The cost of borrowing to finance commercial real estate has fallen so much it is deterring lenders, according to CBRE.

The cost of borrowing to finance commercial real estate has fallen so much it is deterring lenders, according to CBRE.

Returns on lending fell to 3.7% in the second quarter, down 100 bps over the six months to the end of June, the agent said.

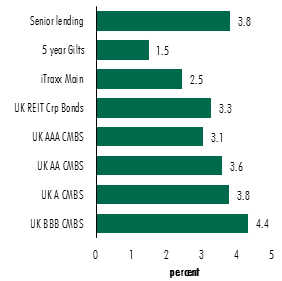

Lenders are still achieving a 2.5% premium over the benchmark Gilt rate but the spread to other investments has widened over the same period, making property lending less attractive as a “value play”, CBRE said.

For banks the risk-weighted returns on assets were forecast to be 1.6-2.6% compared with 1.8-3% at the end of Q1 and 2.4-4% at the end of 2014.

Dominic Smith, head of real estate debt analytics at CBRE, said: “For banks, returns on risk-weighted assets are approaching the level of around 2%, at which they may not meet cost-of-capital hurdles. For other lenders, the relative value play that enticed them into the sector has narrowed noticeably. We may therefore be approaching a point when lenders’ resolve is tested.”