After Anbang, Fosun and Dalian Wanda, the Chinese regulator is now cracking down on Ping An, New China Life Insurance and China RE Asset Management as part of restrictions determining the amount of capital being invested overseas.

A warning note from the China Insurance Regulatory Commission to the three has sparked speculation that assets may be put up for sale.

Although New China and China RE do not have any UK holdings, Ping An notably bought the Lloyds Building in 2013 for £260m and Tower Place in January 2015 for £325m.

The note said the three companies’ overseas investment businesses were in violation of the “provisional regulations on the administration of overseas investment of insurance funds”.

It said they should formulate “rectification plans” and rectify the investment violations.

The moves follow both HNA and Dalian Wanda Group announcing sell offs last year as the government cracked down on overseas investment.

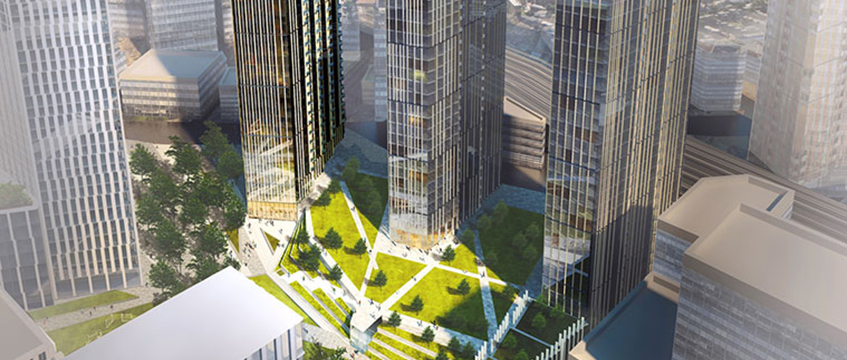

HNA is reported to be mulling a sale of its two London towers, while Dalian Wanda has transferred its UK residential schemes to R&F.

Using analysis from Real Capital Analytics, EG looked into what Chinese investors have bought in London over the last five years, and analysed the assets of the top 10, including what they have bought and sold.

Only a handful of assets have been sold since Chinese players started investing heavily in the UK.

Dalian Wanda’s Nine Elms sites were sold to R+F for £686.9m in 2017 and Fosun sold its Lloyds Chambers building to Abraham Schwarz for £97m in November last year.

According to RCA’s data, the vast majority of the £7.5bn invested by the top 20 buyers between 2013 and 2018 remains in their ownership, at least for now.

To send feedback, e-mail alex.peace@egi.co.uk or tweet @egalexpeace or @estatesgazette