You could say that the retail and leisure market has fallen off a cliff. It would be a horrible pun, but it would also be true. But there is a new kid in town that could just be the saviour of the sector. An activity that just might be able to haul retail and leisure back up to the lofty heights it once scaled.

Okay. No more terrible puns.

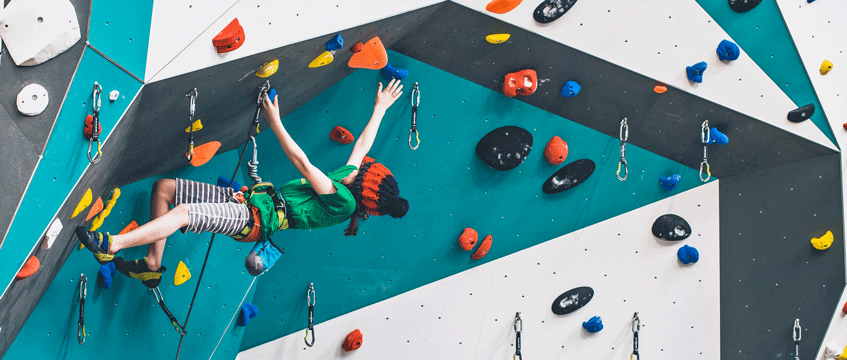

Climbing has traditionally been an outdoor pursuit, undertaken by some of the gnarliest, toughest, mostly Northern, Brits. If you wanted to be a climber, you needed to be tough, unafraid of the elements and probably a bit of a dirtbag.

Not anymore – although you can of course still be all of those things if you want to. Climbing, whether the traditionalists like it or not, is becoming mainstream. It is becoming a family leisure pursuit, an indoor pursuit and the furthest thing from a dirtbag pursuit.

Since climbing was announced as a new sport at the 2020 Olympics in 2016, there has been an increase in the number of people taking up the sport – particularly bouldering and indoor roped climbing.

Plastic pulling, the somewhat derogatory term used by “real” climbers for the indoor sport, has now become a discipline in its own right. According to the Association of British Climbing Walls, around 1m people now climb independently indoors in the UK.

And it is a market that is ripe to explode. According to the latest figures from the British Mountaineering Council, there are fewer than 400 indoor walls in the UK, a modest number to cope with the more than 6m visits that were made to indoor climbing centres in the UK last year.

Potential for growth

Those visit numbers are growing at around 16% year-on-year. The maths is easy, says Mike Axon, director of Big Rock Climbing: “There is significant opportunity for growth.”

Carlene Hughes, associate director in the leisure team at Savills, agrees. She says that operators are “knocking on an open door” at the moment.

But with opportunity always comes an element of risk, so what should landlords and operators alike be thinking about as the indoor climbing sector grows? And what can climbing do to create a community and bring back some much needed life to a retail and leisure sector on the brink of coma?

There are two main types of operator and product in the indoor climbing wall sector. The big box, training-cum-social centre style wall, and the child-focussed fun walls. And there is growth potential for both.

Rock Up, established by climbing enthusiast Aaran Eade during a visit to New Zealand, launched in the UK in 2014 at British Land’s Whiteley shopping centre in Hampshire. Since then it has opened a second centre at BL’s St Stephen’s centre in Hull, Yorkshire, and a third at Aviva’s Broadway Plaza in Birmingham, West Midlands.

More are in the pipeline, including at intu Watford, Hertfordshire, and the Crown Estate’s Rushden Lakes in Northamptonshire.

The business is focussed on the fun climbing sector with a particular leaning towards children – around 70% of its users are kids. It is a modular offering that typically operates from around 6,500 sq ft, with 2,500 sq ft devoted to the climbing arena (a minimum height of 8.5m is needed for this part of the centre), and the remainder incorporating a softplay area, café and rooms for parties.

Chairman and co-founder Heidi Duckworth says the company is poised for growth and is being inundated with offers of space, thanks to the demise of the food and beverage sector.

“The F&B market has taken a big turn and has created opportunities for us,” says Duckworth. “Over the past six to 12 months much more space has become available to us.”

Rock Up recorded year-on-year sales growth of 87% in 2017 and expects turnover this year to top £2.5m. Even in a sector that wasn’t going through somewhat of a slump, it is impressive growth.

“We find we are providing shopping centres and similar outlets with a highly attractive and unique proposition that utilises less space than other leisure activities, is quick to install and more importantly, enhances their overall customer offering,” says Duckworth.

A retail asset

According to Duckworth, Rock Up is drawing fresh footfall to shopping destinations from outside their current catchment. Average drive time to a Rock Up centre is 40 minutes, she says, and the 150,000 customers that come to their centres every year stay for between 90 and 120 minutes on average.

With three sites operational and two more secured, the business is now looking to aggressively expand. It is targeting high footfall locations with a family focus. It is also expanding its offer, seeking to develop atrium-based climbing walls.

Duckworth says these atrium walls, the first of which will open at Rushden Lakes early next year, can provide an eye-catching centrepiece in malls, a real draw for customers and a real bonus for landlords. For Rock Up, it means being able to slot a wall into an existing floorplate, and generally means that finding the required height is much easier.

“These children-focussed walls are of interest to landlords because they create destination and attractiveness,” says Savills’ Hughes. “Anything that can act as a destination draw is a positive.”

Rebecca Ryman, regional managing director at intu, which recently opened a Rock Up at is mall in Watford, says: “We’d be keen to introduce more climbing walls to intu centres because of what they add to the customer experience.

“They’re bright and visually appealing, boost health and wellbeing and everyone from preschool-aged children to corporate customers are catered for, giving them an incredibly broad appeal.

“Repeat visits are encouraged because you set yourself ongoing targets such as how many visits you need to reach the top, and on-site catering facilities help to increase dwell time even further. The amount of space they require is one obvious constraint to growth but equally, we can be very inventive with where they go by taking quirkier sites within centres.”

A focus on wellness, a demand in the National Planning Policy Framework to deliver healthy communities and a real chance that Great Britain could bring home some medals in the climbing competition at the 2020 Olympics in Tokyo is fuelling a boom in the sport for adults as well as children.

Big Rock’s Axon says there has been “meteoric growth” in indoor climbing centres across the South and Midlands.

He opened his first climbing centre in Milton Keynes seven years ago because he wanted somewhere to climb. That is not his motivation anymore.

“There was no market,” says Axon, “we generated a market and now we have a footfall of 100,000 a year at that centre which is growing year on year.”

The growth has been so strong that Big Rock this year opened a second centre just three miles away from the its first. And Axon is certainly happy with the levels of footfall it is already producing.

Open to all

Indoor climbing, he says, is an activity that is open for all people of all ages. It is relatively cheap – £8-12 for as long as you want to climb during opening hours – and is fast becoming a new way of getting a workout. Bin the gym and use the climbing centre as both your training and social club.

Demand is most definitely there – from the public and from landlords seeking operators.

Axon says portfolio owners are examining their estates much more closely and are looking for diversity across their tenant base. Like Rock Up’s Duckworth, Axon says the decline of more traditional retail and leisure occupiers – nightclubs, restaurants and department stores – is throwing up all sorts of opportunities for wall operators.

Could climbing walls and bouldering centres be a new anchor? On their own they may not be quite the draw required, but integrated into a wider leisure offering, which comprises retail and restaurants, they could deliver a destination, says Savills’ Hughes.

Julian Carey, property director at Stenprop, which acquired a couple of climbing wall tenants through some estate purchases, feels more comfortable with this new leisure tenant type than the industry’s last big leisure trend – trampoline parks. At least for now.

Whereas trampoline parks bounced into the UK market in 2015 and very quickly grew their footprints, often paying higher leisure rents, wall operators have, so far at least, been a little slower in their expansion and tend, says Carey, to pay standard industrial rents.

According to EG research, there are more than 200 trampoline parks in the UK with a footprint of close to 5m sq ft. But the market is struggling. A highly propensity of injury and an over-dependence on seasonal trading have led to several firms going out of business, calls for weekly rents and an expansion in to other leisure sectors. Gravity, for example, has recently launched Gravity Rocks, a low-level climbing wall offer that will feature in all of its trampoline walls going forward.

The easy in, easy out set up of a climbing wall is also attractive to a landlord like Stenprop, says Carey, so that if the sector does follow that of the trampoline parks and lose its bounce, units can quickly be converted back to standard boxes.

Supply and demand

But, until the investment starts flowing into indoor climbing, supply will not be able to keep up with demand, says Big Rock’s Axon.

“Lack of investment is the only stop on growth. We could turn the handle and roll out 10 more centres if we had the investment,” he says.

Axon reckons there is a real opportunity to professionalise the indoor climbing sector and turn it into a genuine sub sector of the leisure market.

“Climbing centres have largely been hobby businesses, set up by climbers, but that is starting to peter out,” says Axon, whose core business is transport planner Vectos. “There is an opportunity for big private equity to come in and takeover this market. The UK is well behind the US and Europe. We started alpinism and now we are falling behind.”

Investment is key for Rock Up’s growth too, says Duckworth. The former Boston Consulting Group and Montagu Private Equity director says the firm is likely to seek to raise funds for its expansion next year.

With a retail and leisure market that continues to provide a steady flow of empty space and a growing general interest in climbing as a leisure activity, expansion for both styles of indoor climbing operators should not be too hard a sell.

But, careful site selection and a firm grip on reality will be key if climbing does not want to follow the up and down fortunes of the trampoline park sector.

To send feedback, e-mail Samantha.McClary@egi.co.uk or tweet @Samanthamcclary or @estatesgazette