Cities looking to replace London as a global financial centre will find it difficult to replicate the city’s economic, regulatory and geographic advantages, according to Cushman & Wakefield.

The Winning in Growth Cities report says a range of cities could benefit marginally from London post-Brexit, but the UK capital’s main competition will still be New York.

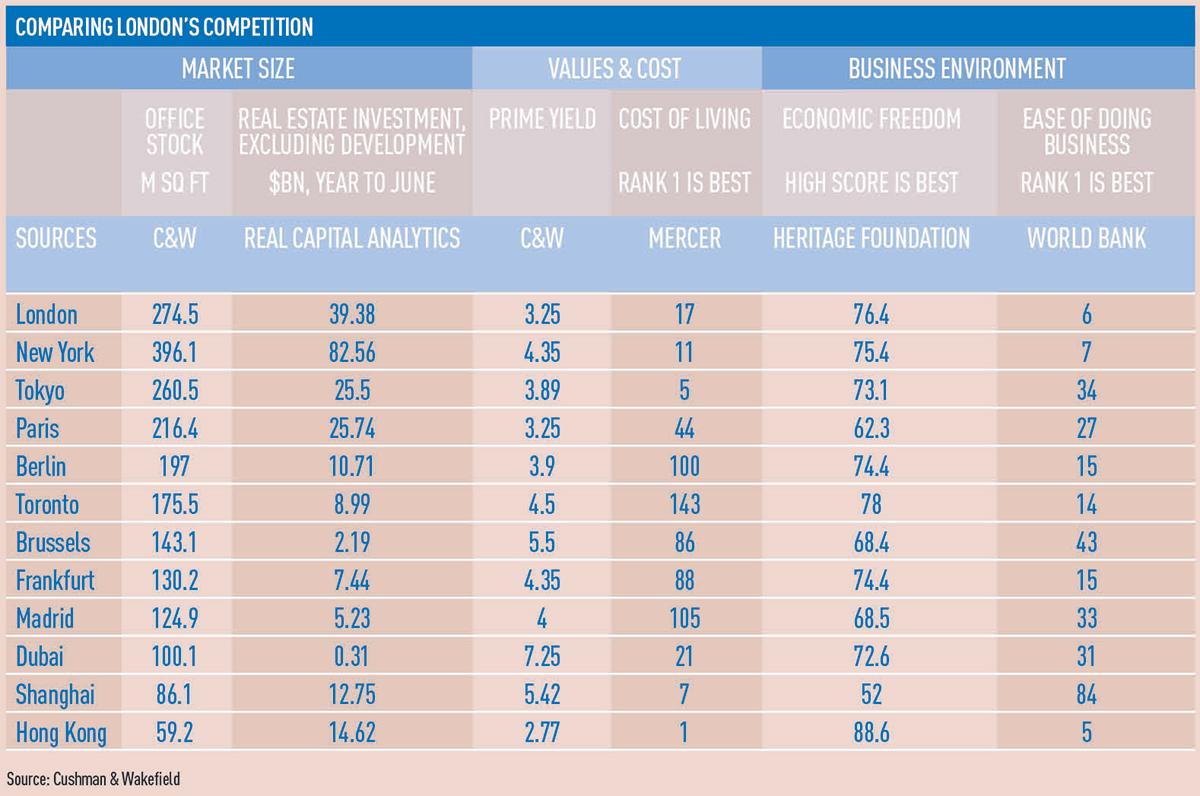

New York was the only city in the past year that matched London’s market position, seeing more than double the amount of real estate investment into the UK capital.

Activity in London slumped in the months leading to the EU referendum as the city lost its place as the top recipient of foreign capital to its US rival.

Prime yields in New York were nearly a percentage point higher at 4.35% and the city ranked alongside London in terms of ease of doing business and economic freedom, according to the World Bank and the Heritage Foundation.

Tokyo, where the office market is only about 5% smaller than London’s at 24.2m sq m (260m sq ft), does not have the centrality London does, which the study said would make communication across the globe more difficult, particularly with the language barrier.

In Europe, Frankfurt has already started building its place in the financial world, as home to the European Central Bank and a number of other international banks, but its office stock is less than half the size of London’s, while Dublin’s is even smaller at 3.3m sq m (35m sq ft).

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette