs, with little inbetween.

Pioneers who can point to tangible business benefits have moved centre stage (the likes of building management software provider Demand Logic), nice-to-haves have shifted closer to must-haves (a connectivity score from Wired Score) and whole sectors that were previously institutionally sceptical of digital change (auctions) are embracing it.

To send feedback, e-mail damian.wild@egi.co.uk or tweet @DamianWild or @estatesgazette