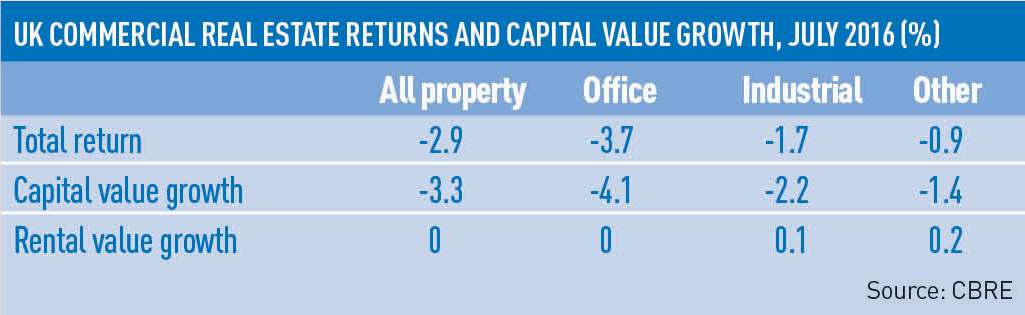

UK commercial property values fell by 3.3% in the first full month after the Brexit vote, the latest CBRE UK monthly index shows.

City offices were hardest hit, with a 6.1% decrease in July, while values in offices across the country fell by 4.1%.

The month saw a flurry of sales by open-ended funds, but the 3.3% drop in the market was less than the circa 10% discount some had applied to the values of their property assets.

Total returns from commercial property were also down by 2.9% – a sharp decline from the 0.6% rise seen in June.

Rental value growth dipped to zero across retail and office markets, while industrial rental value grew by 0.1%

Miles Gibson, head of research at CBRE, said it was too early to tell whether values would continue to slide or whether there would be a bounce-back over the coming months.

He said: “These numbers are volatile. Because we are only one month after a major political event, we would be nervous about drawing conclusions about what this data means at this stage.”

Rob Martin, research director at Legal & General, said that unlike the global financial crisis, which was “a gathering of separate individual events”, the decline this time was more concentrated.

He said: “It hit the market on one specific day. That is part of why we have seen an immediate reduction in values.”

Martin added that uncertainties in the outlook for sterling, interest rates and the future path of tenant demand led to an immediate deterioration in sentiment, but that the long-term effects were still unclear.

He said: “By the end of the year we will have a much stronger idea of how this event is converting into economic activity, occupier behaviour and the outlook for rents.”

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette